Major Indices have posted warning signals of impending price weakness in the coming week.

The Weekly bar last week displays a lower shadow, this signals a selling period during the week. This may follow through in the coming week, there are some important support level to defend.

News to watch is the US Government’s plans for capital gains tax, as the potential trigger for a short-term top.

The overall Primary trends remain firmly UP, however in the commodities space some price consolidation is showing in Gold and Silver and the West Texas Oil price.

Copper returns to a Nine year high closing price and remains very Bullish for further gains.

XJO WEEKLY

Price structure:

Last showed a 3-point decline between the open and close for the week. What is significant is the lower shadow indicating a sell off during the period.

This type of #3 bar can indicate a warning of further selling in the coming 2 week’s. The Weekly low of 6905 points will be the warning level of early weakness.

The weekly key support level of 6737 remains as the first major support level to hold should the Index show further weakness.

Indicator: Relative Strength

The RSI indicator has remained over the key 50 level, last week turned sideways, this is a signal of slowing price momentum. The potential divergence signal has been negated, so the indicator still remains a bullish signal for further positive price momentum.

The RSI should be monitored for a potential move below the key level of 50 to show a shift to bearish momentum.

Comments from last week: Last week saw the second bar outside of the Bollinger bands. With the bands now starting to expand. The resistance level of 7130 remaining in play, there is no evidence of price reversal. It is important to acknowledge where this analysis would be incorrect, in this case a close below the key level of 6737, would signal a false breakout and a bearish move underway.

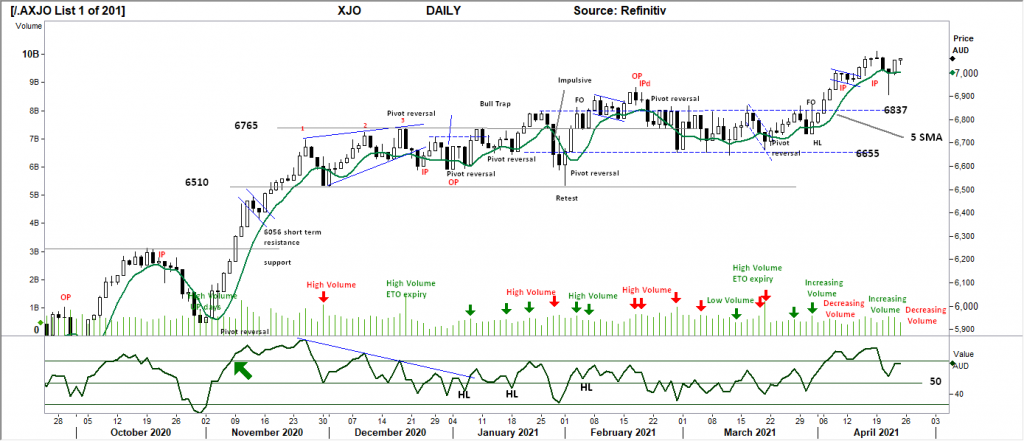

XJO DAILY

Price structure:

The overlay 5 period simple moving average has indicated closing price support; however the average has turned sideways in line with last week’s mid-week sell downs attempt to retest the 6837 level

To build a bullish case, the Wednesday low and Thursday’s range make up a Bullish pivot point, although Friday’s close has not been decisive.

Traders should look for a close over Monday’s high of 7094.8 for a bullish continuation trading above the 5-period simple moving average.

Indicator: Relative Strength

Currently a divergence signal is not in play as the RSI has made a lower high reading last week in line with the market movement.

This should now be monitored for a further move lower on any price weakness.

Indicator: VOLUME

Overall volume has been increasing as price rallies, Last Friday’s volume was not outstanding leading into the weekend. Further price gains would again need strong volumes to confirm broad market participation.

