CFDs, or Contract for Differences, are popular financial derivatives enabling market participants to speculate and employ hedging strategies in the markets, without taking ownership of the underlier.

Formed by way of agreements between buyers and sellers, CFDs are cash-settled transactions. CFD trading does not facilitate the physical delivery of underlying assets, unlike futures and options.

CFDs cover a broad range of financial instruments, such as individual shares, foreign exchange (Forex), indices, cryptocurrencies, and commodities. The wide selection of markets, therefore, can lead to unnecessary confusion concerning CFD trading costs on MetaTrader 4, or MT4.

CFDs Commission/Spread

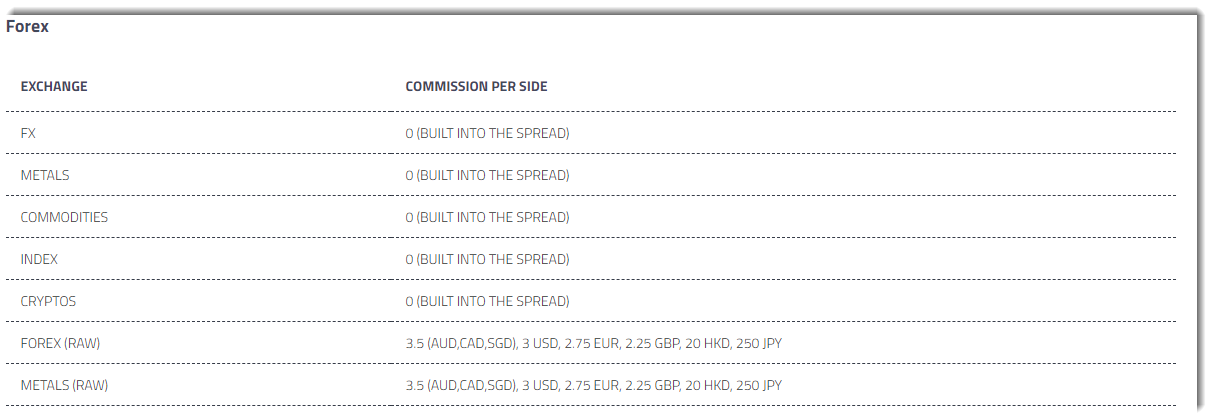

The commission structure for CFD products with FP Markets are reasonably straightforward.

For all MT4 and MT5 products, the commission, or the initial cost of entry, is built into the spread of the product (Forex, Metals, Commodities, Index, and Cryptos). However, when trading with a Raw account you will pay a tighter spread along with a flat pro-rata rate (Forex pairs and Metals only). The commission per side is 3 USD, plus the spread cost (figure 1.A).

For example, imagine a long one-standard lot position of EUR/USD with a 0.1-pip spread. The pip value (pip value is the value describing a one-pip move) is $10, based on a dollar-denominated account.

$1 (the spread) plus $6 (3 USD per side) = 7 USD initial cost of entry.

(Tighter spreads will, of course, lower the initial cost of entry).

(FIGURE 1.A)

- The bid value represents a ‘sell price’.

- The ask value, or sometimes referred to as ‘offer’, represents a ‘buy price’.

The spread is the difference between the bid and ask values, hence bid/ask spread. The spread value tends to vary depending on market conditions.

The spread is one of the main ways in which CFD brokers factor in their commission.

MT4 and MT5 Swap Rates

In order to hold CFD positions past 17.00 New York time (00.00 server time), a swap rate is applied – an interest adjustment made to your account. The client will either receive interest (a credit) or incur a debit for holding a position overnight. Swap rates are derived from the interest rate differentials between the two currency pairs.

The swap is calculated by the position size, the swap charge, the duration the trade is active, and whether the position is long/short. Traders should also be aware triple interest is debited/credited on Wednesday, covering the weekend as brokerages and banks close.

As underlined here, in foreign exchange, or the Forex market, the swap is the interest paid at the time of the rollover. It is the process of extending the settlement date of an active trade to the next trading day, referred to as Tomorrow Next, or Tom-Next.

