US Dollar Index (DXY)

The US dollar index, measures the value of the greenback against a basket of six major world currencies, experienced rampant demand over the past week, adding 3.3%, a week after the V-shaped recovery from levels not seen since September 2018.

The buck’s credentials as a universal currency appear intact. Regardless of whether US Treasury yields have been rising, the dollar continues to flex its financial muscle, the likes of which has not been seen since the 2008 financial crisis.

Friday dipped from best levels a touch short of the 103.00 handle, nosediving into supply-turned demand at 101.79/101.00. Traders will note 103.00 resides just south of major supply coming in at 104.16/103.10, drawn from 2002, an area which held 2017 highs at 103.82.

104.16/103.10 is likely to entice selling/profit taking, though may only donate a minor pullback given demand for the buck right now. Supply-turned demand at 101.79/101.00 holding into the close may encourage dip-buying, with expectations of dethroning 103.00 and possibly gravitating higher this week.

In terms of the RSI indicator, the value approached overbought terrain and marginally dipped, producing bearish divergence.

EUR/USD:

Monthly timeframe:

(Technical change on this timeframe is often limited though serves as guidance to potential longer-term moves)

In the early stages of March, price manoeuvred the pair into demand-turned supply at 1.1857/1.1352. Leaving long-term trend-line resistance (1.6038) unopposed, the unit has reversed gains and burrowed into demand at 1.0488/1.0912. Sustained downside this week/month may prompt an approach to 0.9581/1.0221, a relatively fresh demand area drawn from 2003.

The primary downtrend remains in motion, trading lower since 2008, exhibiting clear lower peaks and troughs.

Daily timeframe:

Demand at 1.0526/1.0638, coupled with RSI bullish divergence ahead of oversold terrain, elbowed its way into the spotlight Friday. Any upside in the EUR currency from here is likely to be capped by 1.0777, the February 20th low and supply pencilled in at 1.0925/1.0864.

Further slides this week, however, has the 1.0493 February 22nd low to target, closely shaded by the 1.0340 January 3rd low.

Interestingly, the 200-day SMA is also beginning to shows signs of resuming downside after flattening since the beginning of March.

H4 timeframe:

Latest developments on the H4 had price action bottom from a 161.8% Fib ext. level at 1.0651, a level stationed a few points north of demand seen at 1.0602/1.0630. Friday made a beeline for local resistance at 1.0816, which aligned closely with channel support-turned resistance (1.1055).

As evident from the chart, price concluded the week snapping daily gains and recording fresh multi-year lows at 1.0637.

H1 timeframe:

Since Thursday, the H1 candles have been busy carving out a consolidation zone between 1.08/1.0650. As you can see, Friday wrapped up modestly advancing of the lower boundary of the said range and testing the underside of 1.07.

Directly above 1.07, limited supply is evident (blue arrow), with some traders betting on an increase to trend-line resistance (1.1189) and possibly 1.08. This is further confirmed by the RSI momentum indicator, recently bottoming ahead of oversold territory and pencilling in bullish divergence.

Structures of Interest:

Long term:

Although monthly price is in the process of chalking up a monstrous bearish engulfing candle, we remain within the walls of demand at 1.0488/1.0912. A similar structural outlook can be seen on the daily timeframe from demand at 1.0526/1.0638 (housed within the current monthly demand), confirmed by the RSI indicator printing bullish divergence.

Short term:

H4 exhibits support from the 161.8% Fib ext. level at 1.0651, closely tied with demand at 1.0602/1.0630 (located within said daily demand). Upside from here, though, could be capped by channel support-turned resistance (1.1055).

On account of the above, H1 action is likely to attempt a run through 1.07 early week, which may entice breakout buying. However, before reaching the upper edge of the H1 range at 1.08, buyers must contend with H4 channel support-turned resistance, a trend-line resistance on the H1 and daily resistance at 1.0777.

AUD/USD:

Monthly timeframe:

(Technical change on this timeframe is often limited though serves as guidance to potential longer term moves)

Overwhelmed by the effects of the coronavirus pandemic, demand at 0.6358/0.6839 and 0.6094/0.5866 yielded last week, scoring seventeen-year lows at 0.5506.

Recent movement exposed another layer of demand at 0.5219/0.5426, potentially enticing further selling over the coming weeks, in line with the primary downtrend, lower since 2011.

Daily timeframe:

Partially altered from previous analysis.

After shedding more than 3.7% mid-week, AUD/USD ranged 450 points Thursday and wrapped up by way of a long legged doji candle. This represents extreme indecision, with movement seen whipsawing through supply-turned demand at 0.5664/0.5798 and testing a well-grounded support level at 0.5563. Upside on this timeframe remains capped by a notable demand-turned supply base at 0.5926/0.6062, which contained downside (as demand) in October 2008.