Comments from last week: The XJO Daily shows the closing price towards the high of the week as an inside period (IP), indicating the market is in balance at this current level, very similar to the previous weeks Friday close. (marked)

Using the 5-period simple moving average, the market can be described as conducting an extended move with continuing closing price above the average line.

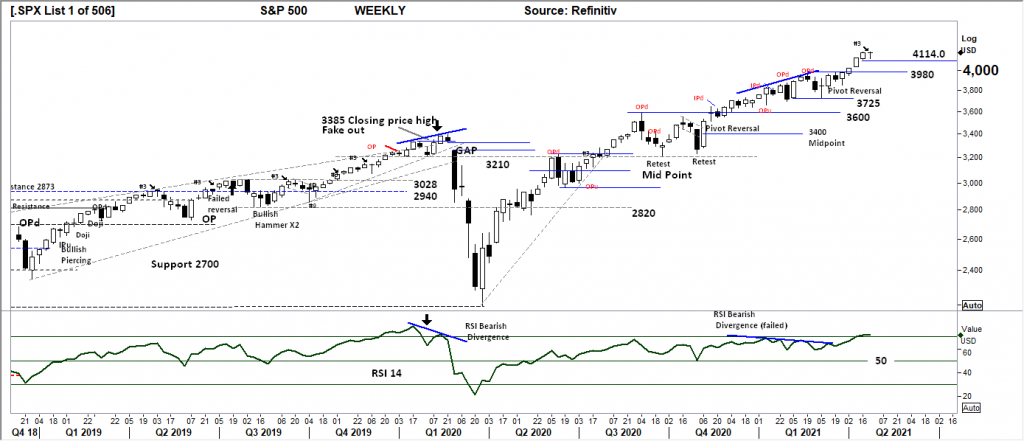

S&P 500 WEEKLY

Price structure:

The Weekly bar shows a 1point gain for the week, however the bar also has a longer lower shadow, indicating the #3 bar, this type of mid-week sell down can be indicative of further selling in the coming 2 weeks. The support level of 4114 remains as the support level to hold. As this type of #3 bar shows selling, this can also lead to a consolidation period during the coming week. A closing price below 4114.0 would be the first bearish signal for a potential short-term top.

Indicator: Relative Strength Indicator

Overall, the RSI is currently reflecting stronger price momentum as the indicator moves higher over the 70 level, this is not a level of over brought, and only indicates very strong momentum, and can last for many weeks. (This type of momentum is often a precursor to profit taking.)

Should the RSI show a movement below the 50 level, this would signal strong bearish price momentum.

It should be acknowledged the RSI has also remained above the 50 level for the past 12 months.

Comments from last week: A very strong price movement underway wit continuing low to high closing bars. The 3980 is now the key short-term level to hold on any retracement. The underlying primary trend remains very strong.

Last week’s low of 4114.0 should be used as the first intimate support level, traders should be aware of a potential close below this level as the first reversal signal.

S&P 500 DAILY

Price structure:

Daily consolidation (bar sandwich) shows the indecision on a daily basis. The daily level of 4100 is the key support level to hold in the coming days. As the daily ranges are large indicating higher volatility this type of price pattern can breakout either way, higher or lower.

As the Weekly chart contains the #3 bar the breakout lower would take preference in the short term.

Support levels, 4100 and 3940 will be the key observation this coming week.

Indicator: Relative Strength

Relative Strength short term has turned higher above the 70 level. The RSI should be monitored for a movement and continuing close above the 70 level.

As upward price momentum may be subject to some profit taking a sideways movement could be expected, this would now be monitored for a Bearish divergence signal.

Comments from last week: The Daily chart shows a short term trendline developing. For short term traders a reversal would gain weight with a close below the 4100 level (this would also confirm the Weekly reversal).

Friday has traded as a short range day and may introduce some price consolidation at this level in the coming days.