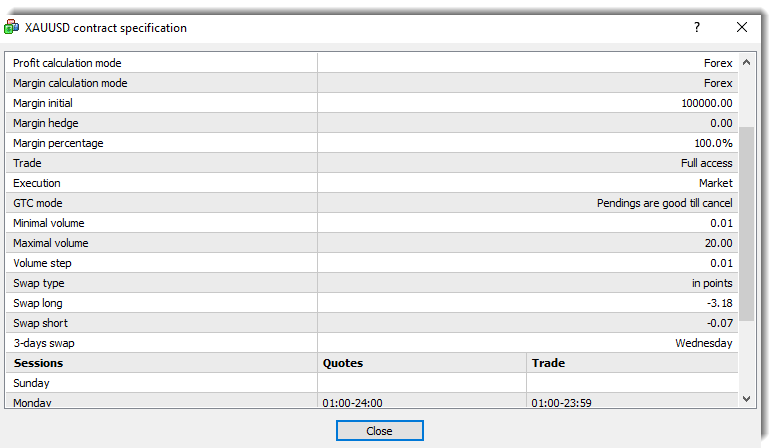

To hold CFDs overnight, swap rates, similar to FX, are quoted in pips/points.

For example, the MT4 specification tab for XAU/USD (gold), as displayed in figure 1.B, shows the swap calculated in points. The long swap rate is -3.18 while the short swap rate is -0.07. In this case, regardless of trade direction, the account will face a debit to hold the commodity CFD overnight.

To calculate the swap rate, consider our user-friendly calculator.

(FIGURE 1.B)

Another thing clients must be aware of is WTI does not charge an overnight swap charge; there is, however, a rollover adjustment each month.

The WTI product is based on future oil products, the contract has a set expiration date. If a client wants to continue holding a position past the expiration date, the old position must be closed as the contract expires and a new one reopened in the new futures contract. Clients may receive or be the bearer of the adjustment depending on their position in the market (long or short) and the next contract price (gaps up or down).

For example, Oil contract price for the May 20 contract’s price was around $19 – $20 and Jun 20 was around $25 – $26. This resulted in a price gap up to around $6.2 per barrel (1000-barrel contracts). In this case, if a client was holding 1 lot long the client would bear the adjustment of $6.2 * 1000 = $6200 rollover adjustment.

Platform Fees

With FP Markets, MetaTrader 4 and 5 trading platforms are free to download, with no inactivity fee. The software comes loaded with a number of features, including real-time market quotes, both on live and demo accounts, one-click trading functionality, multiple order types, and chart window features.

To start trading, opening an account with FP Markets is free. Traders are required to select a base currency from the range offered (USD, GBP or JPY, for example). Any realised non-base currency amounts in your trading account will be converted to your base currency at FP Markets’ prevailing conversion rate. Details of the costs, fees, and charges will be included in your statement, available as an online report, accessed via the MetaTrader platform, or through email or mail.

DISCLAIMER: The information contained in this material is intended for general advice only. It does not take into account your investment objectives, financial situation, or particular needs. FP Markets has made every effort to ensure the accuracy of the information as at the date of publication. FP Markets does not give any warranty or representation as to the material. Examples included in this material are for illustrative purposes only. To the extent permitted by law, FP Markets and its employees shall not be liable for any loss or damage arising in any way (including by way of negligence) from or in connection with any information provided in or omitted from this material. Features of the FP Markets products including applicable fees and charges are outlined in the Product Disclosure Statements available from FP Markets website, www.fpmarkets.com, and should be considered before deciding to deal with those products. Derivatives can be high risk; losses can exceed your initial payment. FP Markets recommends that you seek independent advice. First Prudential Markets Pty Ltd trading as FP Markets ABN 16 112 600 281, Australian Financial Services License Number 286354.

Access +10,000 financial

instruments

Access +10,000 financial

instruments