Asian and Australian stocks were mixed during the Asian session. In Australia, the ASX 200 index rose by 17 points while in Japan, the Nikkei rose by 54 points. US futures rose, with Boeing gaining 60 points. This week, the market will be receiving earnings data from a number of large companies. Some of the companies that are expected to report are Halliburton, Boeing, Chipotle, Proctor & Gamble, and Microsoft among others. Also, the market will receive interest rates decision from the European Central Bank later this week.

ASX 200. In Australia, ASX200 rose from an intraday low of $6626 to a high of $6647. On the 30-minute chart, this price is slightly above the 50% Fibonacci Retracement level. It is also slightly above the upper line of the Envelopes indicator. The RSI has been moving in an upward trend. The index may resume the downward trend to test the 38.2% Fibonacci Retracement level of $6610.

Sterling. The sterling declined as the markets opened for the week. This was in reaction to the weekend action in UK parliament. On Saturday, members of parliament were scheduled to vote for the deal agreed between Boris Johnson and the European Union. This vote did not happen as the members voted for Oliver Letwin’s amendment to seek an extension from the European Union. Boris Johnson sent an unsigned letter to the EU requesting for an extension as required by law. He also sent another letter making the case against another extension. Johnson is expected to table his bill later today and there is a possibility that it could pass.

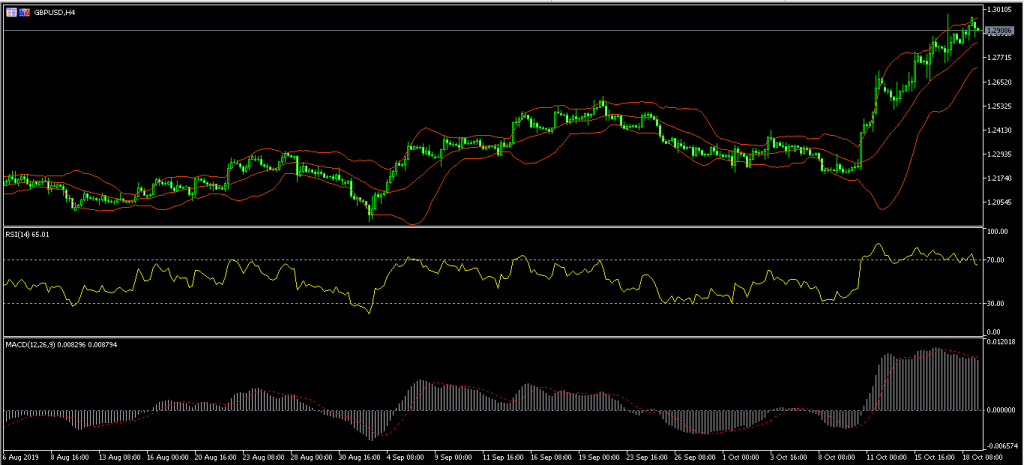

GBP/USD. The GBP/USD pair declined today after the weekend drama in parliament. As of writing, the pair is trading at 1.2909, which is slightly below Friday’s high of 1.2973. On the four-hour chart, this price is slightly below the upper line of the Bollinger Bands while the RSI has moved slightly below the overbought level of 70. The signal line and histogram of the MACD have started to ease slightly. The pair may be slightly volatile today as traders observe the next moves on Brexit.

USD/JPY. The Japanese yen weakened slightly after Japan released its trade numbers for September. The numbers showed that exports declined for the tenth straight month. These declines were driven primarily by weaker exports to South Korea and Japan. According to the Ministry of Finance, outbound shipments declined by 5.2% YoY. On a MoM basis, exports improved by 8.2%. Exports to China declined by 6.7% while shipments to South Korea declined by 15.9%. The latter is attributed to the mini trade war that is going on between Japan and South Korea. The two countries have put in place some trade barriers. Meanwhile, imports declined by 1.5%, which was slightly better than the expected decline of 2.8%. These numbers resulted in a trade deficit of more than $1.1 billion.

The USD/JPY pair rose slightly from Friday’s low of 108.28 to an intraday high of 108.50. On the hourly chart, the price is along the 14-day and 28-day exponential moving averages. It is also below the important support shown in blue below. The average true range, which is an important measure of volatility declined, which was a sign of low volatility. The pair may attempt to retest the previous resistance level of 108.95.

Access 10,000+ financial instruments

Access 10,000+ financial instruments Auto open & close positions

Auto open & close positions News & economic calendar

News & economic calendar Technical indicators & charts

Technical indicators & charts Many more tools included

Many more tools included

By supplying your email you agree to FP Markets privacy policy and receive future marketing materials from FP Markets. You can unsubscribe at any time.

Source - database | Page ID - 22491