Global equities are running on low momentum with indecisive trading ranges and potential topping displays in the daily charts along with bearish retracements in the weekly meeting resistance levels.

Gold remains at risk of setting a double top reversal formation, a breakout is required.

WTI looks to be setting up a potential Relative strength bullish divergence buy signal following the disastrous negative price expiry last week.

Underlying forward Volatility readings remain relatively high and may continue to hold these levels in the coming days.

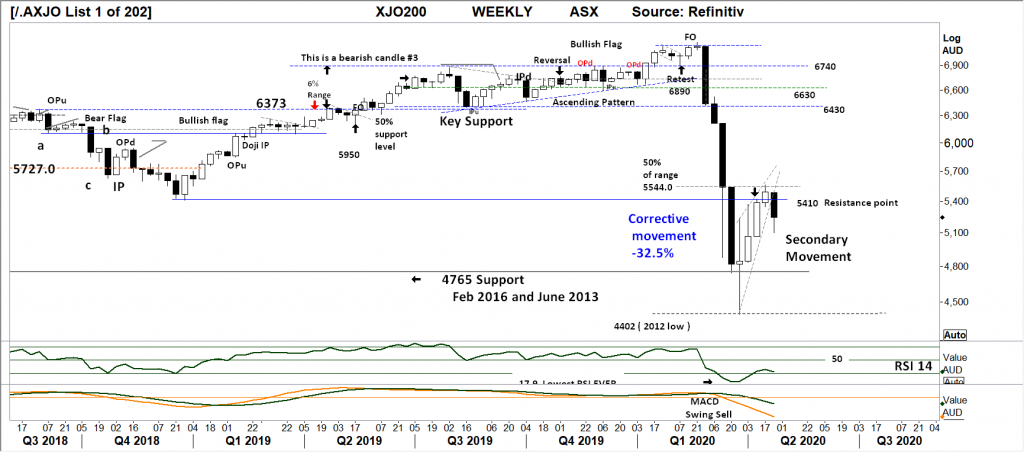

XJO WEEKLY

Price structure:

The XJO puts in a negative week, but can be seen closing off the low of the week. Consolidation at this level could be expected this week. The rejection below 5544 and 5410 is a significant blow to the buyers.

Indicator: Relative Strength

The RSI looks to be rolling over as it remains below the “50” level, this signal the loss of upward momentum on a weekly basis. This should be monitored in the coming weeks for a bullish divergence signal.

Indicator: MACD

The MACD has been slow to react to the initial corrective price movement, and currently remains a “Sell” signal.

Comments from last week: During the market decline the large range week from mid March closed at the 50% of its range. This week the intra week high tested that level, a powerful signal of high price rejection. This current secondary rally remains a weak in structure as last week’s range being a shorter range shows an unwillingness of the buyers to take the market higher.

XJO DAILY

Price structure

A bearish picture further developing in the daily movements. A retest of 5000 seems the closet target, in the coming days a breakdown below this level would be a bearish signal for further declines to retest the lows at 4400. Only a solid close over 5535 would negate this view.

Indicator: Relative Strength

RSI has moved below the key 50 level as price consolidates below the daily resistance shown at 5286

Indicator: VOLUME

The recent daily volumes can be seen rising on down days with Volumes falling on UP days. This is typical Bear market activity. Fridays positive close was achieved on low volume, not a great sign for the Bullish.

Comments from last week: Significant resistance can be seen developing at 5535, with the current price action trading at the lower edge of this bearish flag pattern a breakdown to retest the 5000 level is possible in the coming days. A bullish signal continues in the RSI as the indicator remains over the key 50 level. Look for a movement below the key 50 level on any price weakness as a sign of continuation lower.

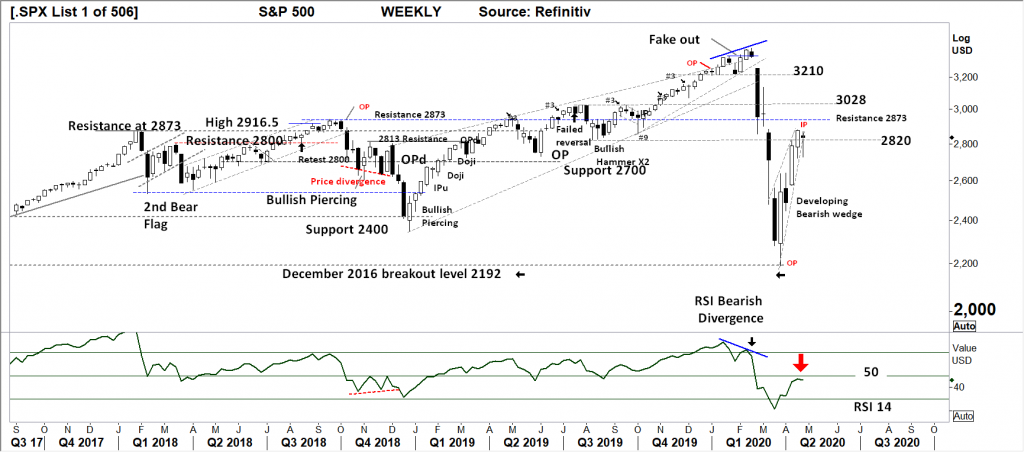

S&P 500 WEEKLY

Price structure:

The developing bearish wedge is showing signs of rejection of higher prices with the inside week (IP) testing lower prices. 2820 will be key level to hold this coming week.

