Reading time: 8 minutes

Demand for industrial applications, investment portfolio diversification and safe-haven bidding, witnessed precious metals prices soar in 2020, a year governed largely on the back of the coronavirus pandemic (COVID-19).

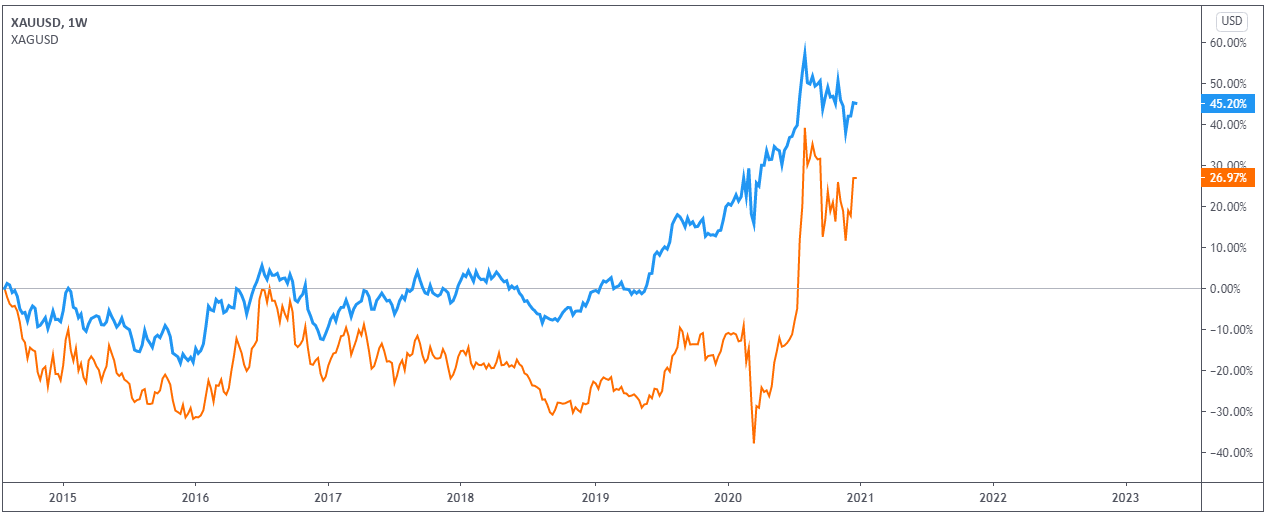

Despite strong bullish gains, primary precious metals such as gold and silver concluded in a corrective phase (figure 1.A). An interesting issue facing retail investors as we step into 2021, therefore, is whether additional corrective structure is on the horizon or whether the precious metals market is set to resume its uptrend.

An additional consideration, of course, is the investment vehicle used to increase portfolio exposure. To help, investors generally look to gold.

(Figure 1.A: XAU/USD [Gold] XAG/USD [Silver] – TradingView)

Physical Gold, Gold Miners, Gold Stocks or Gold Derivatives?

When discussing precious metals trading, gold, often referred to as the yellow metal, is usually the first metal many investors think of.

In terms of gold’s investment vehicles, a number of options are available:

- Directly purchasing physical metals is an investment option. Though possessing bullion can be cumbersome, in terms of transactional logistics and storage. Another investment method is becoming a stakeholder in one of the many gold miners worldwide. However, having direct involvement requires technical knowhow in gold mining. It also requires a large capital outlay.

- Investors can purchase gold stocks (shares). In other words, investing in mining companies listed on a stock exchange.

- Investors may also consider the futures market: exchange-traded derivative contracts. This is almost the same as speculating on current gold prices (spot prices), except speculation is on the price of gold in the future. The futures market is renowned for high market volatility, while additional complications can arise if futures contracts expire. Another derivatives-based product to consider are metals CFDs, or contracts for differences.

- Mutual funds and Exchange-Traded Funds (ETFs) also remain popular investment channels.

