Charts: Trading View

(Italics: Previous Analysis)

EUR/USD:

With the month of August in the rear-view mirror, down 1.6 per cent, the EUR/USD currency pair trades lower 11.60 per cent, year to date. Wednesday, however, witnessed price rally 0.5 per cent, strengthening its position north of parity ($1.00).

The H1 timeframe has price movement closing in on the underside of $1.01, a psychological base complemented by Quasimodo support-turned resistance at $1.0108 and a 100% Fibonacci projection at $1.0114—a bearish AB=CD pattern that also brings the 1.618% Fibonacci extension to the table at $1.0108. Any downside attempts on the H1 chart, of course, has $1.00 arranged as a reasonable support target. Also joining the aforementioned H1 resistances is prime resistance on the H4 chart at $1.0125-1.0105, which happens to accommodate a 100% Fibonacci projection from $1.0105.

Although H4 and H1 resistances echo strong confluence, the bigger picture demonstrates scope to navigate higher levels. Following a rebound from weekly support in the form of a 1.272% Fibonacci projection at $0.9925 (alternate AB=CD bullish formation) and daily support coming in at $0.9919 (aided by a bounce seen from the relative strength index [RSI] trendline resistance-turned support ahead of oversold space), weekly resistance serves as the next upside target at $1.0298. However, while room to advance is indeed present on the higher timeframes, price action on the weekly timeframe has been entrenched within an unmistakable primary bear trend since pencilling in a top in early 2021 with heavy-handed pullbacks in short supply.

Technical Expectation:

H4 prime resistance from $1.0125-1.0105, together with H1 resistance between $1.0114 and $1.01, offers a robust technical ceiling that’s bolstered by the currency pair’s downtrend. Sellers from the noted resistances, nonetheless, are likely to adopt a watchful stance and pursue additional confirmation prior to pulling the trigger, due to weekly and daily price rebounding from respective supports.

