US stocks rose yesterday as investors reacted to the news that the US was not considering delisting Chinese equities as previously reported. This news was viewed as being positive because of how damaging the delisting would be to the markets. There are more than 150 Chinese firms valued at more than $1.2 trillion that are listed in US exchanges. The Dow, Nasdaq, and S&P 500 rose by 5.6%, 11.85%, and 8.65% in the third quarter.

The Aussie jumped after the Reserve Bank of Australia slashed interest rates by 25-basis points. This was the third rate cut this year. In the monetary policy statement, Governor Philip Lowe said that it would be reasonable to expect low interest rates to remain as the bank tries to lower unemployment rates and reach the inflation target. On inflation, the bank said that the inflation will be under the 2% target in 2020 and slightly above the target in 2021. On housing, the governor said that the bank had started to see turnaround in Sydney and Melbourne, which had experienced a period of softening. On the job market, the governor said that the unemployment will likely remain at these levels while wages have been subdued.

The AUD/USD pair rose to a high of 0.6775 after the RBA rates decision. This was the highest level since Friday last week. The pair then pared these gains. As of writing, the price has gone back to 0.6740. This level is close to the lowest level since September 3. On the hourly chart, the price is slightly below the 14-day and 28-day moving averages. There is a possibility that the pair will continue the downward trend it has seen for the past few months.

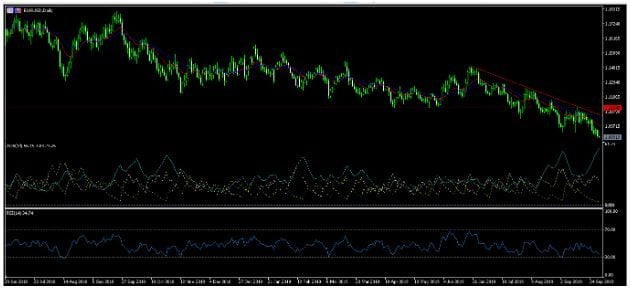

In the third quarter, the euro declined by 3.5% against the US dollar. The currency is now trading close to a three-year low as the market continues to fear a recession. Today, the market will release the manufacturing PMI data for September. The data is expected to show that the PMI declined again to 41.4 from the previous 43.5. In France, the manufacturing PMI is expected to have declined from 51.1 to 50.3 while in the EU, it is expected to have declined from 47.0 to 45.6. Meanwhile, the headline CPI data is expected to have remained unchanged at 1.0% while the core CPI is expected to have increased slightly to 1.0% from 0.9% in August.

On the daily chart, the EUR/USD pair has been on a strong downward trend. This price is below the 14-day (red) and 28-day (blue) EMAs while the Average Directional Index (ADX) has reached the highest level this year. The RSI has been moving lower and is likely headed towards the oversold level. While the pair will likely continue moving lower, talks of fiscal stimulus in the EU could help provide some support.

In September, the Japanese yen declined by almost 2% against the US dollar. This, together with the decline of other major currencies helped push the dollar index to the highest level since 2017. Today, the market received key economic data from Japan. In August, the unemployment rate remained at a historic low of 2.2% while the jobs to applications ratio remained at 1.59. Meanwhile, all big manufacturing capital expenditure declined to 6.6% in the third quarter. It had risen by 7.4% in the second quarter. CAPEX in the small industries contracted by -6.7%. The Tankan large manufacturers index declined to 5 from the previous 7 while the large non-manufacturers index declined from 17 to 15. In September, the manufacturing PMI remained unchanged at 48.9.

The USD/JPY pair rose to a high of 108.20. On the 30-minute chart, the pair is in the 5th part of the Elliot Wave pattern. The price is also above the 14-day and 28-day moving average while the momentum indicator is above the 100 level.

Access 10,000+ financial instruments

Access 10,000+ financial instruments Auto open & close positions

Auto open & close positions News & economic calendar

News & economic calendar Technical indicators & charts

Technical indicators & charts Many more tools included

Many more tools included

By supplying your email you agree to FP Markets privacy policy and receive future marketing materials from FP Markets. You can unsubscribe at any time.

Source - cache | Page ID - 22353