Experience Trading

on the Go

on the Go

Irrespective of your trading experience, or whether you trade a demo account or a live account, it’s likely you’ve come across the phrase ‘Multi-Account Manager for MetaTrader 4’, or simply ‘MAM for MT4’.

It will come as no surprise, many traders, even some experienced professional traders and money managers, are unsure of what a MAM applies to. Whether you are the latter or a new kid on the block, this article helps shed some light on the subject.

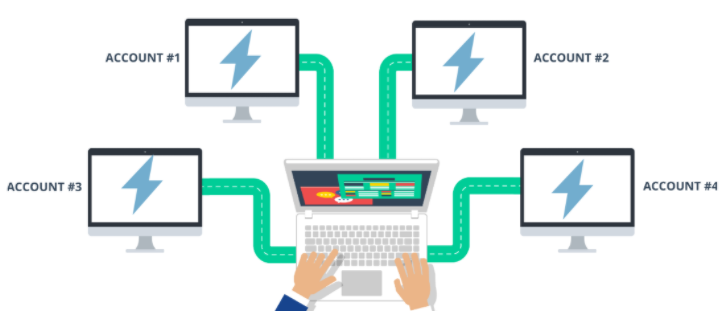

At its core, a multi account manager refers to a single account that fund managers or asset managers use to execute trades from. These trades are then be mirrored in other trading accounts: client accounts belonging to the fund manager. The manner in which it’s mirrored depends on predetermined allocation methods.

Therefore, with just a few clicks, money managers are able to execute trades across several accounts simultaneously. Consequently, the account they conduct trades from is termed the master account, whereas the rest of the managed accounts are known as sub accounts.

If you trade simply to manage your own capital, feel free to trade using any account.

Though if you’re an investment firm or a professional trader managing client money, or a finance-savvy trader who manages your extended family members’ trading accounts, trading using a MAM account is an option. The single most important benefit is the time factor.

To illustrate, if you manage 10 accounts, with a MAM account you will only need to spend a tenth of the time you would normally use to trade all your clients’ accounts. The time saved, therefore, can be put to better use to things such as conducting research, which in turn should lead to more informed trading decisions. If you are looking to save even more time, combining your multi account manager with automated trading strategies (Expert Advisors – EAs) is an option.

Absent of a MAM solution, commanding the same pricing for trades across your sub accounts is also difficult. In the time it takes to transition from one sub account to another, the market would have already moved. In fact, for a highly traded currency such as the USD, the real-time exchange rate fluctuations can be rapid.

In a way, a MAM helps you achieve the same pricing for all your sub accounts, just like block orders help you receive the same pricing for all your trades, except block trades must be executed from one account (this is according to the local law in most countries).

A MAM account is powered by MAM software.

If you are using MetaQuotes’ MT4 platform to trade, using MAM for MT4 is straightforward. MAM is also available for MetaTrader 5 (MT5).

In order to operate a MAM, nevertheless, you must meet the criteria of your chosen provider. With FP Markets, money Managers are required to hold a Financial Services License in their operating jurisdiction and evidence a strong trading history. In addition, the minimum investment requirement to activate a MAM is 10,000 USD. If you do not hold a licence though can prove trading consistency over a 6-month period, a MAM could still be a possibility.

After installing the plugin and complying with the licensing requirements, you have to set the master account so it encompasses all the managed accounts – in other words, linking your clients’ accounts you want to control under the master account. You can contact your brokerage customer support if you encounter a hurdle.

On top of that, a MAM solution allows you to separate your own money from the master account if you so desire.

Depending on your trading strategy, you must decide which allocation methods work best for you. For example, if your clients demonstrate a wide risk tolerance, you can assign higher leveraging ratios to certain sub accounts. MAM for MT4 also allows you to accommodate different order types.

PAMM, or percent allocation management module, has different allocation parameters compared to MAM. Under PAMM, each sub account has a specified ratio in the master account. The ratio is proportional to the deposit amount of each account. For that reason, under PAMM, you cannot assign different leverages to each sub account, nor can you separate your own money from the master account. You also cannot have a different lot allocation across sub accounts. As the name suggests, PAMM is all about percent allocation.

MAM for MT4 is a technological advancement in software, helping money managers succeed in the Forex Market.

Grab the opportunity to use MAM for MT4 and start making better trades for your clients today.

Access 10,000+ financial instruments

Access 10,000+ financial instruments Auto open & close positions

Auto open & close positions News & economic calendar

News & economic calendar Technical indicators & charts

Technical indicators & charts Many more tools included

Many more tools included

By supplying your email you agree to FP Markets privacy policy and receive future marketing materials from FP Markets. You can unsubscribe at any time.

Source - cache | Page ID - 1041