Americans are about to vote for their next president with election day, Tuesday November 3, fast approaching.

In a historic race for the White House, incumbent President Donald Trump, who represents the Republican party, goes head-to-head with Democratic nominee Joe Biden, the 47th vice president of the United States from 2009 to 2017.

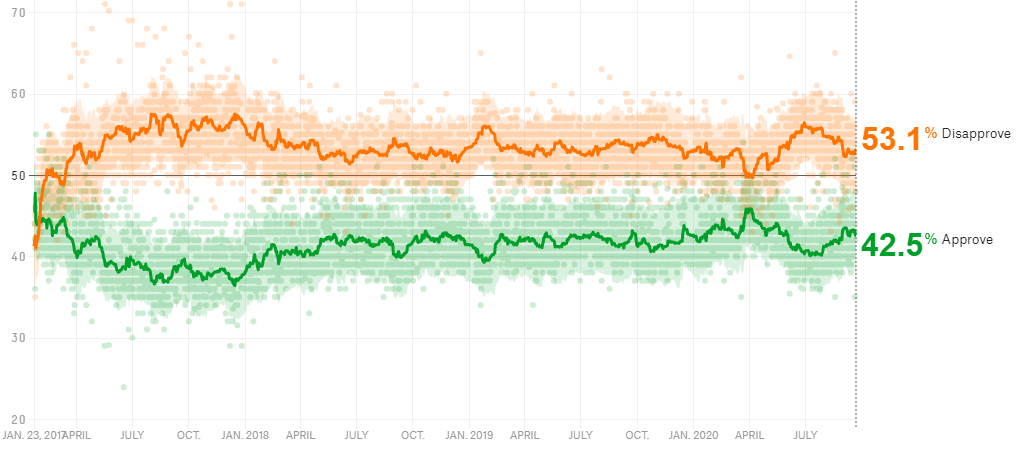

How popular is US President Trump? According to FiveThirtyEight[1], Trump’s approval rating is below 50 percent.

Source: FiveThirtyEight

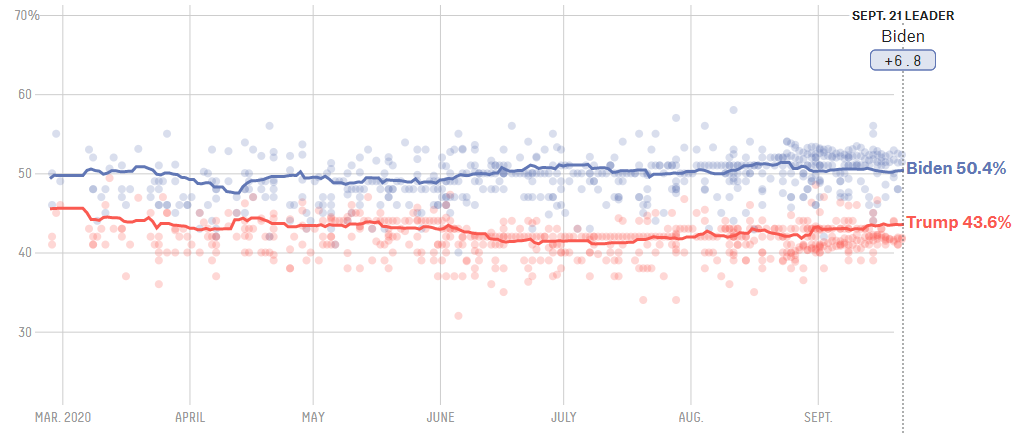

In addition, the national polls, also according to FiveThirtyEight[2], has Biden leading against Trump by nearly seven points.

Source: FiveThirtyEight

Although a positive for Biden, the elections are far from over.

History shows Hillary Clinton led the national polls in 2016, though lost in the electoral college. The electoral college is not an institution; it’s a label given to a group of 538 designated individuals (each state has a different number of electors based on their representatives in Congress), who cast each state’s official votes for president.

US Dollar

2020 has been an historic year so far for the financial markets.

COVID-19 emerged in March, drastically influencing global markets and has remained a dominant weight since. This adds additional uncertainty heading into the political event of the year, owing to the effect it is having on both the economy and how people will vote.

The US dollar, as measured by the US dollar index (compares the value of the USD against six major world currencies, including the euro [EUR], Japanese yen [JPY] and British pound [GBP]), has declined approximately 11 percent from peaks clocked during the height of the coronavirus, yet for nearly two months the buck has been establishing a rounded bottom (see figure A), hinting at the possibility of a recovery. Additionally, we are coming off a nine-year trendline support, visible from the weekly timeframe (see figure B).

