The FP Markets research team produce First Light News during the early hours of the European session, ensuring traders and investors have the news needed to begin their day.

Good morning.

Tuesday finished modestly south for major US equity cash indices. The Dow fell 37 points (-0.12%) to 32,394, the S&P 500 finished 6 points lower (-0.16%) to 3,971, and the Nasdaq 100 was down 62 points (-0.49%) to 12,610. According to the S&P 500 sectors, energy was the clear outperformer, rallying 1.6%, while underperformance was observed in the tech (-0.5%) and communication (-0.8%) sectors amid the rise in US yields. Regarding FAANG stocks, it was another day of red. Meta Platforms (META), Amazon (AMZN), Apple (APPL), Netflix (NFLX) and Alphabet (GOOGL) fell 1.1%, 0.8%, 0.4%, 1.3% and 1.7%, respectively.

US government Treasury yields also bear flattened once again. The 2-year US Treasury yield advanced 9 basis points to eclipse 4.00%, and the benchmark 10-year US Treasury yield extended gains beyond its 200-day simple moving average, adding 4 basis points to test 3.57%.

Regarding tier-1 economic data on Tuesday, according to the Conference Board, US consumer sentiment modestly improved in March. The consumer confidence index jumped to 104.2, following February’s 103.4 print.

‘Driven by an uptick in expectations, consumer confidence improved somewhat in March, but remains below the average level seen in 2022 (104.5). The gain reflects an improved outlook for consumers under 55 years of age and for households earning $50,000 and over’. said Ataman Ozyildirim, Senior Director, Economics at The Conference Board.

Markets Today

Overnight trading in Asia witnessed a positive close across cash markets. The Nikkei 225, South Korea’s KOSPI and Australia’s ASX 200 added 1.2%, 0.2% and 0.2%, respectively. European equity index futures are also positive this morning, indicating a higher open at the top of the hour.

Early hours also saw the latest inflation data out of Australia. Consumer prices cooled to 6.8% in the twelve months to February, down from 7.4% in January (expectations were for a 7.2% print). Core inflation—excludes volatile items—eased to 6.9% in the twelve months to February, following January’s 7.5% reading. The immediate aftermath of the release watched AUD/USD sink 0.3% to touch lows of $0.6687. For many, a slowdown in consumer prices will help support a case for a rate pause at the next meeting on 4 April. STIR markets are currently pricing in a 90% probability of a pause.