Newmont Corp. – Ticker: NEM

Newmont Corp., based in the United States (US), is the world’s largest gold mining company and has been entrenched within an uptrend since 2016 (figure 1.B). Although the mining stock entered into a corrective phase in August 2020, the precious metals company is likely to remain on investors’ watchlists going forward.

Newmont acquired Canada’s Goldcorp in 2019, and is now consequently sitting on 100 million ounces of gold mineral reserves, the most in its history.

(Figure 1.B: NEM weekly chart – TradingView)

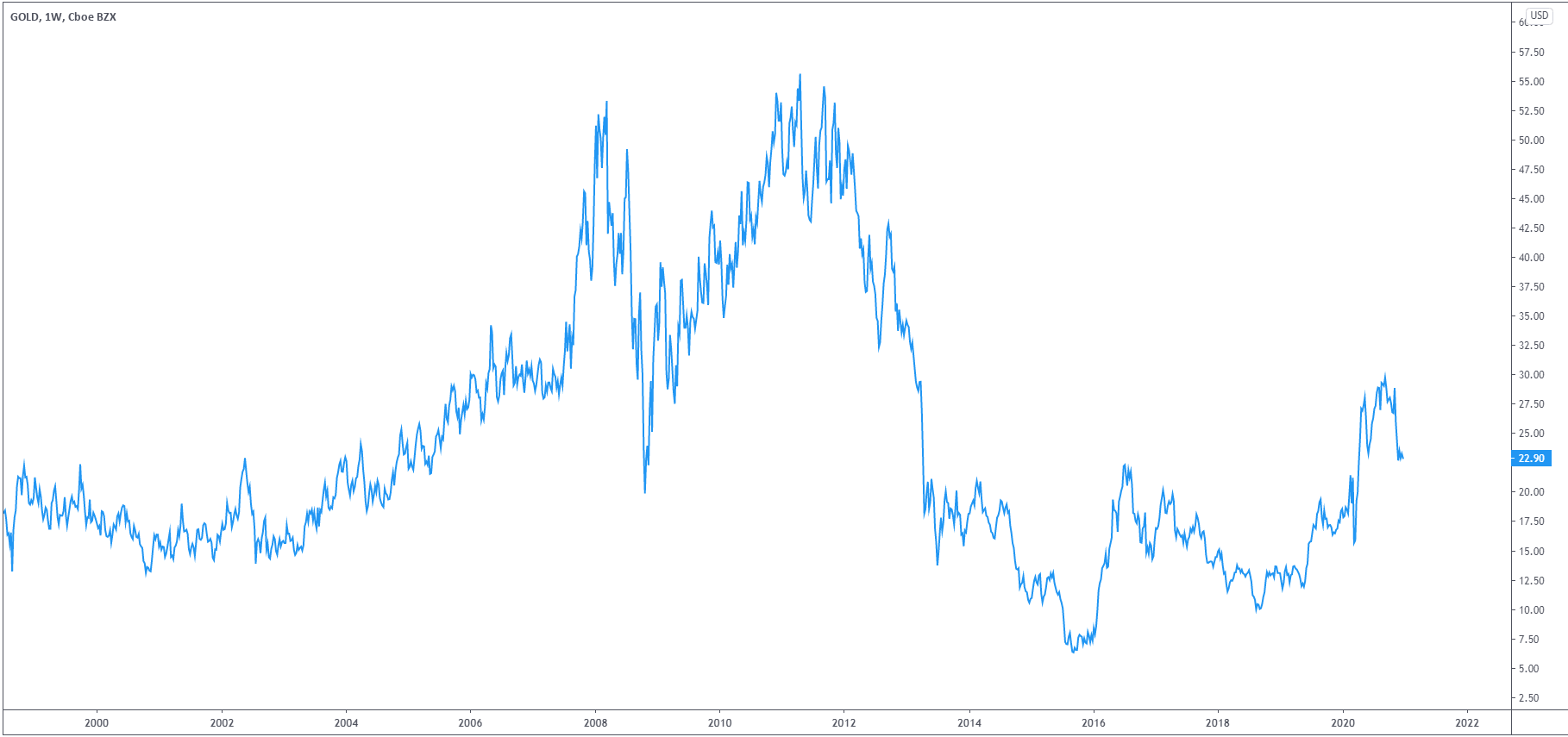

Before Newmont acquired Goldcorp, the largest gold company was Barrick Gold (ticker: GOLD – see figure 1.C). With that being said, Barrick remains an interesting company and is also likely on the watchlists of many investors. Barrick states the company controls 13 gold and copper mining operations over North and South America, Africa, Papua New Guinea and Saudi Arabia. Barrick also state they have one of the deepest project pipelines in the gold industry.

(Figure 1.C: GOLD weekly chart – TradingView)

Investors who prefer the silver market, on the other hand, Pan American Silver (listed on Nasdaq), a premier silver mining company boasting large silver reserves, is interesting.

Silver prices had a noteworthy 2020. Despite entering into a correction in August, XAG/USD (Silver/US dollar) is up 43.22 percent year-to-date (figure 1.D).

(Figure 1.D: Daily chart of XAG/USD – TradingView)

Platinum and Palladium Stocks

Sibanye-Stillwater is a leading South African precious metals mining company traded on the NYSE. According to their website, Sibanye-Stillwater is the world’s largest primary producer of platinum and rhodium, and the second largest primary producer of palladium. The company also acquired Lonmin plc in 2019 – although Lonmin had a history mired in controversy, it had a great deal of platinum reserves in South Africa. Sibanye-Stillwater, therefore, could be a precious metals stock of interest.

Per ounce, platinum is more expensive than gold and has industrial uses in major industries, such as the automotive industry. Having such widespread usage gives it a unique advantage over gold.

The problem with palladium is it is usually mined as a by-product of mining nickel. This may shift investor interest to companies such as New Age Metals Inc – a pure-play palladium stock listed on the TSX Venture Exchange. Pure-play indicates a company’s earnings depend 100% on palladium’s price movement.

