Experience Trading

on the Go

on the Go

Valued for its decorative beauty, silver is a lustrous white metal (symbol Ag) used for producing cutlery, jewellery, coins, ornamental objects and commercial applications.

Aside from silver, other popular investment precious metals are gold, platinum and palladium. By far, silver is the most inexpensive.

The spot price of palladium has more than doubled in the past couple of years, currently worth more than gold bullion, trading at $2,351 an ounce.

Precious metals remain popular additions to investment portfolios, aiding diversification and as a hedge against inflation. In fact, the late Harry Browne, a legendary investment advisor and ex-presidential nominee for the United States Libertarian Party, insisted 25 percent of an investment portfolio should be in precious metals.

Although Browne favoured gold, modern investors, due to industrial applications, are likely to include additional precious metals.

Among other factors, increased industrial use of palladium is one of the main reasons behind its rise. Silver, according to some, has similar potential.

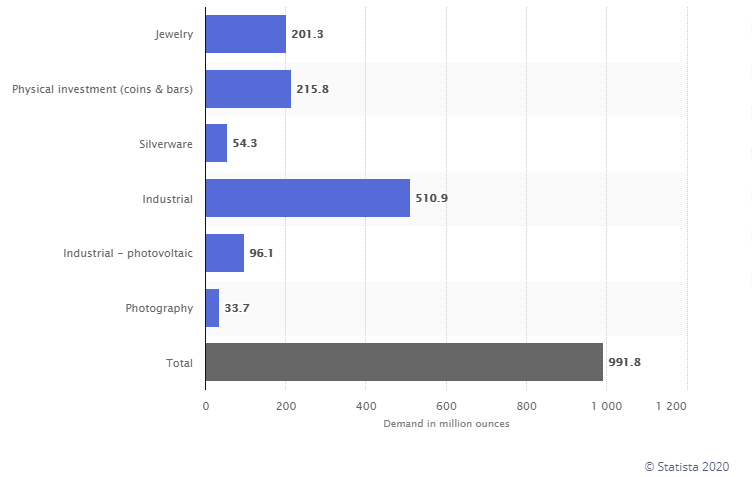

Silver boasts both industrial and investment appeal.

Industrial demand for silver in 2019 was 510.9 million ounces, accounting for more than 50 percent of annual demand worldwide.

Common industrial uses of silver:

With the clear difference between the price of silver and other major precious metals, the question remains whether the market’s pricing of silver will eventually realign?

To help answer this, some investors calculate a gold to silver ratio. The problem is pure gold is usually quoted in troy ounces per US dollar whereas pure silver is quoted in ounces in many markets outside the United States. Therefore, you must first convert the price quoted in the silver market to troy ounces before calculating the ratio, which averaged to approximately 65:1 over the past 45 years.

According to mean reversion, an ounce of gold ought to be worth around 65 ounces of silver. Based on the closing price on 1 December, 2020, silver’s spot price is $23.95 while gold’s spot price is $1,815. This is a ratio of approximately 76:1.

In terms of an inflation hedge, silver has proven itself throughout history as a worthy junior to gold. Most fund managers will attest both metals are generally perceived as a safe-haven asset and a store of value.

With the COVID-19 pandemic expected to continue to weigh on the global economy into 2021, the US Federal Reserve and other central banks are expected to keep interest rates low for a prolonged period to encourage growth, which can eventually lead to an inflationary environment.

However, central banks are unlikely to have the luxury of raising rates to combat rising inflation if COVID-19 is not resolved as early as the market expects. Consequently, the world may endure elevated inflation in 2021, potentially boosting demand for inflation hedges.

In expectation of a bull market, silver investors have the freedom to explore a number of different investment avenues:

Access 10,000+ financial instruments

Access 10,000+ financial instruments Auto open & close positions

Auto open & close positions News & economic calendar

News & economic calendar Technical indicators & charts

Technical indicators & charts Many more tools included

Many more tools included

By supplying your email you agree to FP Markets privacy policy and receive future marketing materials from FP Markets. You can unsubscribe at any time.

Source - cache | Page ID - 1016