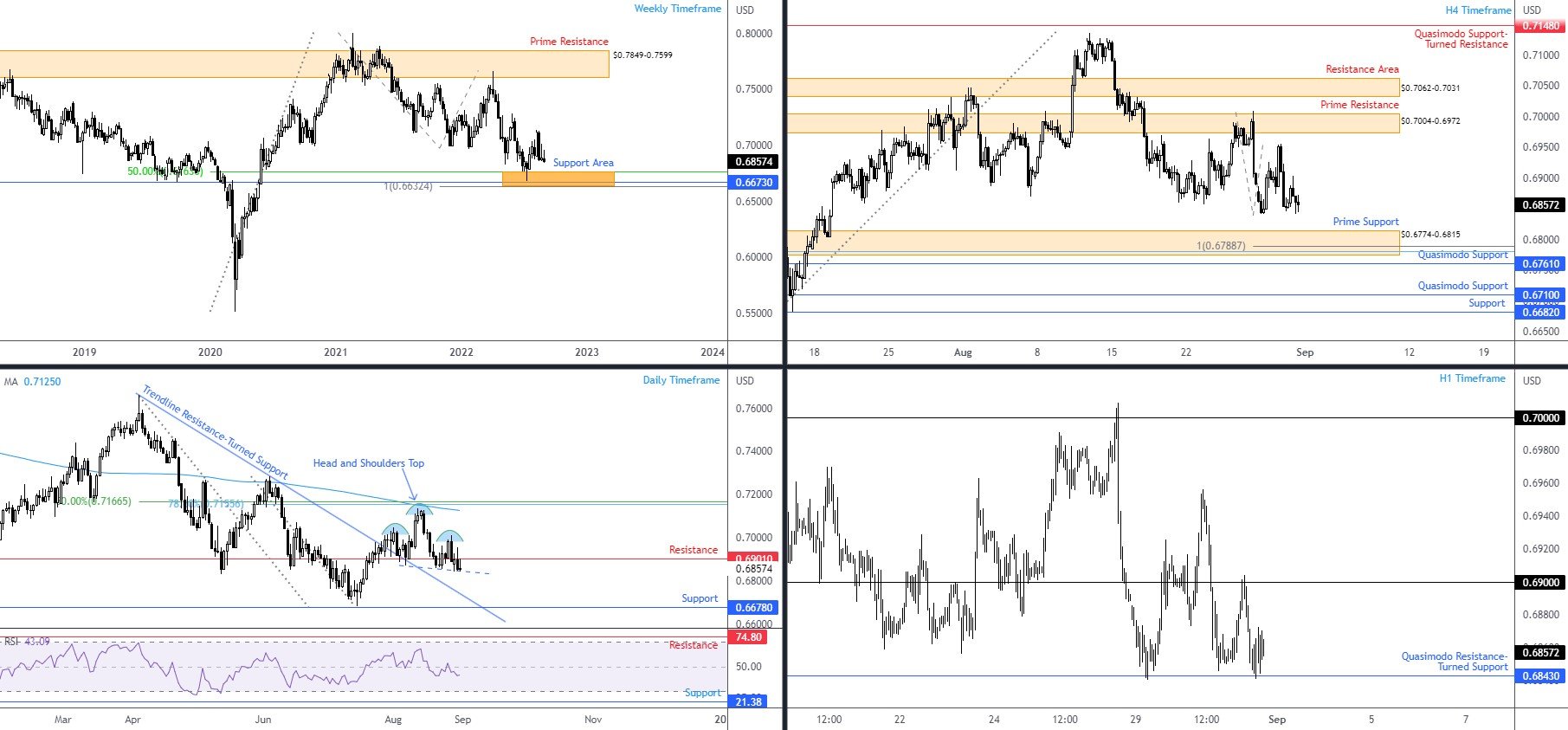

AUD/USD:

AUD/USD:

It was largely another risk-off session on Wednesday, despite major US equity indexes staging a modest comeback. The Australian dollar finished the day off best levels against the US dollar, which, technically speaking (as I noted in previous reports) should not raise many eyebrows.

Due to the somewhat lacklustre movement in recent trading, technical structure remains unchanged on the weekly and daily timeframes, therefore the following should serve as a reminder of where I currently stand (italics):

The currency pair has reflected a primary bear trend since forging a top from $0.8007 (22nd Feb high [2021]), action currently suggesting a drop back into weekly support between $0.6632 and $0.6763, constructed from a 100% Fibonacci projection, horizontal price support, and a 50% retracement. You will also note that the daily price is respecting the lower side of resistance at $0.6901 and on the verge of venturing south of a head and shoulders top pattern neckline, drawn from the low $0.6869. Further adding to this bearish vibe is the daily chart’s relative strength index (RSI) rejecting the underside of the 50.00 centreline. Consequently, daily trendline resistance-turned support, drawn from the high $0.7661, could soon welcome price action, followed closely by support at $0.6678.

Prime support on the H4 scale at $0.6774-0.6815 (houses a 100% Fibonacci projection at $0.6789 and a deep 78.6% Fibonacci retracement at 0.6780, as well as being arranged just north of H4 Quasimodo support at $0.6761) is seen a touch south of current price, holding the $0.68 psychological figure from the H1 timeframe. Yet, in order to reach the said supports, H1 Quasimodo resistance-turned support at $0.6843—tested heading into US hours on Wednesday following a decisive rejection of $0.69 in Asia—must be dethroned.

Technical Expectation:

Weekly, daily, and H4 timeframes, hint that bears are likely to continue to control sentiment for the time being. This, as communicated in previous research, opens the door for a break of H1 Quasimodo resistance-turned support at $0.6843, with short-term selling perhaps unfolding towards $0.68 and H4 prime support at $0.6774-0.6815.

