There were once 3 central bankers one that talks, one that doesn’t, and one says one thing but does another.

We use this opening line in jest, but it’s actually a good analogy of how the Federal Reserve (the talker), the Reserve Bank of Australia (the non-talker) and the Bank of England (talks but doesn’t act) behave. The contrast in styles between the three came to a head last week and its clear the market was impressed with the talker but not the others.

It’s clear COVID has everyone second guessing themselves and that is fair enough. No one has correctly forecasted how the world has, and will, response economically in the post-COVID world. But, it is clear that if you articulate this point clearly and take the market with you on this new-world journey it will reward you with stability. If not, 2013-styled tantrums are in order.

Lets look at each central bank actions individually.

The Federal Reserve

As discussed in the September Fed Playbook, the Fed gave a clear indication November would be when it would begin tapering its QE program. This was clearly communicated throughout August and September – so there was no surprise this was announced last week.

- The reduction is US$15 billion split between US$10 billion in treasuries and US $5 billion in mortgage-backed securities. This US$15 billion reduction will happen every month going forward but the Fed made it very clear the pace can be altered if needed. Thus, November purchases will be US$105 billion, December US$90 billion

and so on until the program is wrapped up. - It left the Federal Funds rate at 0 per cent to 0.25 per cent and suggested ‘lift off’ requires a ‘higher hurdle’ before beginning.

- On inflation it clarified its ‘transitory’ definition, and this was a very important clarification. To the Fed ‘transitory’ means ‘no lasting effect’ on inflation, it does not have a ‘time definition’. In effect it means COVID’s effect on US inflation will filter out and not have a structural long-term impact.

- The Fed new communication point: Policy will adapt appropriately to the dynamics of a fluctuating economy.

All pretty clear, the play book remains the same.

The Reserve Bank of Australia

As we discussed last week, the RBA completely lost control of its Yield Curve Control (YCC) policy. It was frankly – embarrassing. Thus, it was no surprise that at the Board’s meeting last Tuesday it announced:

- It had decided to discontinue the YCC at 10 basis points for the April 2024 Australian government bond.

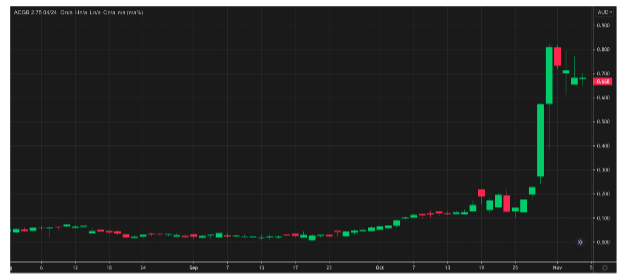

The disorderly conduct in the April 2024 bond is something that needs to be seen.

This is what happens with poor communication.

It reiterated that “the central scenario for the economy is that this condition will not be met before 2024.” This of course relates to the possible movement of the cash rates it also added that “The Board is prepared to be patient”. Meaning it happy for an over run.

What hit the AUD hard was Governor Lowe during the unscheduled webinar stressing how unlikely rate rises in 2022 were. The market still disagrees and is priced for this, but these comments took a full cent out of the AUD/USD.

It leaves the RBA and the market in this strange, cloak and dagger scenario.

The Bank of England

There was a lot of talk the Bank of England would lift rates. Inflation is run at several decade highs and the board was known to be split on how to handle policy. The BoE’s chief economist (a known hawk) was strong on the view that rate would rise sooner rather than later.

Then on Thursday the Board left policy unchanged, with a strong majority vote of 7-2 on the cash rate, and a near enough to the same vote of 6-3 vote on maintaining QE for the rest of the year.

Its justification for this policy stance was the slack in the economy, concerns arising from the furlough and a softer path to the banks growth projections.

What a way to blow up the GBP, the talk had been strong, and the market had a 50:50 position on a rate rise. GBP/USD fell from $1.3650 to a low of $1.3471 a -1.45 per cent fall. UK Gilts were torn to pieces with the 2-year gilt down 21 basis points, the 10-year -14 basis points.

The BoE finished as the worst performance over the past week. But the RBA’s overall performance over this period is just as bad if not worse. There are now clear negatives in the AUD and GBP arising from the handling of policy by each bank.

[/vc_column_text][/vc_column_inner][/vc_row_inner]

Access +10,000 financial

instruments

Access +10,000 financial

instruments