Charts: Trading View

EUR/USD:

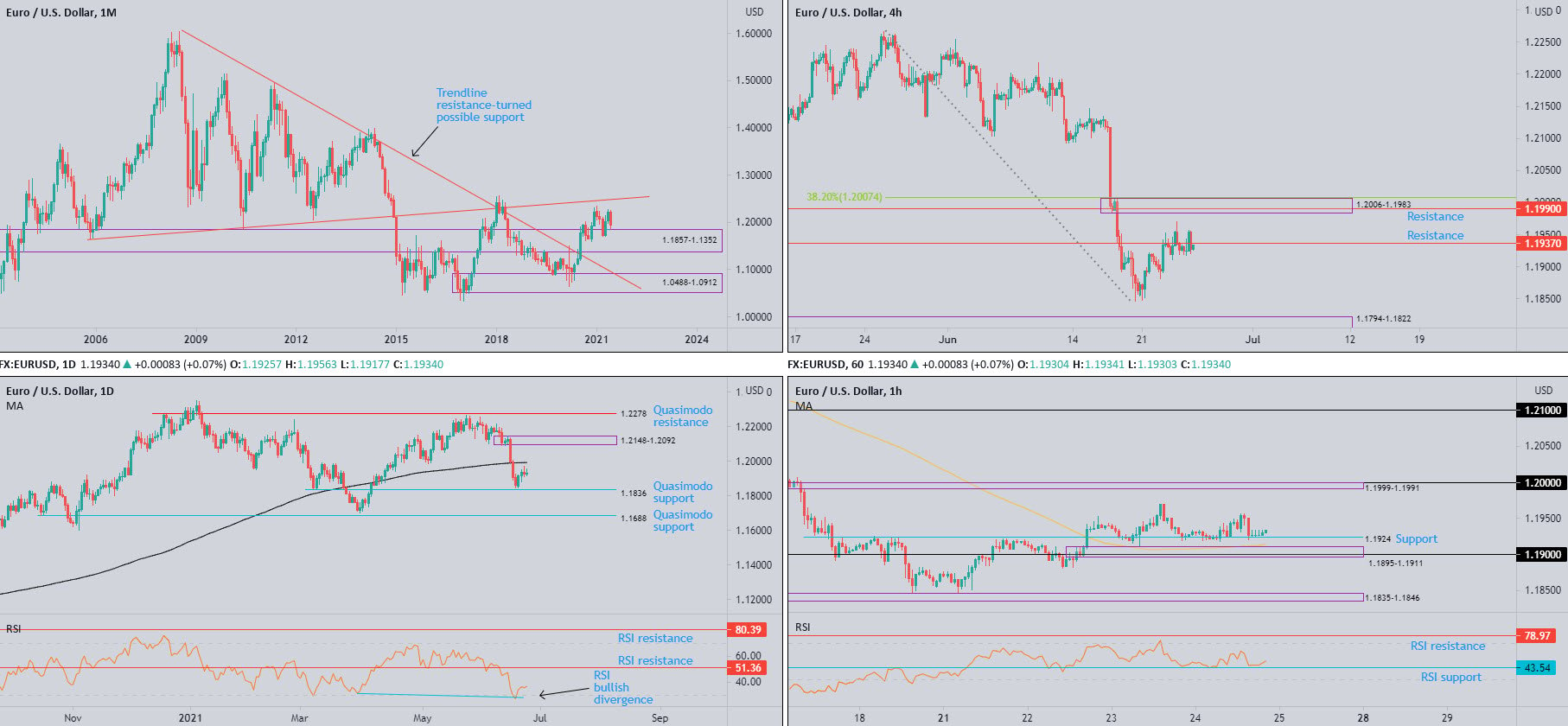

Monthly timeframe:

(Technical change on this timeframe is often limited, though serves as guidance to potential longer-term moves)

Down 2.4 percent MTD, June remains on the ropes. Reclaiming May’s gains and also chipping into April’s upside, EUR/USD is touching gloves with familiar support at $1.1857-1.1352.

Upstream is focused on 2021 peaks at $1.2349; additional enthusiasm may welcome ascending resistance (prior support [$1.1641]).

Based on trend studies, the primary uptrend has been underway since price broke the $1.1714 high (Aug 2015) in July 2017. Additionally, price breached major trendline resistance, taken from the high $1.6038, in July 2020.

Daily timeframe:

Technical framework unchanged from previous research.

Europe’s single currency finished Thursday off session tops, echoing Wednesday’s movement.

Technically, Quasimodo support at $1.1836 and the 200-day simple moving average at $1.1993 continues to command attention on the daily scale.

$1.2148-1.2092 supply entertains territory north of the SMA; another Quasimodo support falls in around $1.1688 should sellers tunnel through $1.1836.

Underpinning gains, the RSI recently pencilled in hidden bullish divergence (commonly forms a trend continuation signal that suggests upside strength).

H4 timeframe:

Since Tuesday, H4 resistance at $1.1937 has occupied the market’s curiosity, despite a number of upside attempts.