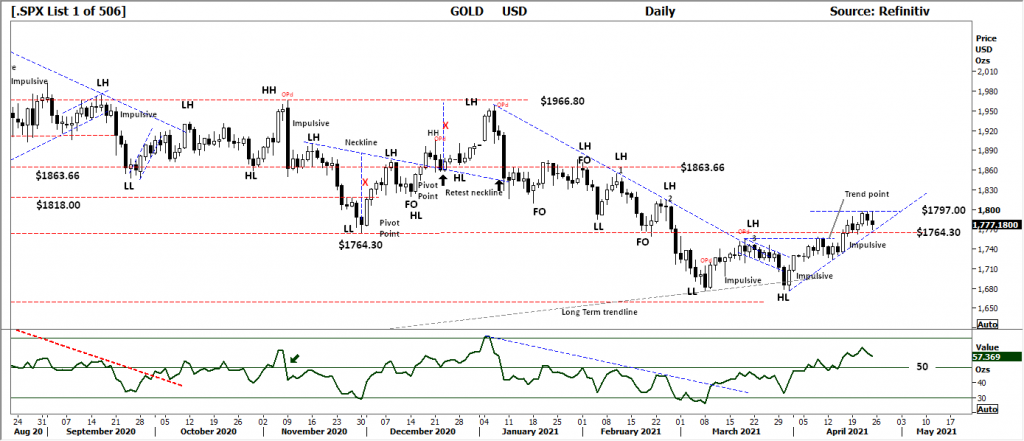

USD Spot GOLD – DAILY

Price structure: A new Primary trend is now underway.

US dollar Gold has not followed through higher last week; however, this retest of the 1764.30 level is an important development for further gains in the coming week.

The primary trend remains UP as this consolidation phase take place, a short term trend line is now in place.

Resistance shown at 1797.0 is the short-term resistance level and remains the go to level for a further price breakout.

A closing price below this $1764.30 level would be a short-term bearish signal.

This will bring price consolidation in the Australian listed Gold producers.

The smaller Australian speculative stocks will remain news dependant and price dependant on the AUDXAU price chart. (see below).

Indicator: Relative Strength

Relative Strength turns lower and remains above the key “50” level. This is an early signal of changing momentum and should be monitored for a further close below the 50 level.

Comments from last week: There is a significant price movement underway. Importantly the resistance level of $1764.30 has been crossed. Any price retracement should use this key level as a continuing support level.

Both the Australian and US GDX ETF is showing early signals of an emerging UP trend.

This a particularly good signal for major Gold mining stocks to show price gains in the coming week.

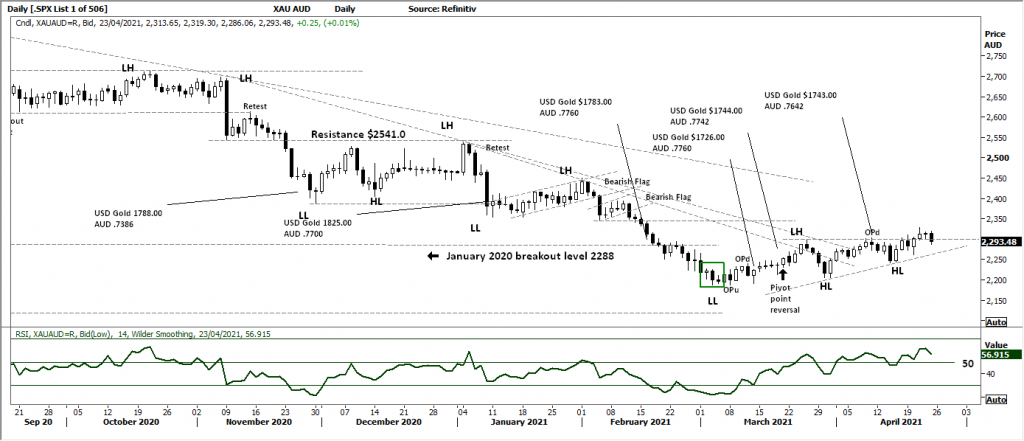

AUD GOLD DAILY

Price structure:

Overall a sideways consolidation in price is developing while price remains below the 2294.0 level. The ascending pattern can lead to a breakout higher and would provide price support for Australian listed Gold producers.

