Are you ready to be a part of the currency revolution? With an FP Markets trading account you can access the cryptocurrency market and trade the most popular cryptocurrencies including Bitcoin, Ethereum, XRP (Ripple), Bitcoin Cash, and Litecoin. There is no requirement for a digital wallet and out cryptocurrency CFD trading platforms allow you trade on both rising and falling prices.

Why Trade Cryptocurrency CFDs?

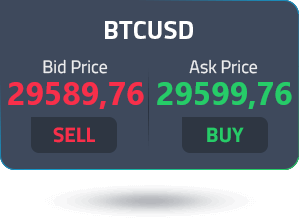

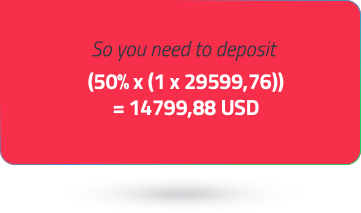

Trading cryptocurrencies via CFDs (Contracts for Difference) is a new way to trade this volatile market. FP Markets offers cryptocurrency CFDs in major assets like Bitcoin, XRP (Ripple), Bitcoin Cash, Litecoin and Ethereum, for positions against the US Dollar and Australian Dollar.

Access 10,000+ financial instruments

Access 10,000+ financial instruments