Advancements in technology have changed the forex trading landscape forever. Online trading platforms have connected global traders, enhancing transparency, liquidity and trade execution speeds. While 30 years ago, the forex market was dominated by big banks and institutional investors, today, retail traders are a huge part of the daily transactions in this market. In the last decade, there has been a 40% surge in daily forex trading volumes, with daily global forex turnover hitting the $6.6 trillion mark in January 2020. The foreign exchange market is now the biggest financial market in the world - dwarfing all of the world's stock markets combined.

Another significant development has been the emergence of algorithmic trading, an effective tool to increase convenience and efficiency in forex trading. Forex algorithmic trading or algo-trading, at its core, is trading based on an algorithm or set of computer programs that include a specific set of rules to complete a particular task.

Traders can set pre-programmed instructions related to certain variables like time, price, volume and stop-loss levels. These instructions are based on their trading strategy. The algorithms follow this strategy and enter and exits trades on the trader’s behalf, when market conditions satisfy the programmed parameters.

As technology continues to advance, so does the number of traders resorting to algorithmic trading. A key area of technological advancement is machine learning. It has taken a life of its own with trading algorithms created after tracking trading decisions and trading activities over a period of time. Implementing these strategies has also become easier with the emergence of robust and feature-rich platforms like MetaTrader 5.

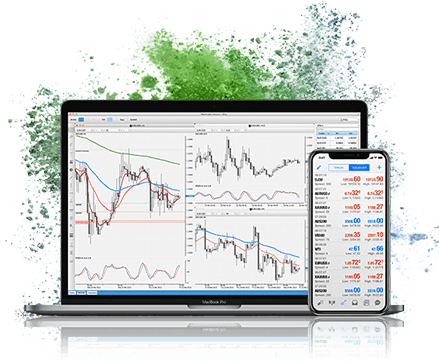

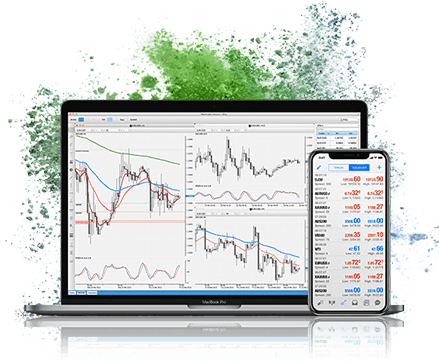

MetaTrader 5 or MT5, the next generation technology after the MetaTrader 4 platform, is a multi-asset trading platform with superior back-testing capabilities, along with an improved strategy tester for algorithmic trading and expert advisors (EAs). FP Markets offers MT5 across different devices and operating systems, including iOS, Android, Windows, Mac and WebTrader, for smart trading, on-the-go. Similarly, traders can utilise algorithmic trading systems such as Autochartist and Autotrade by Myfxbook which are state-of-the-art copy trading services.

Algorithmic trading is possible with the MT4 platform as well. Automated trading robots in MT4 can quickly analyse currency quotes and execute trading strategies on the trader’s behalf. Download FP Market MT4 platform to get free-of-charge trading robots from the Code Base or rent or buy customised applications from the MQL4 Marketplace.

What are the Advantages of

Algorithmic Trading?

Algorithmic trading offers benefits such as increased speed, reduced trading costs, accuracy and removal of trading bias.

Increased Speed: Algorithms are written beforehand and executed automatically. They are able to measure market conditions (multiple technical and fundamental indicators) in a fraction of the time it would take to manually analyse all the information. Traders are able to take advantage of sharp fluctuations in currency rates, following important news releases. They can identify price movements easier and access more trading opportunities at better prices.

Increased Accuracy: With manual trading, there are chances of incorrect entries, such as wrong position size, currency pair or execution price. With algorithmic trading, traders can avoid the pitfalls of human error.

No Emotional Bias: Algorithms are a pre-defined set of criteria, and when trades are limited to them, the aspect of human emotions is removed. Irrational decisions, made out of fear or greed, can often lead to costly trading mistakes. Algo-trading provides a way to avoid that with its role likened to that of a financial advisor.

Time Saving and Reduced Transaction Costs: The need to monitor trading accounts decreases significantly. Traders can simply set up their strategies and let the algorithms execute trades on their behalf. They can concentrate on other activities instead, like market research and forex education. This also lowers transaction costs in the form of saved opportunity costs of continuous market monitoring.

