Reading Time: 8 minutes

- Cryptocurrencies

Cryptocurrencies represent digital currencies (bitcoin [BTC], the largest cryptocurrency by market capitalization, Ethereum [ETH], and Litecoin [LTC], for example). Cryptocurrencies serve as a means of exchange and a store of value, relying on cryptographic techniques (cyber security) using blockchain technology to safeguard and verify transactions.

- Stocks

Stocks indicate partial ownership of a company that reflect the value of a company’s operations. Occasionally, a stock owner is entitled to a dividend, representing a portion of the company’s profits. The value of a stock will fluctuate based on the company’s performance and other variables, such as the release of pertinent news. Their worth on the market is determined by supply and demand.

- Forex

Forex traders speculate on the price movements of a currency pair: a short or long position. Foreign exchange (commonly known as Forex or FX) is a worldwide market where national currencies are exchanged using currency pairs: EUR/USD, and GBP/USD, for example. Due to the global scope of trade, business, and finance, foreign exchange markets are the world’s largest and most liquid financial market.

Terms To Be Aware Of

- Blockchain

A blockchain is a decentralized ledger that records all transactions in a peer-to-peer network. This method allows participants to confirm transactions without the obligation of a central clearing authority

- Store of Value

A valuable item is said to be a store of value if it appreciates rather than losing value over time, generally in times of market turmoil.

- Decentralized Network.

A decentralized market incorporates digital technology that enables buyers and sellers of securities to confirm transactions with one another instead of negotiating at a conventional exchange.

Differences and Similarities Between FX, Crypto, and Stocks

Crypto and Forex trading are decentralized, whereas stocks are traded slightly differently.

Cryptocurrency trading involves purchasing and selling digital assets such as cryptocurrencies, tokens, and other non-fungible tokens (NFTs). Trading foreign currencies involve exchanging one fiat currency for another in the expectation that one of the currencies will appreciate, allowing the trader to resell the asset at a higher price; this is called Forex trading.

Because cryptocurrencies have entered the mainstream over the past few years, numerous Forex traders are unsure whether they should concentrate on crypto exchanges rather than Forex markets or strive to have the best of both worlds.

To trade Forex, you must open a Forex trading account to be able to trade with leverage. There are generally no qualifying requirements, other than the means of deposits. The particular leverage maximum depends on the brokerage, but traders can generally access as much as 500:1 leverage.

When trading stocks, you purchase shares of companies, which can range in price from just a few US dollars to several hundred dollars. Market price varies with supply and demand.

On the other hand, foreign exchange trades often consist of several hundred million dollars in a major currency and are likely to have little or no effect on the market price of that currency pair.

Even though traders and investors are interested in Forex and crypto, cryptocurrency is often seen as an alternative to more traditional assets. Investors can gain wealth through the acquisition of both cryptocurrencies and stocks.

There are also significant distinctions in how crypto and stocks are exchanged. While stock markets are only open during certain hours, you may buy cryptocurrency on any digital currency exchange at any time, day or night.

The tables below show some advantages and disadvantages of the three asset classes.

Pros:

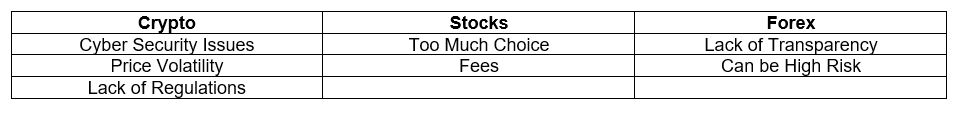

Cons:

Conclusion:

With an understanding of the three asset classes, consider testing each one thoroughly with a demo account from FP Markets. This should give you an insight into the differences and similarities of each asset class without putting any funds at risk, and serve you well when you decide to begin live trading.

FP Markets is one of the leading Forex and CFD brokers and are fully regulated, offering MT4/MT5 and IRESS trading platforms for retail investors and institutional traders, as well as an array of free technical analysis tools and an education section featuring free webinars, training videos, and much more.

Access +10,000 financial

instruments

Access +10,000 financial

instruments