The FP Markets research team produce First Light News during the early hours of the European session, ensuring traders and investors are up to date in the FX space for the day ahead.

Good morning.

Printing a fourth consecutive day in the green on Thursday, the US Dollar Index clocked highs of 104.31, levels not seen since 17 March. US growth data (GDP – second estimate) was marginally stronger than anticipated at 1.3% versus 1.1% (annualised); according to the GDP Deflator, provided by the Bureau of Economic Analysis, inflation was also a touch higher than expected at 4.2% versus 4.0%.

Markets also saw the latest weekly unemployment claims for the US, which came in at 229,000 initial claims, a lower-than-expected number of 245,000. This also represents an increase of 4,000 from last week’s downwardly revised reading of 225,000. Continued claims, or insured unemployment, was 1,794,000 for the week ending 13 May, a decrease of 5,000 from the previous week’s unrevised level of 1,799,000.

US debt ceiling talks remain ongoing and are somewhat optimistic. According to the latest developments, US President Joe Biden and Republican House Speaker Kevin McCarthy are closing in on an agreement. President Biden said in a speech at the Rose Garden, ‘Speaker McCarthy and I have had several productive conversations, and our staffs continue to meet as we speak, as a matter of fact, and they’re making progress’. Biden added, ‘I’ve made clear time and again: defaulting on our national debt is not an option’.