With reference to the RSI indicator, we are trading from unparalleled oversold levels right now, with the value seen bottoming off 10.00.

H4 timeframe:

Partially altered from previous analysis.

As we fade seventeen-year lows, focus on the H4 timeframe remains on newly formed supplies. The latest area to grace the charts falls in around 0.6036/0.5978, which entered the fold on Friday, forcing moves to lows of 0.5746 into the close.

Above 0.6036/0.5978, technical research reveals another layer of supply rests nearby at 0.6147/0.6078, with a break exposing support-turned resistance at 0.6314.

H1 timeframe:

The Australian dollar found itself on reasonably strong footing vs. the buck in early Asia Friday, toppling 0.59 and testing a resistance area comprised of Fib studies, the widely watched psychological figure 0.60 and channel resistance (0.5794), at 0.60/05955 (green).

Boasting tight confluence, AUD/USD reclaimed earlier gains through London and the US sessions, eventually breaching channel support (0.5506) and settling a few points north of 0.58, in the shape of a picture-perfect bullish hammer candlestick pattern.

Meanwhile, technical indicators had the RSI recently crossing beneath 50.00.

Structures of Interest:

Long term:

The break of monthly demand at 0.6094/0.5866 commands attention, suggesting additional loss could be on the cards to demand at 0.5219/0.5426. Daily price, however, recently swerved to support at 0.5563 and holds within the walls of supply-turned demand at 0.5664/0.5798. The fact price closed in the form of a reasonably strong selling wick here, though, indicates a possibly soft market, in line with the primary downtrend.

Short term:

Higher-timeframe flow is further validated on the H4 timeframe, recently fading supply at 0.6036/0.5978. This suggests H1 price, although holding above 0.58 and printing a bullish candlestick signal, is unlikely to generate much to the upside, with a break beneath 0.58 perhaps on in store.

Breakout sellers south of 0.58, therefore, may initially target 0.57, with the possibility of reaching 0.56 and daily support underlined above at 0.5563.

USD/JPY:

Monthly timeframe:

(Technical change on this timeframe is often limited though serves as guidance to potential longer-term moves)

Since kicking off 2017, USD/JPY has been busy carving out a descending triangle pattern (118.66/104.62). February had price elbow a touch outside the upper boundary of the aforementioned descending triangle to 112.22, though retreated lower and produced a shooting star pattern into the month’s end.

March breached the lower edge of the descending triangle, yet has recovered in strong fashion, leaving nearby demand at 96.41/100.81 unchallenged. Note current action is seen mildly fading the descending triangle’s upper boundary.

Daily timeframe:

Partially altered from previous analysis –

Shaped in the form of a near-full-bodied bullish candle Thursday, a critical demand-turned supply at 110.10/109.52 was rattled and retested Friday, perhaps providing a basis for an approach to supply coming in at 112.64/112.10 this week, an area that’s held price action lower on three occasions since March 2019.

Candlestick traders will also note Friday’s action closed by way of a long-legged doji candle pattern.

H4 timeframe:

Thursday crossed paths with supply coming in at 111.65/111.22 which intersected with channel resistance (105.91). The move from here charted the way to demand from 109.31/109.56, prompting another wave of buying Friday that landed the candles back within the aforementioned supply zone.

It should be noted that above the current supply, we have a 161.8% Fib ext. level at 111.87, which happens to be stationed just beneath daily supply drawn from 112.64/112.10.

H1 timeframe:

After spending the majority of Friday’s US session attempting to establish a footing above 111, things turned sour in the last hour, with price donating a relatively dominant bearish candle to 110.75. This potentially lays the foundation for further selling in early trade this week, with 110 on the radar, followed by stacked demand between 108.89/108.50 and 108.84/109.23. Note also the 109 handle intersects with the said zones and the 100-period SMA is seen entering the lower border.

Structures of Interest:

Long term:

Monthly price hovering off notable structure is likely to offer further resistance. However, daily price suggests that before lower prices take hold, a run to supply at 112.64/112.10 might occur. Therefore, expect the possibility of a whipsaw through monthly structure.

Short term:

The combination of H4 supply at 111.65/111.22, H4 channel resistance, the 161.8% H4 Fib ext. point at 111.87 and H1 price recently closing sub 111 echoes an intraday bearish vibe.

In light of the above, traders are likely to seek intraday bearish scenarios under 111 today, targeting the upper boundary of daily demand at 110.10/109.52 and the 110 handle.

