The Australian dollar rose after the RBA left interest rates unchanged at 0.75%. The bank has already implemented three rate cuts this year. In a statement, Governor Philip Lowe said that low-interest rates would help the country maintain growth at a time when global growth is slowing. Lowe expects the economy to grow by 2.75% this year and then pick up gradually to 3% in 2021. The bank expects the unemployment rate to remain unchanged at 5.25% and then slow to 5.0% in 2021. Inflation will reach 2% in 2020.

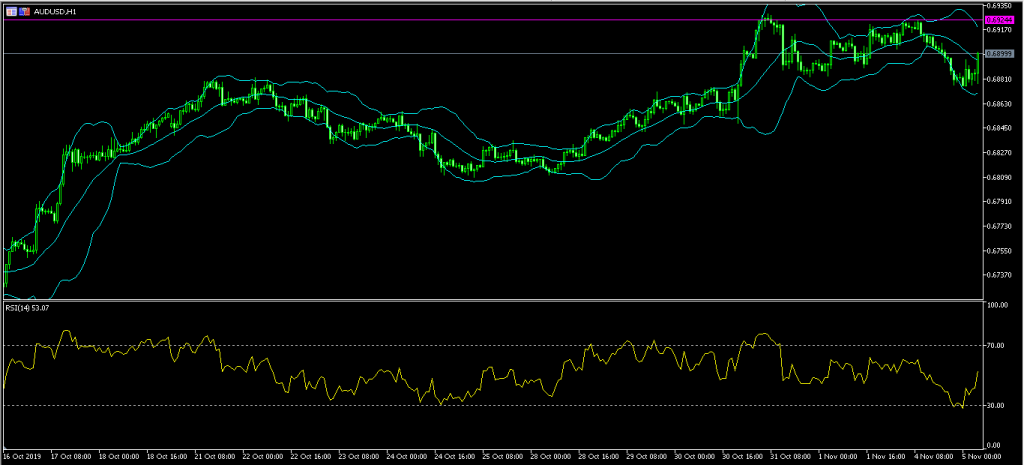

The AUD/USD pair rose after the RBA delivered its rates decision. The pair rose from a low of 0.6875 to a high of 0.6900. On the hourly chart, the pair is trading slightly above the middle line of the Bollinger Bands. The RSI, which was previously in the oversold level has risen to 53. The pair may attempt to retest the previous double top level of 0.6925.

Crude oil prices declined in overnight trading. The price dropped even as traders continue to worry about supply and demand. In recent weeks, the IMF and major central banks have warned about economic growth in the global economy. Weak economic growth is often viewed as a negative for crude oil because it affects demand. As a result, OPEC is said to be considering further supply cuts in the upcoming December meeting. The organisation is also considering actions against uncompliant members like Nigeria. These countries have continued to pump excessive crude oil into the market. Yesterday, the UK announced a ban on hydraulic fracturing.

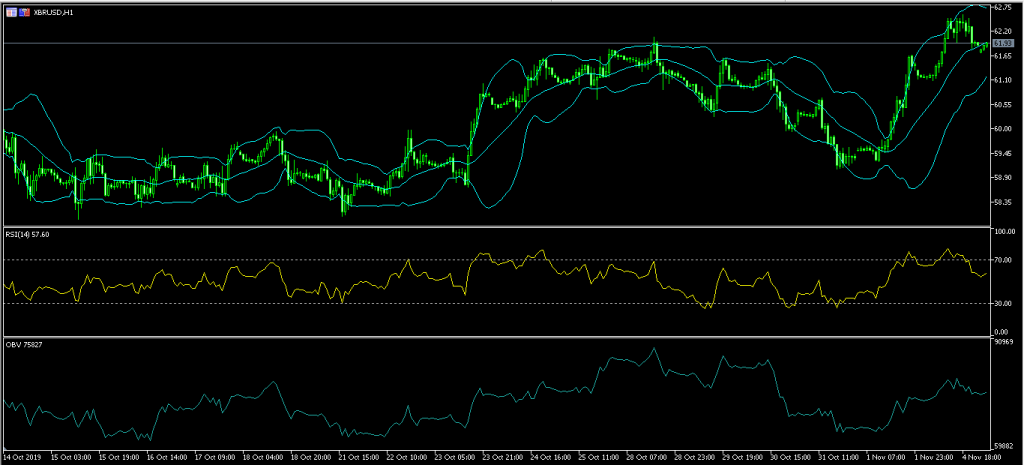

The XBR/USD pair rose sharply yesterday to a high of 62.60. The pair then lost some of these gains during the Asian session. It is trading at 61.95, which is along the middle line of the Bollinger Bands. The RSI has declined from an overbought level of 81 to 57. The On Balance Volume has been relatively unchanged. The pair may continue to move up as traders focus on global trade and potential supply cuts by OPEC.

The US dollar index rose on optimism of trade. The US and China are said to be nearing a trade deal that will help improve global economic sentiment. In a report, the Wall Street Journal wrote that the US and China were considering lowering tariffs as part of a new deal. The two countries have already agreed to one of the several phases of an agreement. This new phase will include additional purchases of US goods by China, easing currency manipulation, and some form of intellectual property protections. The US is said to be considering slashing tariffs of 15% on goods worth $111 billion.

The EUR/USD pair rose slightly to a high of 1.1125. On the hourly chart, the pair has been on a downward trend after forming a double top pattern at 1.1175. The pair is trading below the short and medium-term moving averages. The RSI has moved slightly lower while the signal line of MACD has also declined. The pair may continue moving lower today ahead of the ISM non-manufacturing data from the US.

Access 10,000+ financial instruments

Access 10,000+ financial instruments Auto open & close positions

Auto open & close positions News & economic calendar

News & economic calendar Technical indicators & charts

Technical indicators & charts Many more tools included

Many more tools included

By supplying your email you agree to FP Markets privacy policy and receive future marketing materials from FP Markets. You can unsubscribe at any time.

Source - database | Page ID - 22365