USD/JPY:

USD/JPY:

It was another muted session on Wednesday for USD/JPY. This leaves price action in much the same spot as it was heading into Wednesday’s session. As a result, much of the following analysis will echo similar thoughts as recent writing (italics).

While the weekly timeframe’s price action is busy cementing position north of support at ¥137.23—inching towards forging a fresh multi-year pinnacle with scope to climb as far north as weekly resistance from ¥146.79—daily resistance at ¥139.55 could ‘throw a spanner in the works’ for buyers. Should we overthrow the aforementioned resistance, this sends a robust signal that buyers are still in the driving seat (in line with the current primary bull trend), and will likely want to explore higher territory.

Interestingly, the daily timeframe’s relative strength index (RSI) ventured above its 50.00 centreline after coming within an inch of testing oversold space and forming hidden positive divergence at the beginning of August. Dethroning the 50.00 base adds weight to last week’s push, informing market participants that average gains are exceeding average losses (positive momentum). Upside targets are seen at the indicator trendline resistance, etched from the high 87.44, and indicator resistance at 87.52.

As evident from the H4 timeframe, nearby resistance is featured in the form of a 1.618% Fibonacci projection at ¥140.15, and support demands attention from ¥137.45, closely followed by support at ¥135.58. Realised from the H1 timeframe, recent flow established a bullish flag between ¥139 and ¥138.26, a pattern that experienced a breach to the upside on Tuesday. This indicates a break of ¥139 and at least a potential run at ¥140, with the bullish flag’s profit objective set at ¥141.63 (blue arrows).

Technical Expectation:

All four timeframes suggest a break of ¥139, though traders are urged to pencil in the possibility of turbulence from daily resistance at ¥139.55. Should we clear the noted level, ¥140 represents a reasonable upside objective in the near term.