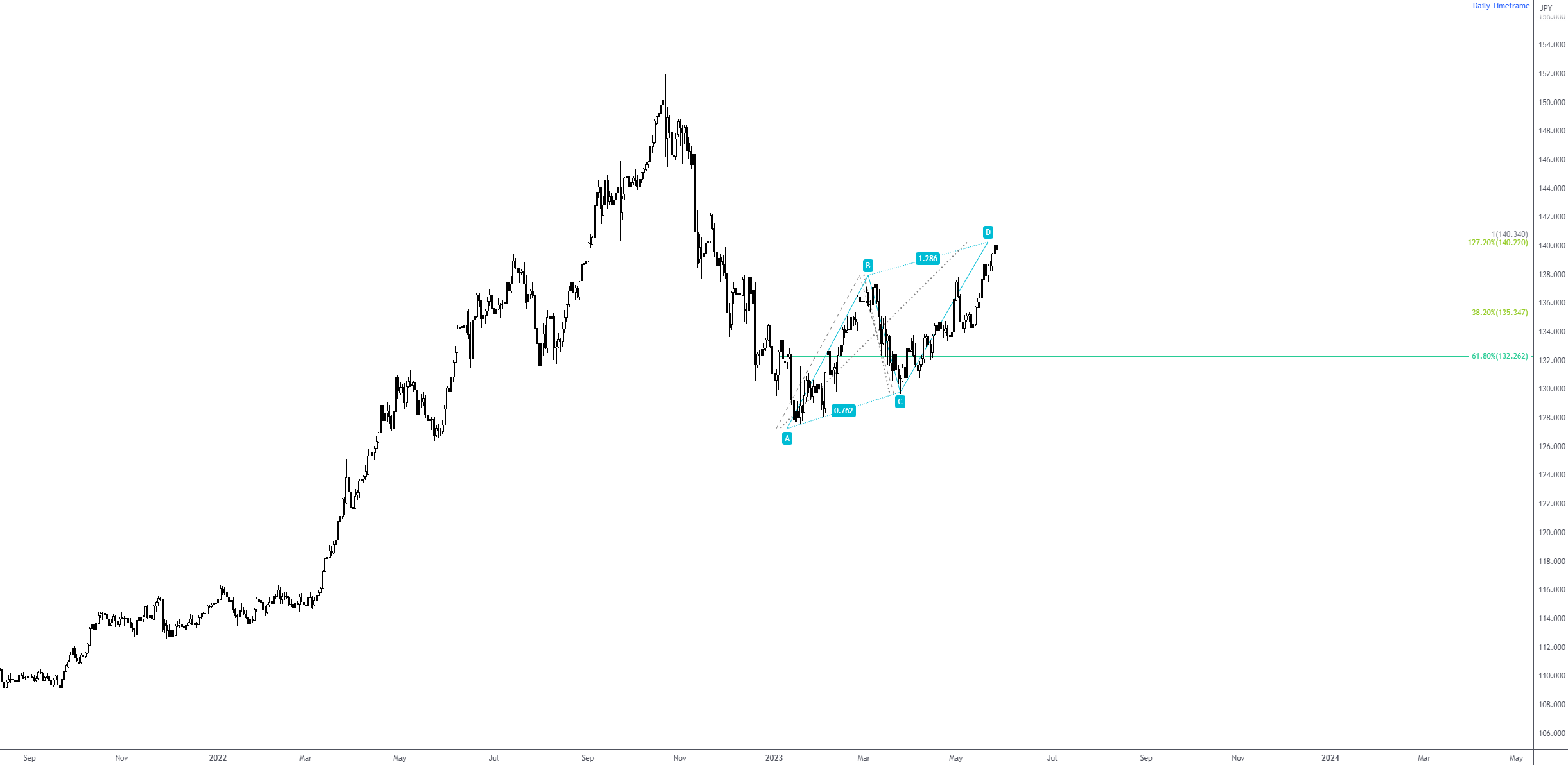

Across the currency space, the USD/JPY pair is a standout market and potentially overbought. Versus the Japanese yen, the US dollar gained 0.4% and refreshed YTD highs of ¥140.23 on Thursday to test a clear-cut AB=CD harmonic resistance at around ¥140.34 (denoted through a 100% projection ratio). Any meaningful reaction from the aforesaid level could have traders/investors take aim at the 38.2% and 61.8% Fibonacci retracement ratios at ¥135.35 and ¥132.26, respectively (common targets for harmonic AB=CD traders).

USD/JPY Daily Chart:

(Trading View – USD/JPY Daily Timeframe)

(Trading View – USD/JPY Daily Timeframe)

Procyclical currencies ended another day underwater on Thursday and were clear G10 underperformers, influenced by several factors, including a sell-off in commodities, USD strength and monetary policy. The New Zealand dollar fell across the board, with NZD/USD punching to fresh YTD lows following the Reserve Bank of New Zealand’s (RBNZ) dovish rate hike earlier in the week. WTD, the currency pair is down an eye-popping -3.2%. Despite the pair finding some respite in early trading this morning (+0.2%), the technical picture exhibits scope to continue south until reaching support at around $0.5992. Equally, AUD/USD is also on the ropes this week, down -2.0% (WTD) and refreshing YTD troughs at around $0.6490.

NZD/USD Daily Chart:

(Trading View – NZD/USD Daily Timeframe)

(Trading View – NZD/USD Daily Timeframe)

