The kiwi rose after Statistics New Zealand released the latest retail sales data. Retail sales rose at an adjusted rate of 1.6% in the September quarter. This was higher than the modest 0.2% in the June quarter. This jump was driven by increased electrical and electronic goods sales, which rose by 4.4% in the quarter. 11 of the 15 retail industries rose in the third quarter. This increase was offset by a drop in fuel retailing, which was down by 2.8%. The market will receive the Financial Stability Report that will be released later today.

The AUD/NZD pair has been on a sharp decline since November 11. The pair has dropped from a high of 1.0865 to a low of 1.0540. The pair is trading below the 14-day and 28-day exponential moving averages. The Parabolic SAR is trading above the price while the RSI has reached the oversold level of 30. The signal line of the MACD continues to be below the neutral level. The pair may continue moving lower.

The Hang Seng index declined slightly even as the market reacted to the latest Alibaba listing. The company’s stock soared by more than 7% after issuing 500 million ordinary shares and 75 million “greenshoe” options. This makes the company’s IPO the largest this year. The company now has a cash hoard of more than $46 billion. Its Hong Kong code is 9988. Nine and eight are considered to be lucky numbers in China. The market reaction came a day after Hong Kong elected anti-China legislators in the first vote since protests began.

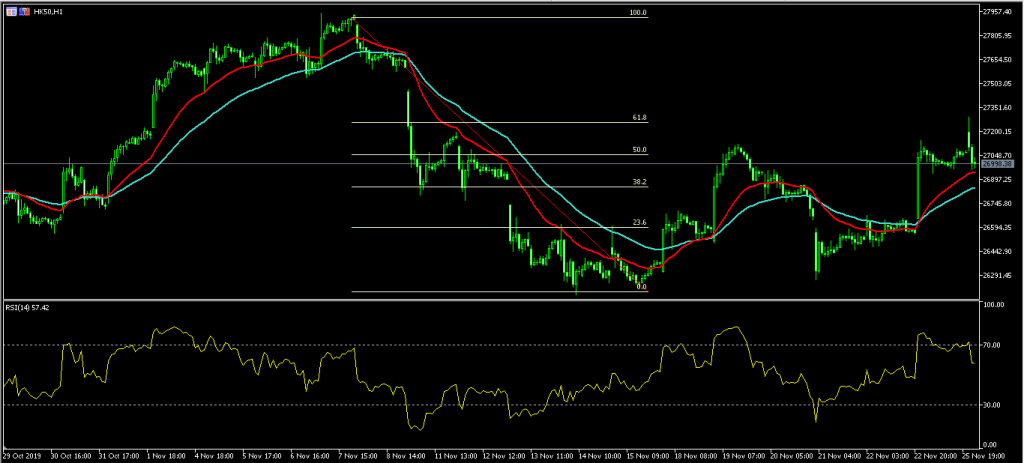

The Hang Seng index rose yesterday after the election results. The market believes that protests will now end. The index reached a high of $27,292. It pared these gains today and is now trading at $26,956. The price is between the 50-day and 38.2% Fibonacci Retracement level. The price remains slightly above the 14-day and 28-day moving averages while the RSI has moved from an overbought level of 70 to 57. The index may move higher in anticipation of a trade deal.

The USD gained after positive signs that a trade deal could be done. This is after China’s lead negotiator Liu He made a “productive” phone call to his American counterparts. The call aimed to iron out some of the key underlying issues. As such, the market viewed this is a positive sign, which also pushed US stocks to record highs. The market will receive the new home sales data for October and the Conference Board’s consumer confidence data. The market will also receive preliminary wholesale inventories and trade data.

The EUR/USD pair declined during the American session. It reached a low of 1.1000 and is now trading at 1.1015. The pair is between the 38.2% and 50% Fibonacci Retracement level. The price is also slightly above the lower line of the Bollinger Bands while the RSI has remained slightly above the oversold level of 30. The signal line of the MACD has continued to drop. The pair may decline to below 1.1000 ahead of important economic data.

Access 10,000+ financial instruments

Access 10,000+ financial instruments Auto open & close positions

Auto open & close positions News & economic calendar

News & economic calendar Technical indicators & charts

Technical indicators & charts Many more tools included

Many more tools included

By supplying your email you agree to FP Markets privacy policy and receive future marketing materials from FP Markets. You can unsubscribe at any time.

Source - cache | Page ID - 22554