A loss of momentum is taking place that may gather momentum with a potential move towards 2600 points.

A solid close over 2873 is required to remain bullish.

Indicator: Relative Strength Indicator.

Relative Strength turning lower below the key 50 level is not a great sign for the Bullish.

Over the coming weeks this would be monitored for a Bullish divergence signal.

Comments from last week: Last week’s very strong close sets the index up to test the next level of resistance at 2873. Relative Strength has turned sideways, this would still be monitored for a move over the “50” level as a signal for further momentum gains in the coming week. This indicator will also be monitored for a bullish divergence signal, however this may take several weeks to develop, as a retest below the “30” level must occur.

S&P 500 DAILY

Price structure

Daily price structure is setting up a bearish flag pattern as the DAILY wedge starts to break down. The projected downside target is 1800 points.

A solid daily close over 2850 is required to develop a bullish view.

Indicator: Relative Strength

RSI from last week bearish divergence is showing signs of turning lower as the signal line turns sideways and remains below the 70 level, look for a cross of the 50 level to confirm a loss of bullish momentum.

Comments from last week: Daily gaps highlight the volatility of market direction along with the consistent large daily ranges, resistance at 2940 remains in place and may be tested early in the week. The price structure remains a secondary reaction within a major market correction.. With RSI moving towards the “70” level again price momentum is considered very strong. Importantly the observation is RSI has NOT made a new high in line with price, a sign of slowing momentum.

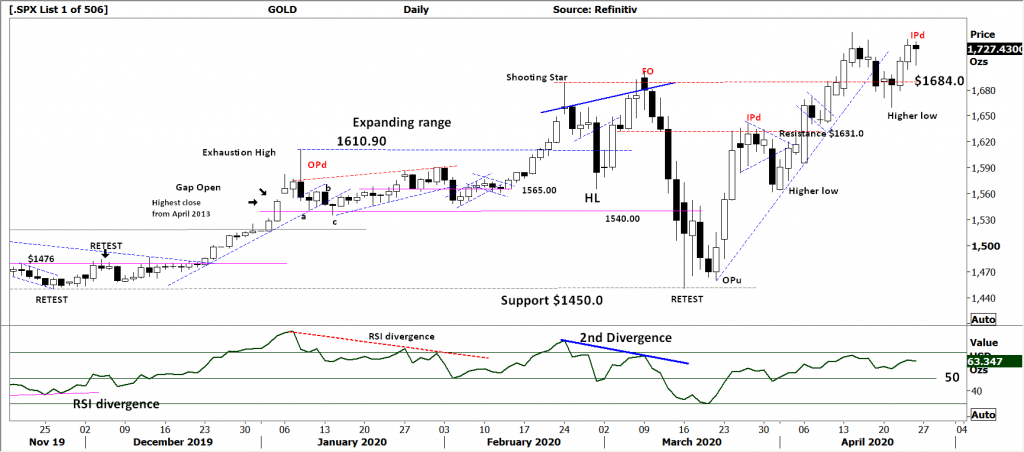

GOLD – WEEKLY

Price structure:

The underlying price structure remains in a Primary UP trend.

The rejection “shooting star” has not followed thru to lower prices. This week should be monitored for a close below the OPd high $1702.56 as the first sign of genuine price weakness.

Indicator: Relative Strength

The Relative Strength indicator has failed to make a new high in line with the underlying price making a new high, an early sign of slowing momentum.

Comments from last week: Last week’s “shooting star” is a significant rejection of higher prices, traders would look for a retest of the $1610 level in the coming week. The OPd high of 6 weeks ago has provided the “fake out” signal as price closes below the high of that rejection point. With a previous strong impulsive range showing strong buying the risk is sellers entering the market taking both “Stop losses and “short position” trades.

GOLD DAILY

Price structure

Friday’s IP (inside period) a signal of indecision as price approaches the previous weeks highs, the risk is a double top playing out into lower prices. First lower level to test is $1684 followed by $1631. While Gold remains in a Primary UP trend the risk of short term profit taking is showing in slowing price momentum.

Indicator: Relative Strength

A sign of overall positive momentum when the RSI remains above the 50 level. This should be monitored in the coming days for a sign of weakness should the 50 level be breached following the “rollover” of 2 weeks ago. A rising indicator would show improving price momentum.