Advantage of Backtesting: Algorithms can be run on historical data to test whether they would have worked in the past. This lets traders take care of any problems in their trading strategies, before they implement the strategy in the live markets. This may increase the chances of long-term success.

Enables Discipline: Since trade execution is automatic and systematic, based on pre-defined parametres, such systems can maintain discipline while trading volatile markets. Traders are able to achieve consistency by sticking to their trading plans.

Diversified Investments: Algo trading allows traders to execute multiple trading strategies across different currency pairs and on multiple accounts at the same time. This helps promote portfolio diversification.

FP Markets is a forex broker

that not only allows you to take advantage of countless options available in this space, but also

provides

access to community-based automated trading strategies (MQL4 and MQL5 marketplace) on its

MT4 and MT5 platforms. Discover

forex trading

on our advanced trading platforms with tight spreads and ultra-fast trade executions.

Implementing

Algorithmic Trading

To successfully use algo trading, market participants focus on specific strategies, trading speed and access to real-time price quotes.

1. Auto-Hedging Strategies:

Algorithmic trading strategies can be used to reduce traders’ risk exposure. Many traders choose to engage in automated rebalancing of portfolios to hedge their exposure to market risk, exchange rate risk and volatility risk.

2. Statistical Algo Strategies:

Based on statistical analysis of historical data, the system can identify trading opportunities and long-term trends. Past market data is given preference over current market data.

3. Algorithmic Trade Execution:

Trades are executed at increased speed to reduce market exposure and build long-term profitability. Forex scalpers often use high-frequency trading strategies to enter and exit multiple positions in a day. They are able to take advantage of incremental price changes in a currency pair within milliseconds.

4. Direct Market Access (DMA)

Traders can connect to multiple trading platforms at a lower cost and higher speed. They have direct access to multiple liquidity providers and access to the best bid/ask quotes for currency pairs. Direct data feed from such liquidity providers or exchanges reduces latency in trading.

FP Markets provides the benefits of DMA forex CFD trading, where clients receive live market prices, full market depth and access to quotes from multiple liquidity providers directly. A DMA model not only offers increased liquidity, it also aligns with your interests, rather than with the broker. When you access DMA pricing for CFD trading, your order will be matched in the underlying market (forex), which means that the broker cannot gain from your losses.

Start trading DMA CFDs with FP Markets.

Who Uses

Algorithmic Trading?

In the past, automated forex trading strategies were widely used by investment banks, pension funds, hedge funds, mutual funds and other institutional investors, who needed to manage their clients’ funds, and increase their returns on investment within a specific duration. These strategies enabled them to spread out the execution of big orders. As a result, they were able to identify trading opportunities in the market prior to retail traders.

As technology advances, the volume of automated electronic trading in the markets will continue to grow. Large institutional investors have invested billions of dollars in low-latency trading technologies provided by algos. Over 80% of forex trading was done using algorithms in 2016.

The advent of powerful online trading platforms such as MT4 and MT5 has helped retail traders who can now implement the same strategies. These platforms provide customised programming options to develop automated systems. Many pre-made indicators and systems are also available for purchase or rent online.

FP Markets provides advanced technical analysis and charting tools to make it easier for traders to engage in automated trading strategies. The MT5 platform enables retail traders to build and fully customise their own automated trading strategies.

How is Algorithmic

Trading Used in

Forex?

Algorithmic trading can enable traders to implement a wide range of strategies in the forex market.

1. Trend Following Strategy

The simplest trading strategy to deploy through automated trading is trend following. The system follows market trends and when a pre-determined set of conditions is fulfilled by the technical indicators, buy or sell orders are placed accordingly. Both current and previous market trends can be compared by the system to identify trading opportunities.

2. Forex Scalping or High Frequency Trading

High-frequency trading or HFT has recently become more popular in the forex world. Aggressive short-term strategies help traders to take advantage of price volatility in currency pairs. Buy and sell signals are generated and trades are executed in a matter of milliseconds. Apart from scalping strategies, arbitrage strategies are also executed. Traders are able to complete thousands of trades per day, helping them to score a favourable win-loss ratio.

3. Arbitrage

Arbitrage is a method of taking advantage of the price difference between multiple markets, in order to gain from the difference in market prices. To achieve this in the forex market, traders might need to invest in large positions, as forex price differences are in micro pips. Triangular arbitrage strategy involves two currency pairs and a cross-currency pair between the two. It is one of the ways the strategy gets deployed through algorithmic trading.