Exchange-Traded Funds (ETFs) – Gold Miners ETF (GDX)

If metals stock trading is not an investor’s cup of tea, ETFs could be an alternative.

Precious metals ETFs are a type of financial derivative in which the underlying asset are precious metals. Some investors prefer precious metals ETFs as it permits exposure to various precious metals simultaneously.

If an investor seeks more of a traditional approach, preferring gold and silver ETFs, investing in GDX is an option. GDX is an ETF that aims to track the movement and returns of the NYSE Arca Gold Miners Index (NTR).

Another choice of derivatives, of course, are CFDs – leveraged trading products that mirror the price of underlying markets: asset classes such as the stock market (share CFDs and Index CFDs) as well as gold and silver (gold CFDs and silver CFDs). CFDs represent an agreement, or contract, between buyers and sellers to exchange the difference between the opening and closing price without taking ownership of the underlying asset. FP Markets allows trading the spot price for metals including Gold or Silver against the US dollar or Australian dollar as a currency pair with competitive leverage rates.

Disclaimer: The information contained in this material is intended for general advice only. It does not take into account your investment objectives, financial situation or particular needs. FP Markets has made every effort to ensure the accuracy of the information as at the date of publication. FP Markets does not give any warranty or representation as to the material. Examples included in this material are for illustrative purposes only. To the extent permitted by law, FP Markets and its employees shall not be liable for any loss or damage arising in any way (including by way of negligence) from or in connection with any information provided in or omitted from this material. Features of the FP Markets products including applicable fees and charges are outlined in the Product Disclosure Statements available from FP Markets website, www.fpmarkets.com and should be considered before deciding to deal in those products. Derivatives can be risky; losses can exceed your initial payment. FP Markets recommends that you seek independent advice. First Prudential Markets Pty Ltd trading as FP Markets ABN 16 112 600 281, Australian Financial Services License Number 286354.

Access +10,000 financial

instruments

Access +10,000 financial

instruments