The Australian dollar tanked after weak employment data from the Australian Bureau of Statistics. In October, the unemployment rate rose to 5.3% from 5.2%. This coincided with a 0.5% increase in the participation rate. Monthly trend employment increased by about 12k people. The number of employed people declined by 19k on seasonally-adjusted terms. Meanwhile, the market reacted to weak economic data from China. Retail sales declined from 7.8% to 7.2% while fixed asset investment declined from 5.4% to 5.2%. Industrial production declined from the previous 5.8% to 4.7%. Australia exports two-thirds of their goods to China.

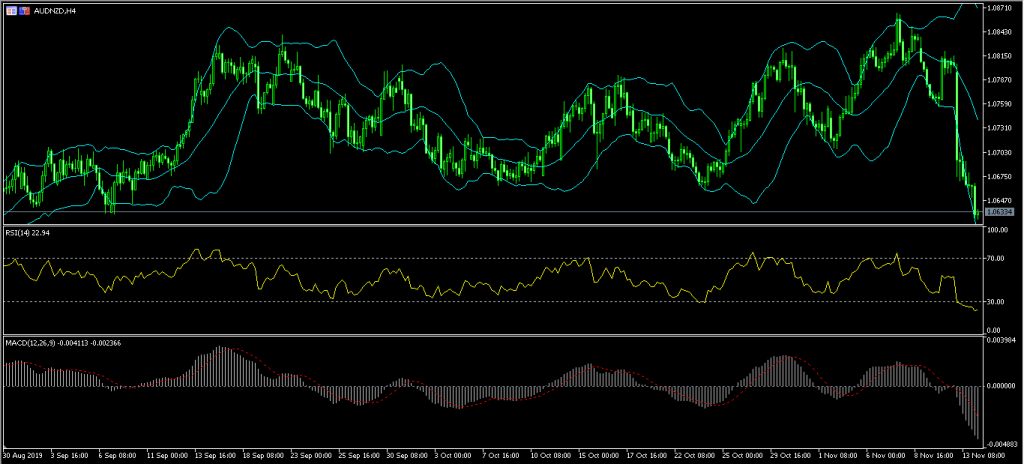

The AUD/NZD pair declined sharply after the weak economic data from Australia and China. In the past two days, the AUD/NZD pair has dropped from 1.0865 to a low of 1.0625. This was the lowest level since September 6. The price is along the lower line of the Bollinger Bands while the RSI has dropped to below 25 on the four-hour chart. The signal line of the MACD indicator has also dropped sharply. The pair may continue to decline to test the important support 1.0600.

The US dollar was relatively unchanged after data from the US showed a slight improvement in inflation. Headline CPI increased from 1.7% in September to 1.8% in October. The CPI increased by 0.4% on a MoM basis. Core CPI declined slightly from 2.4% to 2.3%. It increased from 0.1% to 0.2% on a MoM basis. The market then focused on a testimony by Jerome Powell to Congress. In his testimony, the Fed chair praised the US economy for its resilience. Still, he said that the Fed is not likely to slash rates again this year. Later today, the market will receive initial jobless claims and PPI data from the US. Powell will also continue his testimony.