The smaller Australian speculative explorer stocks will remain news dependant.

Indicator: Relative Strength

This momentum indicator has continued a wider swing higher over the key 50 level in line with price gains to reconfirm a valid RSI buy signal.

Last week’s downturn indicates a slowing of upward momentum, this should now be monitored for a move below the “50” level as a signal of price weakness.

Comments from last week: The support resistance level of $26.00 has been an important level for the past 10 months. Silver has again recovered to this level, the important observation is the recent Higher low (HL) point prior to the breakout. Silver now targets the $27.70 level in any continued price move. In the coming week $26.00 could provide the support level, with $24.60 as key support should a price retracement occur..

COPPER DAILY

Price structure: Inventories remain historically low.

Copper is trading at a nine-year high.

Last week’s close shows a very strong bullish continuation move in the price of Copper. This commodity remains on track to retest the $4.50 level. A daily close over this $4.50 level would be a very bullish signal for further gains.

Copper remains in a very strong Primary UP trend.

Indicator: Relative Strength

Relative Strength has moved just above the 70 level.

An early BEARISH divergence signal has continued to develop. Further confirmation will shown as a move below the “70” level and below the internal low set during February. The highlighted level in red.

It should be remembered the RSI can track above the 50 -70 level for many weeks at a time and currently remains a signal of very strong price momentum.

Comments from last week: Copper has set a Pennant breakout bar noted as an impulsive move as the range exceed the previous 5 weeks.

This is a very good setup for further gains within the current primary UP trend.

Of concern is the Relative strength indicator not setting a new high. (see note).

AUSTRALIAN VOLATILITY INDEX:

The benign reading in the XVI remains a positive for Australian equities. The higher midweek range shadow shows volatility can easily become elevated as markets enter period of price volatility.

The XVI is the difference of 1-month forward pricing of ETO Options against current month.

As markets anticipate events, the forward priced option volatility changes, hence as forward price changes, this “skew” in pricing is measured in this XVI.

The XVI value works as an inverse observation to the underlying market.

Comments from last week: Current volatility reading remains positive for further gains within the Australian equities sector.

Traders should be aware of the old adage that low volatility leads to high volatility and visa versa as we are currently seeing after many years of elevated readings.

USD DOLLAR INDEX

Price structure:

Continued weakness in the USD Index denies the call for a Bullish flag breakout, the continued decline in price is now testing lower levels at 90.66. A breakdown below this level would send a strong bullish signal to the commodity markets.

Indicator: Relative Strength

While the RSI has made a sharp decline below the 50 level and continued lower, a more significant loss of momentum is currently unfolding.

Comments from last week: The recent observations of price action indicated a Bullish flag building; however the continuing price grind lower is now testing the 91.66 level. This is not a bullish signal as a breakdown below this level would set a bearish signal for further declines.

This current decline remains supportive of the commodities complex, and traders should see continuing gains in metals.

WTI CRUDE OIL

Price structure: This commodity is news driven by supply -demand.

The bullish breakout 2 weeks ago has failed to immediately follow through to higher prices. The “tentative” trendline has again been moved to encompass last week’s bar.

The resistance level of $66.00 remains the key level to reach as the current price remains above the $61.80 level.

WTI remains in a Primary UP trend.

Indicator: Relative Strength

RSI turning lower while above the 50 indicates a slowing of price momentum in the current price consolidation phase.

Comments from last week A new tentative trendline is now in place as last week’s bar has set a new bullish pivot point following the Bullish flag formation.

The closing price above the key $61.80 level is important and can be viewed as an early move towards the $66.00 resistance level with $75.20 remaining the upside target.

Access +10,000 financial

instruments

Access +10,000 financial

instruments