North of $1.1937 is supply from $1.2006-1.1983, sharing space with resistance at $1.1990 and a neighbouring 38.2% Fib retracement value from $1.2007.

What’s technically interesting is the 200-day simple moving average highlighted above at $1.1993 intersects with the aforesaid supply area.

H1 timeframe:

Mid-week trading observed short-term flow shake hands with support at $1.1924, and also introduced demand at $1.1895-1.1911 (an important decision point encompassing $1.19). Technical eyes will note the 100-period simple moving average is circling close by at $1.1914.

Upriver, the widely watched $1.20 figure is visible, aligning closely with supply at $1.1999-1.1991.

Momentum studies, according to the RSI, has the value engaging support at 43.54. Resistance is seen at 78.97, tucked within overbought space, while south of support, the oversold range is on the radar.

In terms of Thursday’s data, in the week ending 19th June, US unemployment claims came in above 400,000 for a second consecutive week. US durable goods orders increased 2.3 percent in May, reversing a drop in April. And, according to the Bureau of Economic Analysis (BEA), Real gross domestic product (GDP) increased at an annual rate of 6.4 percent in the first quarter of 2021, according to the ‘third’ estimate. In the fourth quarter, real GDP increased 4.3 percent.

Observed levels:

Recognising the monthly timeframe is coming from support at $1.1857-1.1352, on top of the daily timeframe exhibiting space to test the underside of the 200-day simple moving average at $1.1993, unwraps a bullish tone on the bigger picture.

Lower on the curve, in conjunction with higher timeframes, H1 holds support at $1.1924—reinforced by demand at $1.1895-1.1911—and H4 resistance from $1.1937 appears on the verge of stepping aside. Chart studies, therefore, indicates a bullish scenario could develop, targeting the $1.20ish neighbourhood.

AUD/USD:

Monthly timeframe:

(Technical change on this timeframe is often limited, though serves as guidance to potential longer-term moves)

Since the beginning of 2021, buyers and sellers have been squaring off south of trendline resistance (prior support – $0.4776 low) and supply from $0.8303-0.8082.

Support is featured at $0.7394. Additional downside pressure brings light to demand at $0.7029-0.6664 (prior supply).

June is currently down by 1.9 percent.

Trend studies (despite the trendline resistance [$1.0582] breach in July 2020) show the primary downtrend (since mid-2011) remains in play until breaking $0.8135 (January high [2018]).

Daily timeframe:

Latest out of the daily chart reveals the unit brushed aside the 200-day simple moving average at $0.7554, and directed focus on resistance at $0.7626. Note the aforesaid SMA could serve as support if tested.

Also of note is supply-turned demand at $0.7453-0.7384 (aligns with a collection of Fib studies and monthly support at $0.7394).

From the RSI, the indicator exited oversold territory this week, which, as aired in recent analysis, is action some traders view as bullish.

H4 timeframe:

Following price recoiling from support at $0.7485 at the beginning of the week, Wednesday crossed swords with resistance at $0.7588, with Thursday’s bullish efforts contained by the aforesaid resistance.

Beyond resistance, another resistance is visible between $0.7660 and $0.7635, consisting of Fibonacci retracement structure (blue).

H1 timeframe:

The harmonic bat pattern’s potential reversal zone (PRZ) highlighted in previous writing between $0.7626 and $0.7600 remains to the upside. Price action traders will note that above the pattern’s PRZ we have resistance at $0.7646.

South of current price, we also see the 100-period simple moving average, currently circling $0.7542, followed by support at $0.7511.

As for the RSI, the value is trading at 60.00, following an earlier test of resistance from within overbought at 72.21.

Observed levels:

Technical eyes likely to remain on the H1 timeframe’s harmonic bat pattern’s potential reversal zone (PRZ) between 0.7626 and 0.7600. Note the upper edge of this zone represents daily resistance.

Additional resistance to be mindful of is the H4 Fib resistance (blue) between $0.7660 and $0.7635, which intersects with H1 resistance from $0.7646.

DISCLAIMER:

The information contained in this material is intended for general advice only. It does not take into account your investment objectives, financial situation or particular needs. FP Markets has made every effort to ensure the accuracy of the information as at the date of publication. FP Markets does not give any warranty or representation as to the material. Examples included in this material are for illustrative purposes only. To the extent permitted by law, FP Markets and its employees shall not be liable for any loss or damage arising in any way (including by way of negligence) from or in connection with any information provided in or omitted from this material. Features of the FP Markets products including applicable fees and charges are outlined in the Product Disclosure Statements available from FP Markets website, www.fpmarkets.com and should be considered before deciding to deal in those products. Derivatives can be risky; losses can exceed your initial payment. FP Markets recommends that you seek independent advice. First Prudential Markets Pty Ltd trading as FP Markets ABN 16 112 600 281, Australian Financial Services License Number 286354.

Access +10,000 financial

instruments

Access +10,000 financial

instruments