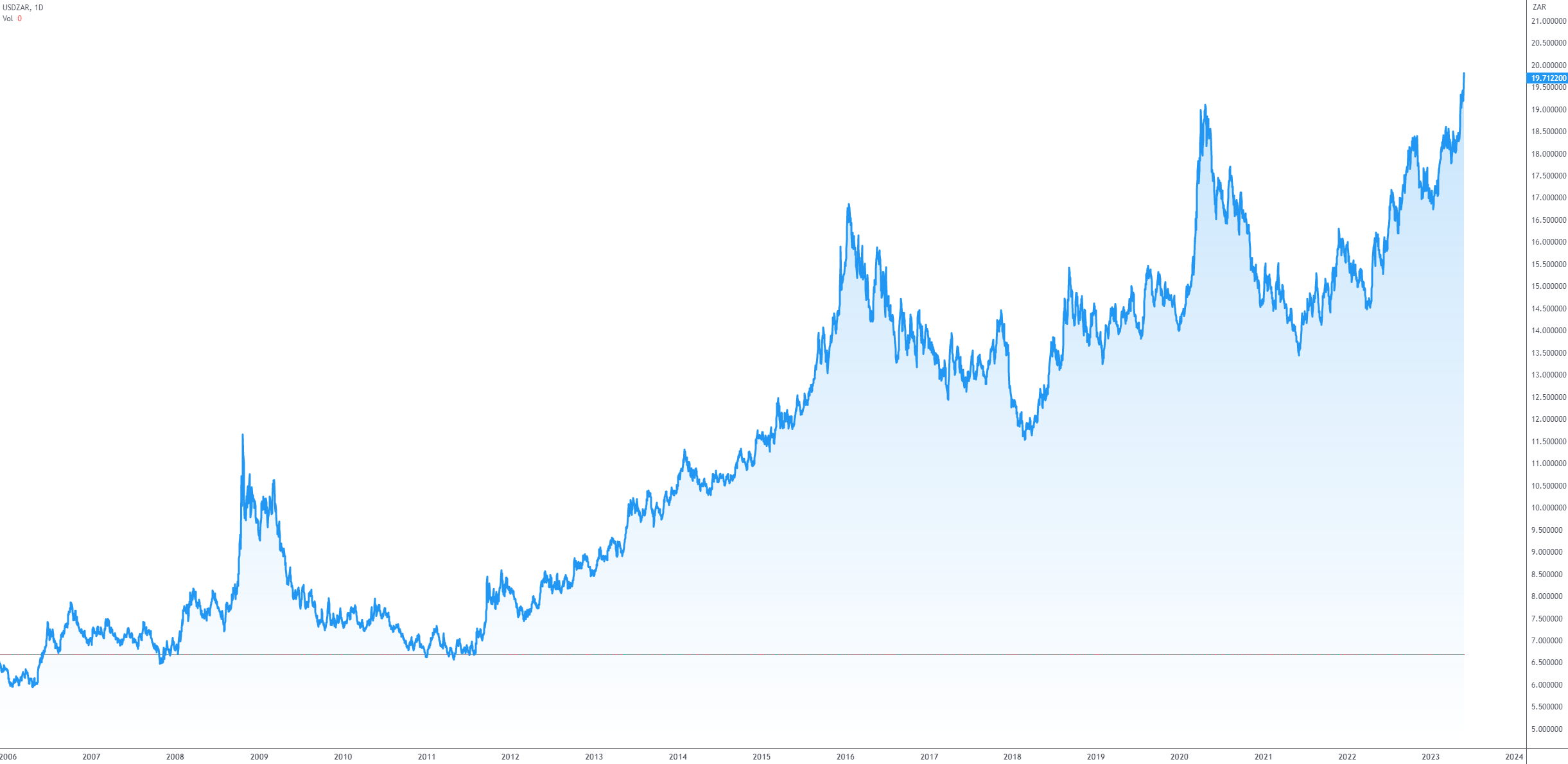

Elsewhere, emerging FX currencies were lower against the US dollar. The South African Rand (ZAR) and the Brazilian Real (BRL) underperformed, with the USD/ZAR (+3.0%) currency pair punching to record highs of R19.84. This market has been entrenched in a consistent uptrend since mid-2021. In fact, USD/ZAR is quite a chart, opening the door to potential dip-buying opportunities.

USD/ZAR Daily Chart:

(Trading View – USD/ZAR Daily Timeframe)

(Trading View – USD/ZAR Daily Timeframe)

Headline Events for the Day Ahead:

Month-Over-Month UK Retail Sales Data for April at 7:00 am GMT+1 (Expected: +0.3%; Previous: -0.9%).

Month-Over-Month US Core PCE Price Index for April at 1:30 pm GMT+1 (Expected: +0.3%; Previous: -0.9%).

Month-Over-Month US Durable Goods Orders for April at 1:30 pm GMT+1 (Expected: -1.0%; Previous: -3.2%).

Thanks for reading. Have a great day!

DISCLAIMER:

The information contained in this material is intended for general advice only. It does not take into account your investment objectives, financial situation or particular needs. FP Markets has made every effort to ensure the accuracy of the information as at the date of publication. FP Markets does not give any warranty or representation as to the material. Examples included in this material are for illustrative purposes only. To the extent permitted by law, FP Markets and its employees shall not be liable for any loss or damage arising in any way (including by way of negligence) from or in connection with any information provided in or omitted from this material. Features of the FP Markets products including applicable fees and charges are outlined in the Product Disclosure Statements available from FP Markets website, www.fpmarkets.com and should be considered before deciding to deal in those products. Derivatives can be risky; losses can exceed your initial payment. FP Markets recommends that you seek independent advice. First Prudential Markets Pty Ltd trading as FP Markets ABN 16 112 600 281, Australian Financial Services License Number 286354.

Access +10,000 financial

instruments

Access +10,000 financial

instruments