4. News Trading

Forex market volatility is sparked by important news releases, economic data releases and geo-political developments. There are news-based automated trading strategies that are connected to news wires. Based on the difference between market consensus regarding economic indicators and the actual figures, the system can generate trade signals. Traders can further add technical indicators, based specific parametres as well. This helps them to take advantage of sudden market reversals, often seen after the release of reports like the US NFP (Non-Farm Payroll Report).

5. News Sentiment or Market Sentiment

News sentiment and market sentiment data have been used by hedge funds for a long time to devise sophisticated algorithms to place trades. With the help of powerful technologies like AI (Artificial Intelligence) and NLP (Natural Language Processing), systems can now sift through millions of news articles, social media commentaries, opinion articles and analyst reports to identify and predict market sentiment. Market tops and bottoms can be predicted using commercial and non-commercial positioning.

6. Mean Reversion Strategies

A mean reversion strategy is based on the idea that currency prices ultimately revert to their mean values or average. “Pairs trading” is one way this strategy is used, where traders try to take advantage of spreads between two correlated currency pairs. Technical indicators like the RSI, Money Flow and Bollinger Bands can help identify overbought and oversold levels, which can then help traders enter and exit mean reversion trades. Algorithmic trading strategies based on mean reversion typically calculate the average asset prices through historical data, and then trades are based on the current prices reverting to this average price in the near future.

7. Iceberg Order Strategies

Typically used by large institutional

traders, this strategy divides single large orders into multiple smaller

limit orders. Smaller forex

positions are executed through different systems to avoid any sudden impact of currency price

fluctuations.

How Can Retail

Traders Start

Algorithmic Trading?

Detailed

knowledge is the first step to implementing algorithmic trading. For starters, traders need to have

a

good understanding of the currency market. This includes knowledge of currency pairs, factors that

influence

their prices, correlation between currency pairs, terms like spread, pips and leverage and

more.

Trading Strategies

Then there are several kinds of strategies that forex traders can deploy through algorithmic trading. To decide on a strategy, a trader needs to consider their long-term goals, risk-reward profile, trading experience and risk management strategies. Some common strategies used in algorithmic trading are:

Statistical strategies

Arbitrage

Hedging strategies

Sentiment-based strategies

Momentum strategies

Risk Management

There are a number of factors to consider before switching to algo trading, such as:

Check whether algorithmic trading is allowed in the regulatory jurisdiction you are trading in.

Accessibility, Scalability and Stability of the trading platform

Backtesting capabilities

Quality of historical data available for testing strategies.

Programming Skills

It’s not necessary to be an expert programmer to be able to code the algorithmic trading strategy. The MT4 platform provides MQL4 IDE (Integrated Development Environment), which allows traders to develop their own trading robots (algo strategies) or technical indicators of any complexities. It is a developer-friendly language, with high functionality and flexibility.

The in-built MetaEditor also has a de-bugger, after which the application is moved automatically to the Strategy Tester to be optimized and tested. The MQL4 marketplace can be used to source many readymade algorithmic applications, available for rent or purchase.

Open an account with FP Markets to access the MetaTrader market and MQL4 community.

Trading with Automated Strategies

There are 3 popular ways to take advantage of automated trading systems in the forex market:

1.

Using a System Developed by an Expert: Beginners can start by renting applications or purchasing them online. Creators need to provide a detailed description of how the strategy works, whether it is used to trade trends or ranges, the risk-reward ratio, time range of the strategy (long-term or short term) and risk management tips. The problem with these systems is that traders have to trust a system developed by a third-party for their hard-earned capital.

2.

Tweaking a Readymade System to Suit Trader Goals: Many traders might also consider modifying a system to suit their strategies. For instance, if they don’t agree with the entry-level parameters or the stop/limit levels used, they can customise them. They can also consider including specific technical indicators.

3.

Developing an Algorithm from Scratch: Highly experienced traders can develop these systems from scratch. This could be resource-intensive and time-consuming, but if it turns out to be successful, the setting up costs could be offset by trading gains. Moreover, the MQL4 and MQL5 marketplace lets traders put up their successful systems for rent or sale.

What is Black Box

Trading in

Forex?

A branch of algorithmic trading applications is “black boxes” or “quants.” At the core, black boxes are trading strategies converted into computer coding language, which are then included into trading software. However, these are proprietary technologies, developed by large institutions. Intricate lines of programming code, developed by computer engineers and coders, can be protected under copyright laws. In addition, firms employ technologies, like big data analytics, to provide their clients superior trading systems that offer an edge over other systems.