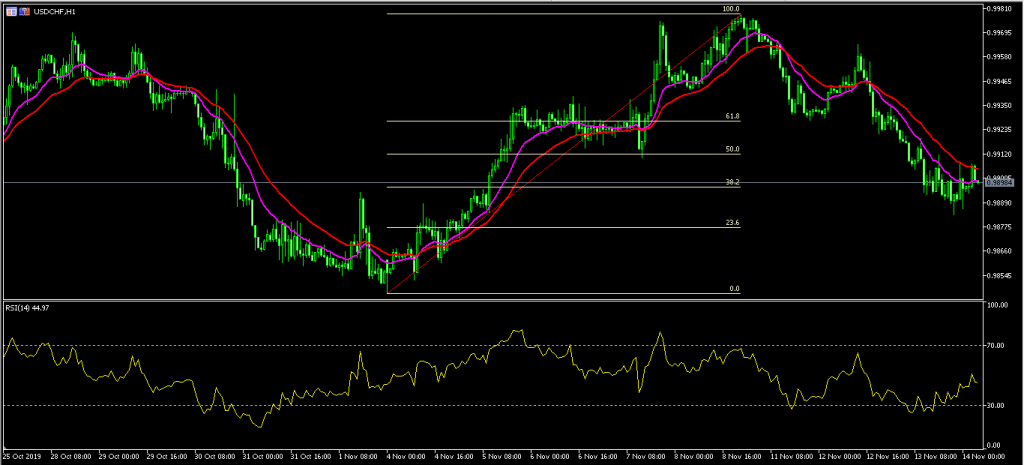

The USD/CHF pair was unchanged during the Asian session. The pair is trading at 0.9899, which is slightly above yesterday’s low of 0.9883. The price is along the 38.2% Fibonacci Retracement level on the hourly chart. The price is along the 14-day moving average and below the 28-day moving averages. The RSI has been moving higher. The pair may resume the downward trend as it attempts to test the 23.6% Fibonacci Retracement level of 0.9877. This could depend on the PPI data from the US and Switzerland.

The Swedish krona continued to decline even as the country’s central bank is said to be considering abandoning negative interest rates in December. Sweden was among the first country to try an era of negative rates. The bank is expected to raise rates from the current minus 0.25% to 0%. However, this has failed to raise the krona, which has become the worst-performing currency in the developed world. The nation will release the unemployment data for October. Meanwhile, the market will receive important data like the German GDP, Spain’s CPI, UK retail sales, and EU’s CPI data.

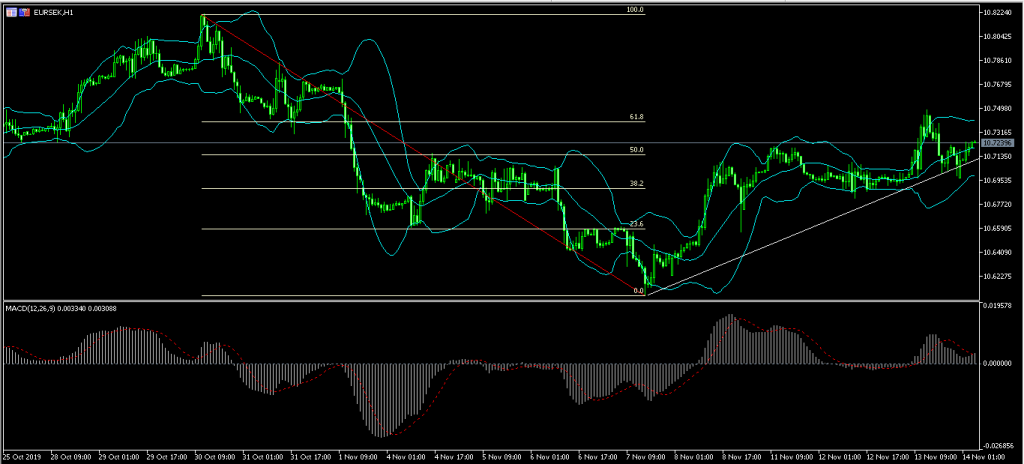

The EUR/SEK pair rose to a high of 10.7245 from yesterday’s low of 10.6965. The price is above the 50% Fibonacci Retracement level on the hourly chart. The price is also slightly above the middle line of the Bollinger Bands. The signal line of the MACD indicator has been declining. The pair may continue moving upwards to retest the important resistance level of 0.7400.

Access 10,000+ financial instruments

Access 10,000+ financial instruments Auto open & close positions

Auto open & close positions News & economic calendar

News & economic calendar Technical indicators & charts

Technical indicators & charts Many more tools included

Many more tools included

By supplying your email you agree to FP Markets privacy policy and receive future marketing materials from FP Markets. You can unsubscribe at any time.

Source - cache | Page ID - 22352