Cryptocurrency has become increasingly popular in recent years, creating a range of opportunities for traders who want to take advantage of market price movements. In just a decade, the cryptocurrency market for digital currencies has grown from one to over 2,000 cryptocurrencies.

Nonetheless, the market involves quite a lot of processes and jargon which can be daunting for both novice and seasoned traders alike. It’s essential to know how the market operates and how to trade cryptocurrency before you join in the market action.

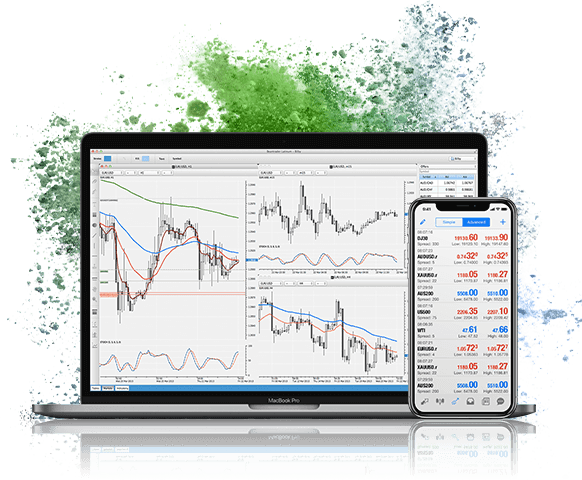

Access 10,000+ financial instruments

Access 10,000+ financial instruments