With US elections and US stimulus news is continuing to drive market sentiment on a daily basis, daily volatility will remain for the coming weeks.

European lockdowns are growing and continuing to bring uncertainty to the local bourses, while the US records its largest infection rate last week. Markets continue to range trade between support and resistance.

The word “consolidation” is used throughout this report.

This offers ample opportunity for day traders and short term traders at the same time offers accumulation opportunities for the longer term holder.

As fund managers continue to look for “yield” the market may continue to find buyer support.

Gold, Silver and Oil continue to consolidate, holding back the Precious metals majors from any form of breakout. While the junior explorers continue to gain an interest from day traders.

XJO WEEKLY

Price structure:

An indecisive week with a narrow open and close range. The fact that the market is consolidating at the 6200 point level is a bullish sign for further gains. These types of consolidation can last for many weeks. The “impulsive” bar from 3 weeks ago dominates the current price action. Price movement back into the midpoint would be the first bearish signal for traders.

Indicator: Relative Strength

The RSI indicates has followed through as the signal line crosses upward over the key 50 level, a continuing bullish signal. The key observation for this indicator at this point is the reading above the key level of 50.

Further consolidation in the price chart below 6200 may see this once again dip further below the key 50 level targeting the 30 level.

Indicator: MACD

MACD confirms the swing “Sell” signal again this week and has continued the developing sideways movement, only reflecting the slowing momentum. The completed full cross over becomes the Sell signal. It should be acknowledged this indicator is very slow to react on a weekly basis and may continue to track sideways in the coming weeks.

Comments from last week: Simple observation of the Weekly charts is often the best analysis, in this case the large range bar of 2 weeks ago has followed through into higher values, but last week’s range is short and shows a lack of buyer commitment at this significant 6200 point long term resistance level. Last week’s 6093 low price must now provide support to consider an overall bullish case for the index. Importantly no real bearish information will be provided in the chart until the 5725-support level is broken, this seems unlikely based on the recent strong impulsive move.

XJO DAILY

Price structure:

Last Thursdays “test and reject” of lower levels is the key observation in this current price action. Fridays “inside period” shows the sellers are not in control of the short term price action.

Currently this is a “buy the dip” market.

Indicator: Relative Strength

RSI has rolled lower from above 70, this is not necessarily a bearish signal but this should be monitored for a move below the 50 level, this would be the first bearish signal, however given the sideways consolidation movement of price, this turn lower would be expected.

Indicator: VOLUME

Volumes have been robust during the past week on Thursday the test and reject day, there may be a change from distribution to accumulation. Significant volume increases need to show on the “up days” to confirm the longer-term bullish view. Fridays inside day (IP) was not supported by strong volume.

This will need to improve in the coming days to maintain a Bullish volatility breakout.

Comments from last week: The daily ranges are moving sideways at this significant 6200 point resistance level. The market appears to be in balance for now. From mid June 2020 this daily chart shows 3 attempts to break the support level at 5725, it would be considered the consolidation pattern is complete. However the resistance level also has 3 attempts to breakout. My view is the market will breakout higher as a significant volatility event with 6390 and 6890 as the next resistance levels.

S&P 500 WEEKLY

Price structure:

The S&P is building a Bullish flag pattern and may continue to move around the 3460 “midpoint” resistance in the coming weeks. 3230 will remain long term support on any further price declines, this level must be held for the market to remain a Bullish trend.

Indicator: Relative Strength Indicator

Relative Strength turning sideways is simply a reaction calculation of the weeks large price range. There is still not much to glean from its position as the prior move was not over the “70” level. A move below the 50 level is a signal of renewed bearish momentum.

Comments from last week: The Weekly S&P remains bullish with last weeks close above the “midpoint”3460 level. With 3230 as the support level a case for consolidation remains, there is no bearish signal present. Last week “spinning top” indicates the market is in balance. The underlying Primary trend remains UP.

S&P 500 DAILY

Price structure:

Intimate daily support has developed at 3420 as the past week consolidated inside last Monday’s bearish bar. A daily close above resistance at 3580 will be the key level to signal a breakout higher. The past weeks’ small range days, a sign of low volatility week will lead to a volatile breakout. Support at 3230 will be the key level on an y further breakdown of price.