Black box trading strategies provide the same functions as other automated trading systems:

Finding trading opportunities and providing trading signals

Automatically executing trading strategies

Providing risk management through position sizing, hedging strategies

and portfolio optimisation.

What is the Best

Algorithmic Trading

Software?

MetaTrader 4 and MetaTrader 5 both offer extensive functionalities

to create and deploy algorithmic

trading strategies in the forex market.

1. MetaTrader 4 (MT4)

Created mainly for forex trading, MT4 provides the best tools in the market. It is also more suitable for beginners. Strategies can be backtested using 30 technical indicators and 9 timeframes. Over 1,700 trading robots are available in the MQL4 marketplace, for purchase or rent. These trading robots are also known as Expert Advisors (EA), which can execute strategies on the trader’s behalf.

Moreover, the MQL4 programming language is one of the most versatile for programmers to develop their own automated trading strategies. Traders can choose to publish these systems on the “Code Base,” from where they can be downloaded by other traders or sell them in the marketplace.

2. MetaTrader 5 (MT5)

MT5 is a multi-asset platform, which allows automated trading in forex as well as other markets, like commodities, indices and more. It cannot be termed as a superior version of MT4, since both have their own advantages and user base. MT5 is more suitable for experienced traders, who can use its advanced strategy tester. This improved strategy tester offers several testing modes to match trader requirements for an optimal speed or quality ratio.

Visual testing makes analysis easier, as does graphical display of results. The MQL5 marketplace further provides over 2,500 readymade algorithmic applications for purchase or rent. Apart from developing their own trading robots using the MQL5 IDE development environment, traders can copy strategies of successful traders through hundreds of free and paid “Trade Signals” available on the MQL5 “Showcase.”

FP Markets provides opportunities for algorithmic trading in the forex market, for all levels of traders on its MT4 and MT5 platforms. The world’s most popular trading platforms come with the advantage of the tightest raw spreads, fastest executions, advanced technical analysis tools and choice from over 10K financial instruments.

Choose a platform depending on your preferences and add algorithmic trading strategies to enhance the trading experience.

What Factors to

Consider with Forex

Automated Trading

Software?

The best platforms offer features such as:

1. Access to the Multiple Assets: While MT4 is suitable for forex trading, MT5 can support other markets as well. Choose a broker who provides opportunities to trade in multiple currency pairs.

2. Flexible and Standard Programming Language: Both MQL4 and MQL5 are known to be flexible and developer friendly. MQL4 is similar to C, C++, PHP and VBScript. If you are not a skilled programmer, you can purchase or rent applications from the MQL4 community.

3. Advanced Technical Analysis: To create powerful strategies, you need access to advanced technical indicators and charting tools. This allows flexibility in pursuing trading styles and strategies.

4. Multi Device Accessibility: Trading platforms need to be supported across multiple devices and operating systems, like iOS, Android and Windows, so that you can access your account and position at any time and from anywhere.

5. Functional Interface: An easy to understand interface will allow you to understand the system quickly and make manual changes in a faster manner.

6. Detailed Price Data History for Backtesting: Make sure your platform has detailed price histories that can be backtested through multiple time frames. This will allow you to optimise your trading strategies.

7. Forex VPS: Through Forex Virtual Private Servers (VPS), you will not have to worry about latency or power disruptions. This will allow your Expert Advisors (EAs) to continue operating 24/7, minimising slippage and enhancing the trading experience.

FP Markets’ VPS Hosting for MT4 and MT5 takes advantage of the Equinix NY4 grid in New York, to maximise up-time for algorithmic and active traders. This cutting-edge technology ensures that trades can be executed at lightning speeds and traders remain free of concerns regarding bandwidth issues and power outages.

Přístup k více než 10 000 finančních nástrojů

Přístup k více než 10 000 finančních nástrojů Automatické otevírání a zavírání pozic

Automatické otevírání a zavírání pozic Zprávy a hospodářský kalendář

Zprávy a hospodářský kalendář Technické indikátory a grafy

Technické indikátory a grafy Mnoho dalších dodaných nástrojů

Mnoho dalších dodaných nástrojů

Zadáním své e-mailové adresy vyjadřujete souhlas se zásadami ochrany osobních údajů FP Markets a v budoucnu budete od FP Markets dostávat marketingové materiály. Odběr můžete kdykoli odhlásit.

Source - database | Page ID - 20759