(Figure A – US dollar index daily timeframe provided by TradingView)

(Figure B – US dollar index weekly timeframe provided by TradingView)

The combination of the COVID-19 pandemic plaguing major economies and US presidential elections increases market volatility and uncertainty. Investors loathe uncertainty. Elections can have a dramatic effect on the domestic economy and currency markets, with events likely to substantially impact the USD.

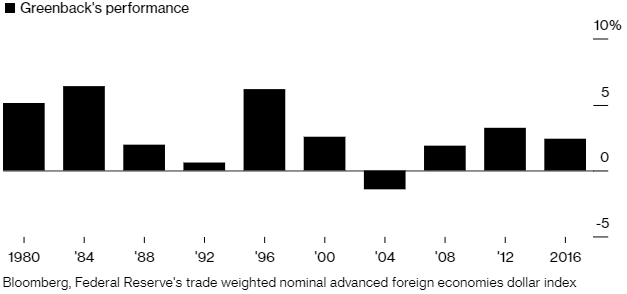

(Bloomberg) The dollar strengthened in the 100 trading days after nine of the past 10 elections from 1980 to 2016’, according to Richard Falkenhall, a senior foreign-exchange strategist at SEB AB in Stockholm. ‘The currency performed better following Democratic wins, rising an average 4% after these votes versus about 2% when Republicans prevailed’, Falkenhall said, noting the 1984 and 2008 votes were excluded from this calculation due to outsized drivers beyond the election.

‘The findings suggest that Joe Biden being elected for president would be the best possible outcome for the dollar’[3].

Incorporating analysts’ expectations helps get a feel for where professionals see the US dollar trading to in the event of a Republican or Democrat victory. As always, though, trading decisions should be based on independent analysis and your own investment objectives.

Trump Win: USD Reaction?

An escalation in trade war will be on the minds of many investors should Trump secure another presidential term. This may have a damaging effect on US exporting companies and weigh on the greenback. Though analysts claim this is likely to be offset by tax cuts and deregulation.

According to Mark Mobius, the founder of Mobius Capital Partners, ‘If Trump wins, then you will probably see a stronger dollar coming in’. Mobius adds ‘dollar weakness is really a vote of confidence on the US and particularly on the success of Trump’[4].

Biden Win: USD Reaction?

The stock market will likely rally should Biden become US president in light of more trade-friendly policies. The safe-haven dollar, therefore, may lose its appeal.

UBS expects the US dollar to continue to weaken against the euro, and at a faster rate under a Democratic outcome. This is especially so because the dollar is strongly overvalued against the euro and the pound under Trump’s current policy mix[5].

For news, webinars, articles and analysis, visit our dedicated US Elections 2020 Page or sign up to our exclusive webinar series.

[webinars]Disclaimer:

The information contained in this material is intended for general advice only. It does not take into account your investment objectives, financial situation or particular needs. FP Markets has made every effort to ensure the accuracy of the information as at the date of publication. FP Markets does not give any warranty or representation as to the material. Examples included in this material are for illustrative purposes only. To the extent permitted by law, FP Markets and its employees shall not be liable for any loss or damage arising in any way (including by way of negligence) from or in connection with any information provided in or omitted from this material. Features of the FP Markets products including applicable fees and charges are outlined in the Product Disclosure Statements available from FP Markets website, www.fpmarkets.com and should be considered before deciding to deal in those products. Derivatives can be risky; losses can exceed your initial payment. FP Markets recommends that you seek independent advice. First Prudential Markets Pty Ltd trading as FP Markets ABN 16 112 600 281, Australian Financial Services License Number 286354.

[1] https://projects.fivethirtyeight.com/trump-approval-ratings/?cid=rrpromo

[2] https://projects.fivethirtyeight.com/polls/president-general/national/

[3] https://www.bloomberg.com/news/articles/2020-07-01/elections-are-good-for-the-dollar-especially-when-democrats-win

[4] https://economictimes.indiatimes.com/markets/expert-view/if-trump-wins-you-will-probably-see-a-stronger-dollar-mark-mobius/articleshow/77889907.cms?from=mdr

[5] https://markets.businessinsider.com/news/stocks/what-us-elections-mean-european-investors-ubs-2020-9-1029557038#

Access +10,000 financial

instruments

Access +10,000 financial

instruments