Comments from last week: The $1631 is now an important potential support level in the coming days. Friday’s strong rejection to trade below the highs of early March is a significant sign of price weakness. It should be noted Friday’s range is large when compared to recent price action. This can be a very strong short-term signal, in this case for near term price weakness back to $1631 daily support or $1610.0 Weekly support.

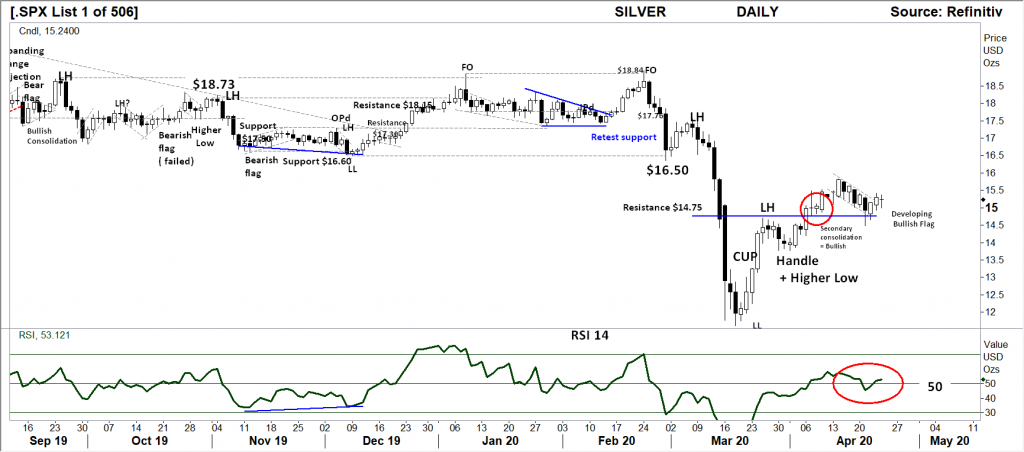

SILVER DAILY

Price structure:

The Daily chart of Silver has developed a bullish flag structure with last week testing the $14.75 support level. However, the breakout currently underway has been indecisive and at risk of breaking down.

Silver remains in a short term bullish structure, with $14.75 being the key support level in the coming days.

Indicator: Relative Strength

The Relative Strength has turned lower, but so-far remaining over the 50 level. This should be monitored in the coming days for a move higher in-line with further Bullish price movements, a further move below the 50 level would be in line with falling price.

Comments from last week: The daily chart of Silver is developing a Bullish flag structure, the $14.75 level would be looked at as a strong support level as this pattern develops. The Daily price trend remain UP. With a continued breakout the immediate price target of $16.50 is targeted.

AUSTRALIAN VOLATILITY INDEX

Current volatility levels remain the 2nd highest since the GFC. The recent statistics around flattening the curve has allowed this Volatility measure to retrace lower.

The most important observation is the value has maintained a relatively high reading currently at 27, reminding the trader this indicator has the potential to move higher in the next week.

Should the value fall in the coming days, this would show a continuing bullish signal in equities.

The XVI is the difference of 1 month forward pricing of ETO Options against current month.

As markets anticipate events, the forward priced option volatility changes, hence as forward price changes, this “skew” in pricing is measured in this XVI.

The XVI value works as an inverse observation to the underlying market.

An XVI over “13” is generally bearish for equities

USD DOLLAR INDEX

Price structure:

USD Index remains directionless as it grinds higher towards 101.0. The current bearish structure remains in the developing price channel of 98.45 to 101.0. A potential retest of the lower level underway.

Indicator: Relative Strength

Relative Strength has remained above the 50 level, however the sideways movement is a continuing sign of weak momentum.

Comments from last week: With the Short retest of 98.45 complete with the “pipe reversal” the higher low is now in place. This is an important level to hold, further gains in this USD value would be bullish for commodities and apply pressure to the FX crosses particularly the Australian dollar. Gold traders should monitor this against the Gold price as an influence in the local miners underlying price.

WTI CRUDE OIL

Price structure: This commodity is news driven.

With crude inventory levels at capacity, Oil has paid the price as demand slips away.

The consolidation around the $20 level has given way to a further capitulation low.

Last week’s Bullish hammer has the potential to retest the $29.20 level in the coming week.

Indicator: Relative Strength

Relative Strength remains VERY weak as the reading is below 30. This should be monitored for a movement over the “30” level should price breakout higher over resistance. At this point in time the Indicator backs up the potential for further price consolidation.

Comments from last week: Oil prints prices into the low $17.0, with more fundamental issues driving the price, storage facilities remain at full capacity. This current chart shows the front month currently coming to expiry. However the Primary trend remains down across all near contracts. The Weekly chart shows the 2nd month (inset) closing at $25.03 and not making a new low.

Relative Strength remains VERY weak as the reading is below 30. This should be monitored for a movement over the “30” level should price breakout higher over resistance. At this point in time the Indicator backs up the potential for further price consolidation.

Access +10,000 financial

instruments

Access +10,000 financial

instruments