US Inflation Data

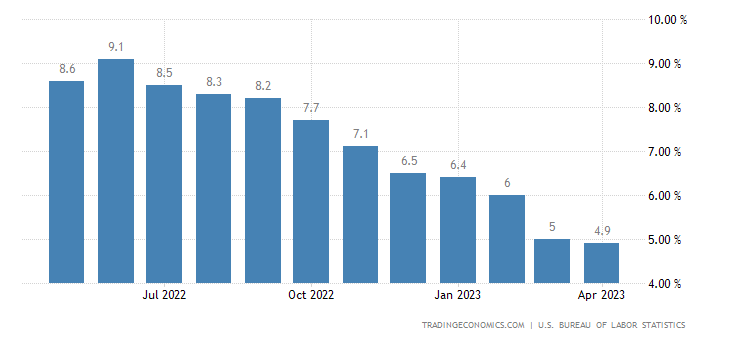

It was all about US inflation on Wednesday. In the twelve months to April, consumer prices elbowed beneath 5.0% to 4.9%, which was just a touch under the median consensus of 5.0%. This essentially informs the American public how much more expensive goods and services have got between April of this year and April of last.

The 4.9% reading also marks the tenth consecutive month that annual inflation has cooled and is the first time in two years since we’ve explored territory south of the 5.0% rate. Food prices came in flat between March and April, displaying no change; energy, nevertheless, increased by +0.6%, and shelter grew by +0.4%.

Core inflation—which strips out more volatile components such as food and energy costs—remains stubborn (sticky) at 5.5% in April, 0.1 percentage points down from March’s 5.6% reading and essentially in line with economists’ expectations. On a month-over-month basis, inflation increased 0.4%, up 0.3 percentage points from March’s 0.1% rate. Core month-over-month inflation for April, nevertheless, matched March at 0.4%.

Core inflation—which strips out more volatile components such as food and energy costs—remains stubborn (sticky) at 5.5% in April, 0.1 percentage points down from March’s 5.6% reading and essentially in line with economists’ expectations. On a month-over-month basis, inflation increased 0.4%, up 0.3 percentage points from March’s 0.1% rate. Core month-over-month inflation for April, nevertheless, matched March at 0.4%.

Market Reaction; Where Next for the Euro?

The immediate aftermath of the US CPI release witnessed the EUR/USD catch a bid and eventually knock some of the wind out of the $1.10 handle: a clear-cut bull trap which likely ensnared breakout buyers and consumed several protective stops from those attempting to fade the psychological level. Subsequent price action observed sellers regain some command, though we have yet to revisit pre-announcement levels (as of writing) around H1 support from $1.0948.

Technically, chart studies suggest EUR/USD bulls could remain on the offensive over the coming weeks, honing in on higher timeframe resistance between $1.1174 (weekly timeframe) and $1.1138 (daily timeframe). Not only is there clear room to manoeuvre to the upside, but the trend also remains in favour of bulls: we’ve seen a clear uptrend emerge since bottoming in September 2022 around $0.9536.

So, ultimately, despite $1.10 holding firm as resistance on Wednesday, it appears vulnerable. Beyond the current H1 support mentioned above at $1.0948, limited support is visible until $1.09, which resides a touch north of the 50-day simple moving average on the daily scale at $1.0860. Consequently, any move sub $1.0948 could unlock the door for short-term breakout selling towards $1.09ish, though rebounding from $1.0948 appears the more technically sound scenario, according to analysis. If we should eventually pursue ground above $1.10, as suggested on the bigger picture, H1 resistance calls for attention at $1.1040, followed by $1.11 and daily resistance from $1.1138.

DISCLAIMER:

The information contained in this material is intended for general advice only. It does not take into account your investment objectives, financial situation or particular needs. FP Markets has made every effort to ensure the accuracy of the information as at the date of publication. FP Markets does not give any warranty or representation as to the material. Examples included in this material are for illustrative purposes only. To the extent permitted by law, FP Markets and its employees shall not be liable for any loss or damage arising in any way (including by way of negligence) from or in connection with any information provided in or omitted from this material. Features of the FP Markets products including applicable fees and charges are outlined in the Product Disclosure Statements available from FP Markets website, www.fpmarkets.com and should be considered before deciding to deal in those products. Derivatives can be risky; losses can exceed your initial payment. FP Markets recommends that you seek independent advice. First Prudential Markets Pty Ltd trading as FP Markets ABN 16 112 600 281, Australian Financial Services License Number 286354.

Access +10,000 financial

instruments

Access +10,000 financial

instruments