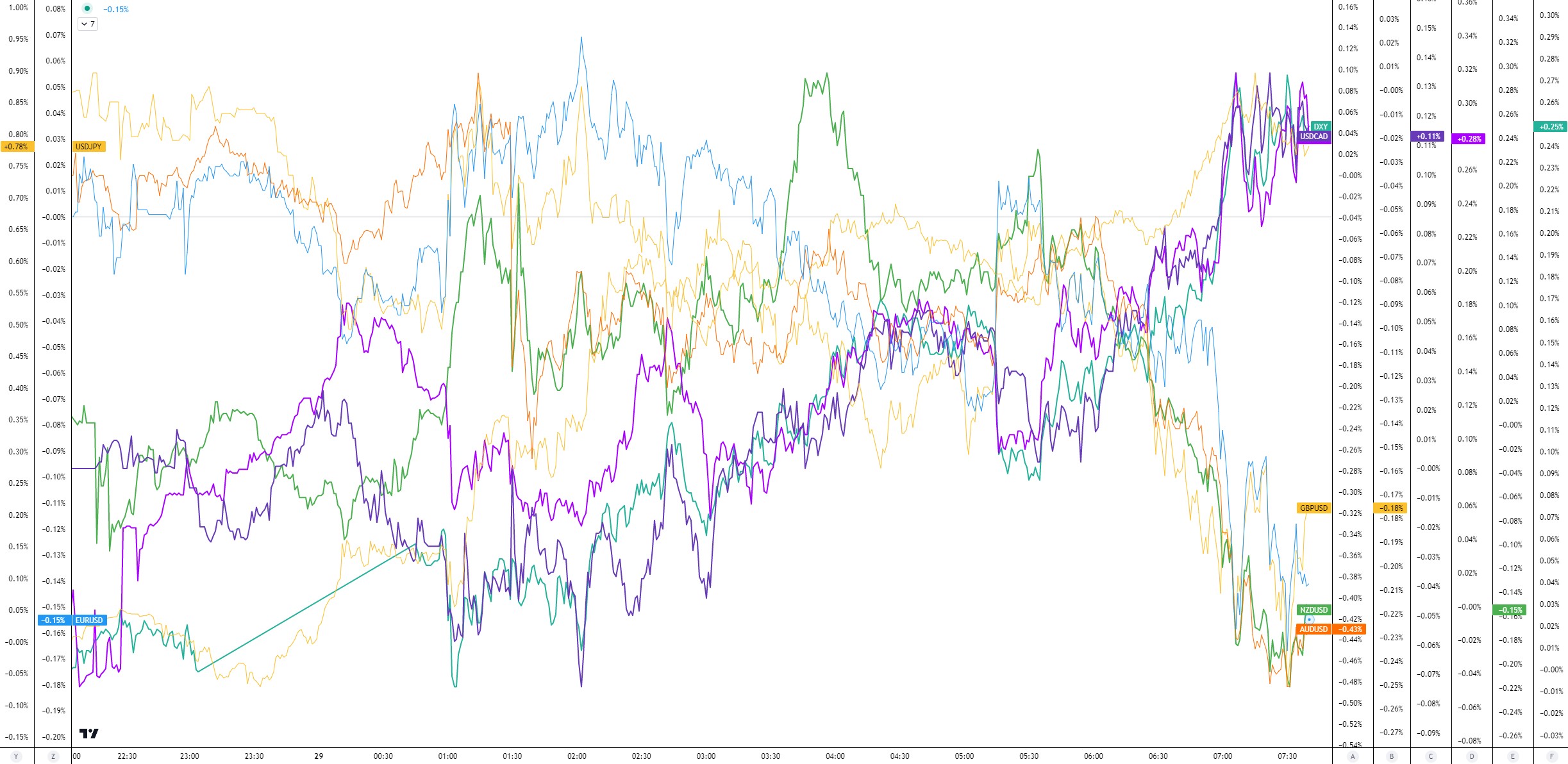

In FX, the US Dollar Index is 0.3% higher this morning, following a near-test of its 50-day simple moving average at 103.47 last week. Across the G10 space, the Japanese yen is the clear laggard at the time of writing; the USD/JPY is trading nearly 0.9% in the green. AUD/USD is also a notable currency pair in early trading, down 0.5% following the dip in annual inflation.

In FX, the US Dollar Index is 0.3% higher this morning, following a near-test of its 50-day simple moving average at 103.47 last week. Across the G10 space, the Japanese yen is the clear laggard at the time of writing; the USD/JPY is trading nearly 0.9% in the green. AUD/USD is also a notable currency pair in early trading, down 0.5% following the dip in annual inflation.

In the commodities space, spot gold (XAU/USD) and spot silver (XAG/USD) are down in early movement, erasing 0.7% and 1.0%, respectively. WTI oil is mildly higher at the time of writing, up 0.3%, extending recovery gains beyond its 20-day simple moving average at $72.97.

Finally, major cryptos are upbeat this morning. Bitcoin against the US dollar (BTC/USD) is 1.2% higher, with Ripple on track to register its fifth consecutive daily gain against the buck (+5.3%).

Headline Events for the Day Ahead:

US Month-Over-Month Pending Home Sales for February at 3:00 pm GMT+1 (Expected: -2.9%; Previous: -8.1%).

Chart of the Day

According to the daily timeframe, spot gold (XAU/USD) is chalking up a bullish pennant pattern between $2,009 and $1,934. Note that this is commonly viewed as a continuation pattern.

Major Currency Markets as of 07:50 am GMT+1:

DISCLAIMER:

The information contained in this material is intended for general advice only. It does not take into account your investment objectives, financial situation or particular needs. FP Markets has made every effort to ensure the accuracy of the information as at the date of publication. FP Markets does not give any warranty or representation as to the material. Examples included in this material are for illustrative purposes only. To the extent permitted by law, FP Markets and its employees shall not be liable for any loss or damage arising in any way (including by way of negligence) from or in connection with any information provided in or omitted from this material. Features of the FP Markets products including applicable fees and charges are outlined in the Product Disclosure Statements available from FP Markets website, www.fpmarkets.com and should be considered before deciding to deal in those products. Derivatives can be risky; losses can exceed your initial payment. FP Markets recommends that you seek independent advice. First Prudential Markets Pty Ltd trading as FP Markets ABN 16 112 600 281, Australian Financial Services License Number 286354.

Access +10,000 financial

instruments

Access +10,000 financial

instruments