Reading Time: 10 minutes

Market participants frequently misunderstand CFDs and spread betting, and can, by its very nature, be considered a risk. Although both are traded on margin, taxation applied to spread betting and CFDs (Contracts for Differences) is the primary distinction between the two. Spread bets are not subject to capital gains tax and stamp duty in the UK. Earnings derived from CFDs, however are free from stamp duty though are subject to capital gains tax.

One of the key benefits of trading CFDs is that it offers a way to speculate across a broad range of financial products (shares, Forex [currencies], indices, individual shares, and commodities) that don’t require ownership (buying and selling) of the underlying assets. CFDs are also cash-settled.

With CFD trading, you agree to exchange the difference in the price of an asset between the time the contract is opened and the time it is closed. CFD positions allow you to bet on price movements in either direction, with the amount of profit or loss you make depending on how accurately your prediction was made.

It is recommended that you learn as much as you can about CFD trading, from the basics—such as how the CFD market operates—to long and short trades (their meaning and application), leverage, hedging strategies, as well as basic risk-management techniques (protective stop-loss orders and take-profit orders, for example).

- Short and Long Position Trading is a KEY benefit to trading CFDs

Trading CFDs lets you speculate on price swings in either direction; typical trades in the CFD market. A long position reflects a buy position, therefore if the underlying market advances, that trader receives profit, and a loss would occur should the position turn unfavourable (hit the protective stop-loss order by moving south). Selling, known as going short, is the opposite of purchasing. The trader bets that the underlying market will decline and profits should a fall in price emerge. A loss would obviously occur if the position turns north and triggers any protective stop-loss order. Understanding the difference between going long and short is imperative. In fact, knowledge of the market traded is a crucial part of risk management.

- Leverage

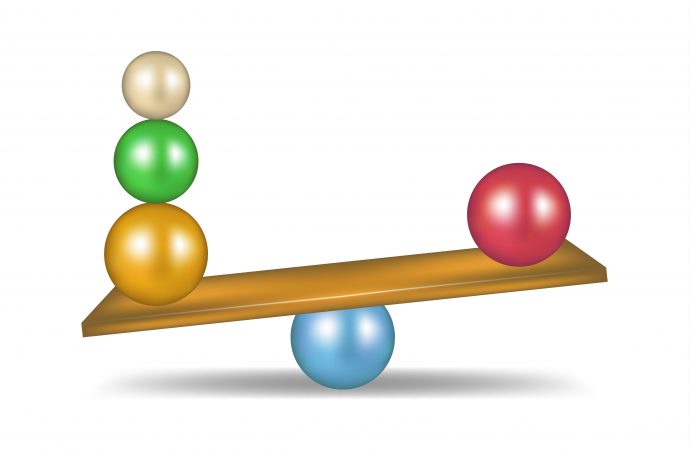

Leverage and margin (mentioned below) are key risk elements in the CFD market. Because trading in CFDs is leveraged, it is possible to increase exposure without committing the entire cost of the notional position at the beginning of the trade.

Suppose you were interested in opening a stake (a trade) equal to 500 Apple shares. In the case of a normal trade (physically dealing in shares), this would entail making an up-front payment equal to the total cost of the shares. On the other hand, if you use a CFD, a small amount of money is required as collateral, generally around 5% of the notional amount—this is the initial margin needed to open a trade.

- Margin

Margin works closely with leverage and is another component of risk in CFD trading.

For instance, you would require $100,000 in your account to trade 1 standard lot of the USD/JPY currency pair without using margin. But with a Margin Requirement of just 1%, you would only have to deposit $1,000 in your account as collateral to trade an equivalent $100,000 position, hence you have leveraged the trade. The leverage offered in this transaction would be 100:1 (note that leverage is a fixed ratio by your broker and does not change unless you do so through your client portal or the customer support). Leverage and margin can be confusing to newer traders. It is encouraged to do your homework and understand the risks involved with leverage and margin. Consider visiting FP Markets, who offer detailed video tutorials on leverage and margin.

- Hedging

CFDs can also protect an existing portfolio from incurring more losses—another form of risk management. As an example, if you had reason to believe that the value of some Amazon shares in your portfolio might experience a temporary drop in price as a direct result of an unsatisfactory earnings report, you can mitigate some of the potential loss by going short on Amazon through a CFD trade. Any decrease in the value of the Amazon shares in your portfolio would be offset by a gain in your short CFD transaction, if you chose to hedge your risk in this manner.

Risks of CFD Trading:

- Liquidity and volatility risk.

- Leverage and margin.

- CFD trading, although not mentioned above, is an over-the-counter market (OTC) and therefore does not subscribe to the rigorous regulatory requirements associated with exchange-based trading.

- Protective stop-loss orders are an efficient method for limiting exposure to risk when engaging in CFD trading. Your open positions will be closed automatically (at the next available price) once the price reaches your protective stop-loss order.

Benefits of CFD Trading:

- Access to the underlying asset at a cost lower than purchasing the asset outright.

- Access to a broad range of trading instruments is one of the primary advantages of CFD trading.

- Ease of execution and the flexibility to go long or short. CFDs are typically favoured for day trading and other short-term trading methods due to the simplicity of CFDs as well as the leverage offered through these instruments.

- CFDs don’t have an expiration date and are cash settled.

Choosing a CFD Provider

Choosing a reliable CFD service provider (CFD broker) is an important step in your trading journey.

A CFD brokerage, such as FP Markets, is a fully regulated broker with a superior track record. FP Markets also offers access to multiple financial instruments, including over 60+ currency pairs, such as EUR/USD and GBP/USD, standard and raw CFD account types, as well as professional and retail investor accounts.

Head over to FP Markets today and open a trading account; they have something for all trading styles from beginners to experienced traders.

Access +10,000 financial

instruments

Access +10,000 financial

instruments