Reading Time 7 Minutes

CFDs (contract for differences) are derivative products that allow traders to hedge against market risks. CFDs also provide traders the ability to profit from the movement of both rising and falling markets—assume risk. In addition, margin trading (the use of leverage) enables traders to make more efficient use of their capital across a wide range of financial markets, all from a centralised trading platform. CFDs are a good choice for beginners, allowing smaller lot sizes.

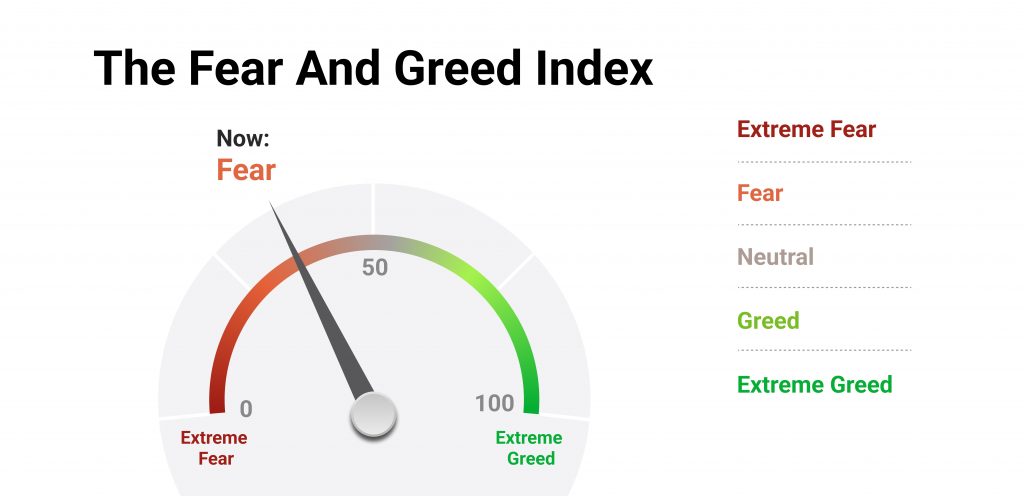

However, leveraged CFDs can be high risk. During times of high market volatility, leverage can magnify gains and losses. Consequently, it is vital to work with proper risk-management tools and trade with an objective frame of mind.

Five Common CFD Trading Mistakes

Mistakes are inevitable in life and also in CFD trading, despite best efforts. We learn by our mistakes. The following should help highlight the most frequent errors made by newbie traders and, on occasion, expert traders.

- Lack of a Proper Trading Plan (Trading Strategy)

An absence of a trading plan is one of the most common mistakes beginner CFD traders make: the lack of a correctly thought-out and tested trading plan with clear objectives. Your trading plan needs to consider available funds, trading platforms, which CFD Forex trading brokers to work with and, of course, the financial instruments you are going to trade: Forex, indices, commodities, for example.

- Inadequate Education

As with all types of trading, research is imperative. Decide on the type of analysis: fundamental or technical analysis are common trading and investment approaches. Both types are a learning curve and require research. Some take years before they perfect their strategy. Apart from fundamental research, various technical indicators may be utilised to evaluate where the market is headed. Technical indicators and volume indicators can prove essential in identifying entry and exit locations. Bear in mind that these are tools and not a guarantee of success. Employing risk-management methods, such as stop-loss orders and take-profit levels at the correct places is crucial.

- Understanding How CFDs Work

You do not own the underlying asset. You are trading a contract: the difference between the opening and closing prices. Some confusion remains about spread betting and CFDs. Although similar, spread betting is only allowed in the UK and Ireland. It is considered gambling in other countries.

- Know Your Trading Platform and The Tools Available

If you’re a seasoned trader, you should already understand your chosen platform. It is crucial to recognise the basics before trading with real money. These can be things like how to place an order, understanding price movement, as well as technical indicators, trend lines, support and resistance and the Market Watch Window. New traders should take some time using a demo account to familiarise themselves with the platform, while not risking their capital. The most widely used platform Is still MetaTrader 4 (MT4).

Always select a fully regulated broker, with transparent pricing and excellent customer service.

- Choosing the Right CFD Broker

Take a breath, do lots of research, and ensure you choose the correct broker for your trading. There are many brokers out there offering promotions. This is a big step in your trading profession. If you choose the wrong broker, it could lead to a short trading career.

Always select a fully regulated broker, with transparent pricing and excellent customer service.

- Don’t Get Caught Up in the Excitement of a Run of Winning Trades

While consecutive winning trades is nice, it can bring on a barrage of emotions. On the flip side, a run of losing trades can draw emotions into play. Try to adhere to your strategy. Every trader at one time in their trading career has fallen victim to emotional trading. Letting an unfavorable trade run is a way to completely wipe an account, hoping that a trade will turn.

This is why in leveraged trading you have to remember that higher gains can also mean more significant losses. There has been a lot written on the subject of emotional trading. It will take time to learn emotional control but is vital to do so. One method is to keep a trading journal of all the trades you make. Record your emotions at the time of the trade; this could be helpful in the future.

Access +10,000 financial

instruments

Access +10,000 financial

instruments