GBP/USD:

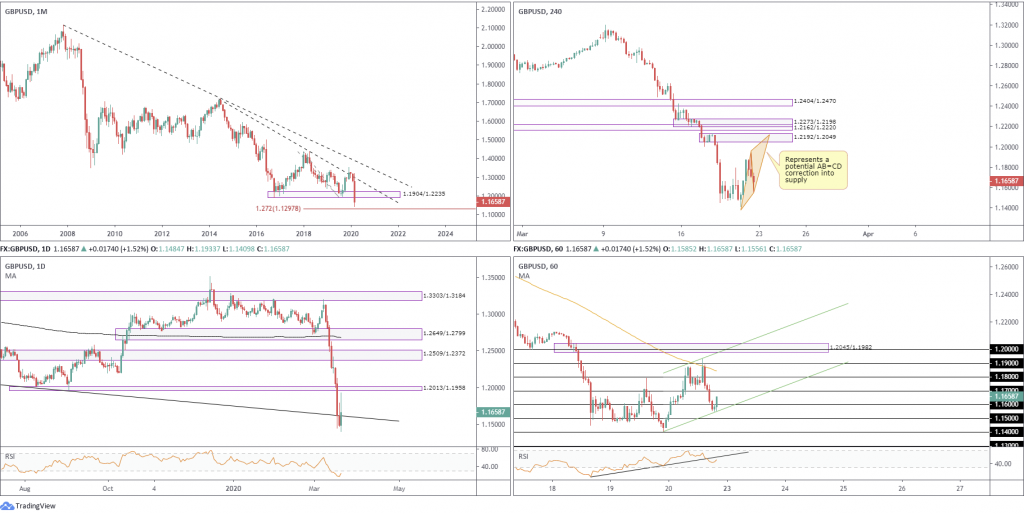

Monthly timeframe:

(Technical change on this timeframe is often limited though serves as guidance to potential longer term moves)

Down more than 9% in the month of March, south of trendline resistance (1.7191) traders pushed through a familiar area of support at 1.1904/1.2235 in recent trading. With price toying with lows not seen since the 1980s, the next observable support target on the monthly timeframe falls in around 1.1297, a 127.2% Fib ext. level.

Daily timeframe:

Partially altered from previous analysis.

Downside risks continue to build in GBP/USD after rattling trend-line support (1.2373) last week and pulling the RSI indicator deep into oversold terrain. Down more than 5% on the week, a decisive hold beneath the said trend-line support places the weekly 127.2% Fib ext. firmly on the radar at 1.1297.

The 200-day SMA has also begun turning lower after flattening since November 2019.

H4 timeframe:

Fading historic lows, GBP/USD H4 activity is in the process of possibly chalking up an AB=CD bearish configuration (orange), terminating within the upper boundary of fresh supply at 1.2192/1.2049. Combining the area of stacked supply just above at 1.2273/1.2198 and 1.2162/1.2220, we have ourselves a strong area of confluence on this timeframe, in the event we reach levels this far north this week.

H1 timeframe:

Friday ended a tumultuous week closing strongly above 1.16, after a decisive decline from peaks above 1.19 and the 100-period SMA at the beginning of US trade. A rather large ascending channel (1.1410/1.1932) is in process, with 1.17 seen close by as potential resistance.

Ruled largely by round numbers on this timeframe, a break of 1.17 has 1.18 in the firing line, followed by 1.19 (and the 100-period SMA) and then 1.20 which happens to be encapsulated within supply at 1.2045/1.1982.

Interestingly, we also broke RSI trendline support and trade sub 50.00.

Structures of Interest:

Long term:

From longer-term charts, price action is ripe for additional downside, particularly if we retake (on a daily basis) daily trend-line support.

Short term:

While there’s a chance the H4 AB=CD bearish pattern may not come to fruition, it’s still worth keeping an eye on this week, as it could prove to be monstrous resistance, given the supply present in this area.

Ultimately, H1 is bullish until locking horns with 1.17, therefore the latter could also prove valuable resistance this week. Conservative traders, however, will likely seek additional confirmation before committing, given the increased volatility.

DISCLAIMER:

The information contained in this material is intended for general advice only. It does not take into account your investment objectives, financial situation or particular needs. FP Markets has made every effort to ensure the accuracy of the information as at the date of publication. FP Markets does not give any warranty or representation as to the material. Examples included in this material are for illustrative purposes only. To the extent permitted by law, FP Markets and its employees shall not be liable for any loss or damage arising in any way (including by way of negligence) from or in connection with any information provided in or omitted from this material. Features of the FP Markets products including applicable fees and charges are outlined in the Product Disclosure Statements available from FP Markets website, www.fpmarkets.com and should be considered before deciding to deal in those products. Derivatives can be risky; losses can exceed your initial payment. FP Markets recommends that you seek independent advice. First Prudential Markets Pty Ltd trading as FP Markets ABN 16 112 600 281, Australian Financial Services License Number 286354.

Access +10,000 financial

instruments

Access +10,000 financial

instruments