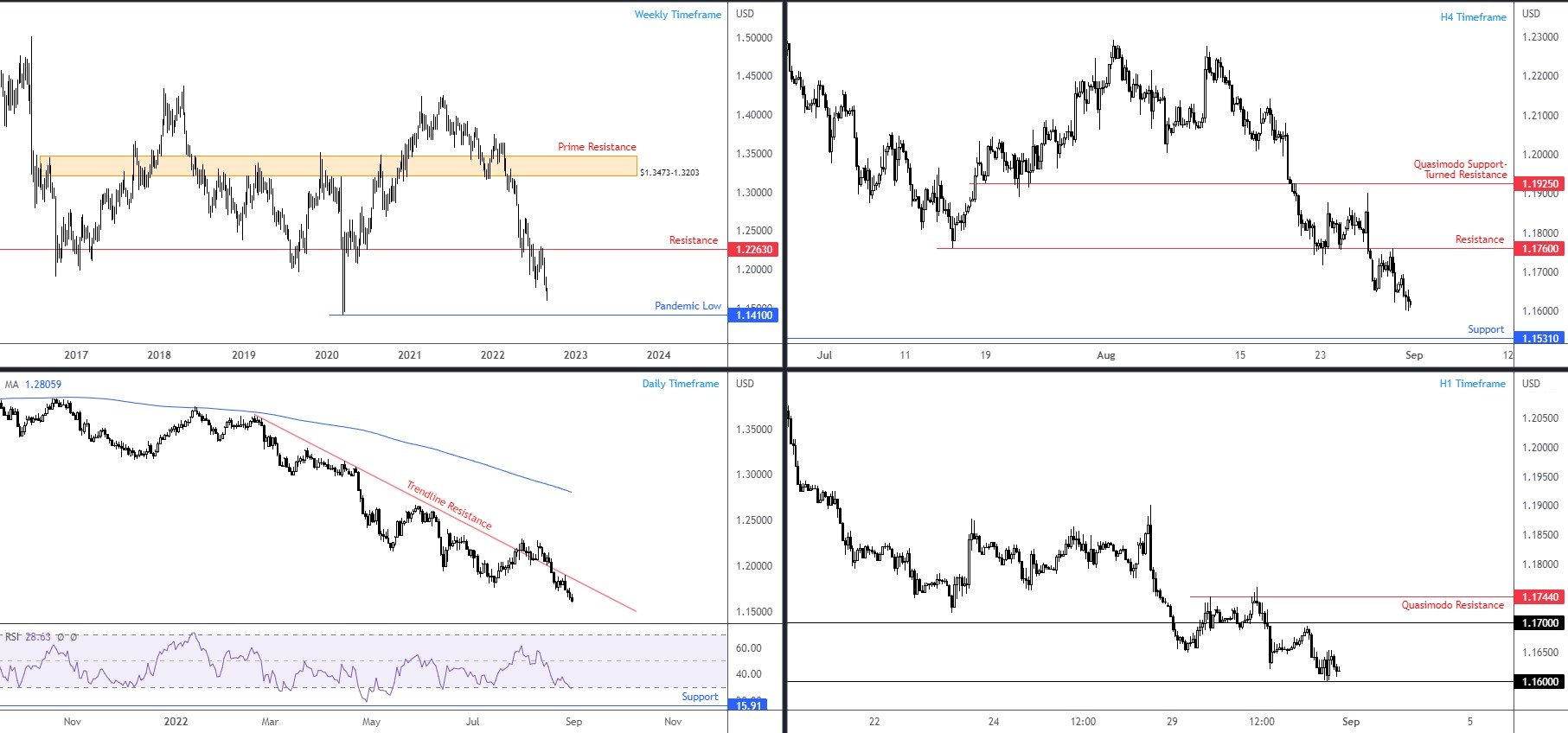

GBP/USD:

GBP/USD:

Downside risks for sterling remain elevated and the technical framework also subscribes to a bearish position.

Longer-term technical price action shines the spotlight on the pandemic low of $1.1410, following a retest of weekly resistance at $1.2263. Pair this with the primary bear trend since early 2021, I see little technical evidence suggesting a bullish revival just yet. A similar vibe is seen from the daily timeframe; limited support is visible until $1.1410 and the unit is seen reacting to the underside of trendline resistance, extended from the high $1.3639. According to the daily chart’s relative strength index (RSI), the indicator stepped into oversold territory, a move shifting attention to support at 15.91.

The H4 timeframe offers straightforward price structure; after a pip-perfect rejection of resistance at $1.1760, the pair appears poised to continue tunnelling southbound until support at $1.1531. On the H1 timeframe, the unit is kissing the upper edge of $1.16, threatening to probe space beneath the psychological value and make its way to H4 support pencilled in above at $1.1531.

Technical Expectation:

This is a market for sellers, according to the current technical (and fundamental) picture.

The pandemic low of $1.1410 remains in the line of fire for sellers on the bigger picture, giving bears some space to work with which implies any rallies are likely to be viewed as selling opportunities.

Shorter term, a break under $1.16 would likely be recognised as a bearish breakout opportunity, in line with the prevailing downtrend, targeting at least H4 support from $1.1531.

The information contained in this material is intended for general advice only. It does not take into account your investment objectives, financial situation or particular needs. FP Markets has made every effort to ensure the accuracy of the information as at the date of publication. FP Markets does not give any warranty or representation as to the material. Examples included in this material are for illustrative purposes only. To the extent permitted by law, FP Markets and its employees shall not be liable for any loss or damage arising in any way (including by way of negligence) from or in connection with any information provided in or omitted from this material. Features of the FP Markets products including applicable fees and charges are outlined in the Product Disclosure Statements available from FP Markets website, www.fpmarkets.com and should be considered before deciding to deal in those products. Derivatives can be risky; losses can exceed your initial payment. FP Markets recommends that you seek independent advice. First Prudential Markets Pty Ltd trading as FP Markets ABN 16 112 600 281, Australian Financial Services License Number 286354.

Access +10,000 financial

instruments

Access +10,000 financial

instruments