Indicator: Relative Strength

Relative strength has again turned higher from the recent retracement from below the 50 level. As this type of price consolidation can last for many months the RSI would be expected to drift below 70 but remain at or above the key 50 level.

Comments from last week: Intraday support remains at the 3350 level at this point in the continuing development of price structure, last week’s retracement may be seen as the potential retest of this level as the market consolidates. The small daily GAP seen in the 3300 level would be the first target on any further price decline in the coming days.

USD Spot GOLD – WEEKLY

Price structure:

The underlying price structure remains in a Primary UP trend.

The whole world still wants to be “long” Gold, until they don’t.

The Gold price has a significant amount of work to do before any form of breakout can be called. There are 2 key resistance levels in play $1939.65 and $1970.0 where the market has remained below for the past 10 weeks. (Hardly Bullish)

The current rejection of $1939.65 is a bearish signal for a further decline, ultimately towards the long term trend line.

Indicator: Relative Strength

Relative Strength turns lower to move below “70”, this can be monitored to remain above the “50” level, as the instrument may find consolidation at this “midpoint” level.

Further selling below the support $1858.0 low may see a complete loss of positive momentum.

Comments from last week: This current move remains highly tradable from the point of view the $1858 level may have set the required “higher low” as part of an ongoing Primary UP trend. Resistance remains at the $1939.65 level with price again rejecting this level. My consistent comments are this market will consolidate further between $1939.65 and $1858.0 and remain highly tradeable on a short term basis. This current consolidation is being driven by the USD Index (DXY) movements setting up a new UP trend, see chart below.

AUD GOLD DAILY

Price structure:

Further rejection at $2720 with a complete bearish “pivot point” This market continues to be range bound.

Australian listed producers equity price will continue to be under pressure as this price structure continues to range trade.

Not included in this observation are the juniors with drilling and assay programs underway.

Indicator: Relative Strength

With the RSI turning lower, the crossover below the 50 level is a signal upward momentum maybe waining in the short term.

Traders would monitor this indicator for a continued swing higher in line with any price gains to confirm a valid buy signal.

Comments from last week: The first bullish signal from AUDXAU for a long period of time. Last Thursdays pivot bar also an impulsive price move has close well above the price action of the past 30 days. Immediate follow through is required to remain bullish, the falling AUD has prompted this breakout. Significant resistance remains at the $2720 level. When the excitement around the merger between NST and SAR resides local producers may again simply consolidate lower.

SILVER DAILY

Price structure:

Silver displays the same consolidation as most economic dependant metals. The current daily congestion is BEARISH and at risk of further testing the lower trend line with a further break of $23.40 support level.

The key level of $26.18, if broken would be a very bullish signal, however the Bearish “pivot reversal” of 9 trading days back continues to dominate the current price action.

Indicator: Relative Strength

With RSI now below “70” and moving along the “50” level, this only suggests further consolidation in price.

Indicator: MACD

The MACD has provided a swing Buy signal and should be monitored to remain as a buy signal. With the MACD now moving sideways this should be monitored for a further sell signal.

Comments from last week: The daily price structure for Silver remain Bearish with the Pivot reversal in place. Support / Resistance shown at $23.40 will be the key swing area to monitor. This price chart needs a closing price over $26.00 to give a bullish signal, otherwise a close towards the “tentative” trend line is a highly probable outcome.

COPPER DAILY

Price structure: Inventories under pressure

The early RSI divergence signal discussed last week may be coming into play with price rejection at $3.20

The current pivot point remains a bullish set up, however consolidation around the $3.10 level seems evident in this bullish trend.

$3.30 remains the overall target in the coming weeks.

Indicator: Relative Strength

Relative Strength has moved strongly over the 50 level and now moving back below the 70 level. An early divergence signal may be developing, this will be monitored in the coming week. Confirmation will be shown if price moves below the current support level of $2.98.

Comments from last week: It is highly anticipated the Global recovery will continue to pressure inventories and keep a buyer support under the price. The “pivot point” from last week has not followed thru to higher prices, but remains a bullish signal as price consolidates towards the highs of recent weeks. Overhead resistance at $3.20 remains the price target.

AUSTRALIAN VOLATILITY INDEX

A further decline in the XVI remain a slightly bullish signal for equities. It is important to note this volatility index is not pricing in higher volatility around the US elections.

