Experience Trading

on the Go

on the Go

Precious metals have the added advantage of safe-haven properties, a store of value that some prefer to physically hold as an investment approach. Consumers tend to be more comfortable owning precious metals (in particular physical gold) over other metals – mass market demand plays a large part in determining the price of gold.

The precious metals market is usually denominated in troy ounces per US dollar, and remains popular among investors. Though different metals often command different investment strategies.

For example, the price of gold generally correlates with inflation expectations – gold usually trades opposite to the US dollar, therefore can serve as a hedge against inflation. For that reason, investors may find use in monitoring the US consumer price index (CPI), an indicator measuring the percentage change of a basket of goods and services consumed by households.

Purchasing shares of mining companies through a stock exchange is an additional strategy some employ to aid portfolio diversification. A rally in metals prices tends to bolster the price of mining stocks related to the respective metals.

Palladium Bullion: Now More Expensive Than Gold

Palladium is important for industrial applications, mostly used in catalytic converters which controls exhaust emissions. Approximately 85 percent of palladium ends up in the exhaust systems in cars. Additionally, it is also used for the production of multi-layer ceramic capacitors (found in cellular phones and notebooks) as well as applications in photography, dentistry and jewellery.

The white gold available at goldsmiths is also mixed with palladium or other like-coloured metals. Notably, white gold has become the overwhelming choice for wedding bands in the United States, likely one of the reasons behind palladium’s rise over the price of gold.

Base metals are usually used as raw materials: input prices for many sectors of the economy. Consequently, investing strategies tend to focus on underlying economic growth. Since US interest rates are expected to remain low for the next three years, some investment systems have adopted a bullish outlook on GDP growth expectations.

Copper is a popular base metal, often considered a proxy for economic growth. If economic growth is expected to accelerate, demand for copper often increases. Conversely, if the economy contracts, copper prices tend to turn lower. This is largely due to copper being tied closely to the construction industry – an average single-family home uses 439 pounds of copper.

Considering construction is often viewed as a barometer for the wider economy and economic performance, using GDP growth forecasts is a strategy worth considering for predicting copper price movement and highlighting investment opportunities.

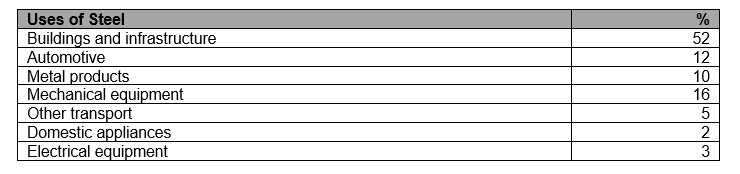

Source: World Steel Association

Additional base metals are nickel and iron ore, primarily used as raw materials to produce steel.

Like copper, steel is dependent on GDP growth. However, it is also necessary to take into account China’s GDP growth, as China consumes 51.3 percent of the world’s finished steel products (2019). Apart from China’s economic growth, China’s stockpiles of steel can affect the country’s demand. For example, if China is expecting a boost in economic growth but its steel inventories are high, China is unlikely to import much steel. Prudent investors seldom underestimate the impact of inventories on supply.

Access 10,000+ financial instruments

Access 10,000+ financial instruments Auto open & close positions

Auto open & close positions News & economic calendar

News & economic calendar Technical indicators & charts

Technical indicators & charts Many more tools included

Many more tools included

By supplying your email you agree to FP Markets privacy policy and receive future marketing materials from FP Markets. You can unsubscribe at any time.

Source - database | Page ID - 1037