A move above the 22 level would be a bearish signal for equities.

However a move lower is expected as news around the Australian Covid situation becomes less important.

The XVI is the difference of 1-month forward pricing of ETO Options against current month.

As markets anticipate events, the forward priced option volatility changes, hence as forward price changes, this “skew” in pricing is measured in this XVI.

The XVI value works as an inverse observation to the underlying market.

Comments from last week: Volatility remains consistently high (above 13) this will continue to flow thru to equities. The current 19.92 close is lower than last week providing a bullish window for last weeks move in equities. A continued decline in this value will underpin gains in equities. The Australian XVI remains slightly bearish for equities in the big picture but the current decline is a good signal the underlying Index’s may hold their recent gains, because the market is not pricing in higher risk.

USD DOLLAR INDEX

Price structure:

From a bullish pattern to a breakdown.

A new Lower high (LH) and Lower Low (LL) along the current down trendline. Support at 92.10 is not expected to a hold a retest of this important support level. ( See RSI note )

Indicator: Relative Strength

A complete breakdown of the Relative strength to move below the “50” level, the current swing lower is a significant implication for price. What was a bullish signal 2 weeks ago, is now confirming further price weakness with a continuing decline in reading.

Comments from last week: Well here we are again above the extended trend line, and the DXY has confirmed a higher low in place (HL) with the impulsive move on Tuesday last week. The trend line is now invalid and has been moved to a tentative trend line. The Daily chart is showing an emerging UP trend, this will continue to keep pressure on the Gold price and provide support for other commodities.

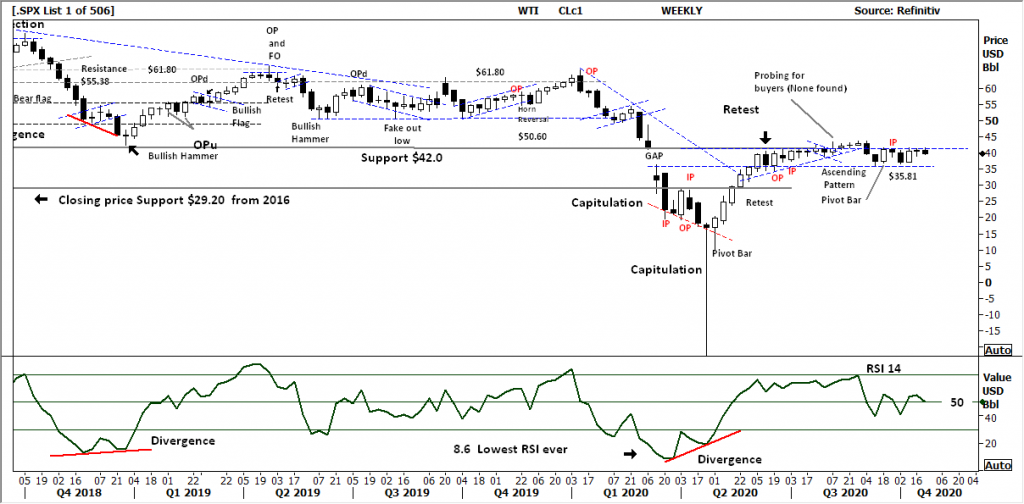

WTI CRUDE OIL

Price structure: This commodity is news driven by supply -demand.

The word consolidation has been used consistently in this report and again sums up the price movement in Oil.

No trend is evident.

Support remains at $35.81 with resistance at $42.00.

The only movement that can come out of this type of price action is a volatile breakout. Higher or Lower, the preference is higher as the capitulation move from Q2 2020 would have satisfied the sellers.

Indicator: Relative Strength

RSI turning lower is not a great signal for the bullish. Confused? So is the market.

Comments from last week : The “no price range” week only further confirms OIL into a consolidation above $35.81 and below the $42.0 level. While not a bearish signal in price, the expectation is for further consolidation until the $42.0 level is cleared. RSI 2 weeks ago made a sharp recovery over the 50 level however 2 weeks ago the key 50 level was again lost, again last week a further cross of the 50 level is good, but at risk of turning lower again.

Access +10,000 financial

instruments

Access +10,000 financial

instruments