A stunning week of volatility in all asset classes, with forward volatility measures approaching GFC highs, equity markets and some base commodities moving back to levels last seen during 2016.

However this week sees Bullish divergence developing in the Relative strength in some Indices’.

Gold and Silver have set significant lows and show they are not the safe haven and offer significant trading opportunities.

WTI oil sets 2016 lows as news flow disrupts support levels.

XJO WEEKLY

The Weekly XJO shows complete disregard for the long term trend line as lower support levels are tested in this CORRECTIVE price movement.

This corrective movement does not change the underlying UP Primary trend.

Currently the Weekly bar shows the close at the 50% “mid-point” of the range.

5410 has become the underlying closing price support level to hold in the coming week.

Relative strength remains below the key level of 50, moving below “30” showing a loss of positive momentum.

MACD finally gives the swing sell signal, highlighting the uselessness of this indicator during volatile price movements.

Comments from last week: With the week closing on the low of 6216 points the range shows sellers closing the market, however the range is shorter from the previous week a signal of lack of commitment. Further selling may see the long term trend line (tentative) confirmed at the 6000 point level.

XJO DAILY

With the breakdown below 6245 seemingly complete, the final bar shows as a piercing “hammer” bar. Further price gains would be monitored for a retest of the 6245 level.

Current support would be broken with a daily close below 5300 being Thursday’s low.

Importantly for now the Relative strength indicator (14) follow a reading not seen since 2015, now shows the early signs of Bullish divergence. Traders should monitor this potential early bullish signal for movement above the “30” level and “50” level.

Comments from last week: Last Monday’s low of 6245 provided a key reversal signal. However the 6390 level is now the current key resistance level. Last Wednesday / Thursday confirmed this level.

Friday’s low close shows sellers in control for the day.

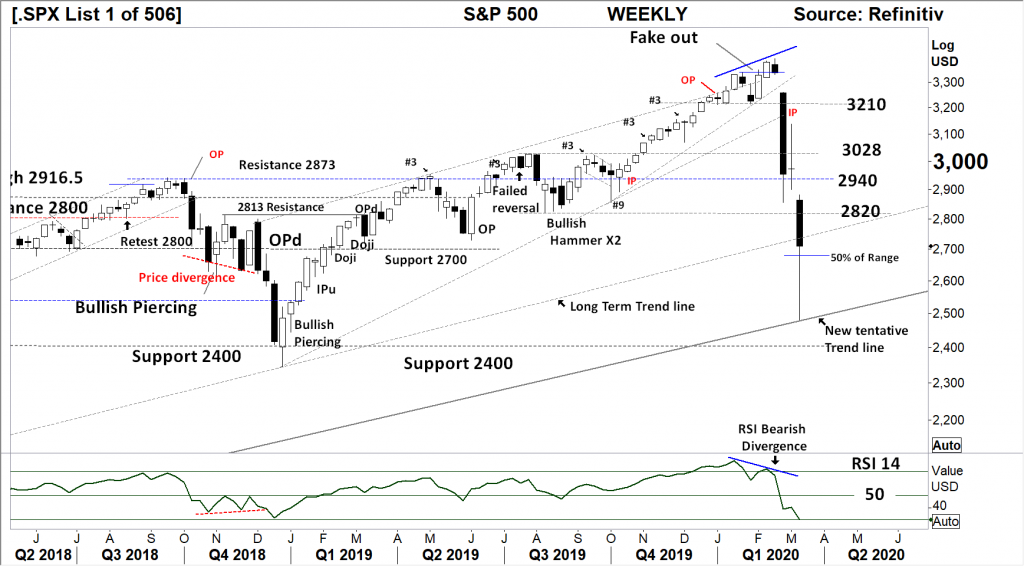

S&P 500 WEEKLY

Following Mondays GAP open and capitulation move lower the close on Friday has gained back more than 50% of the range, a bullish signal.

Further gains could test 2820 as resistance.

The 50% midpoint is calculated at 2680 and should be monitored in the coming week as “weekly” support.

Relative strength (14) has turned lower as may be expected, and close to indicating an “oversold” condition, this should be treated with caution, as momentum is weak.

Comments from last week: The S&P 500 has provided an early signal of support above the 2940 level, last week’s inside period is a sign of “balance” above this key level of support. Relative strength bearish divergence remains in play, this market would be monitored for a breakdown and close below 2940 in the coming week as a signal for a retest of the long term trend line.

S&P 500 DAILY

Looking at the bearish Flag target, Thursday low met that target followed by Friday Bullish reversal bar closing the Gap.

Further gains may test the recent 2940 support level as “resistance” in the coming days.

A closing break down of the low at 2478 would be a very bearish signal for further price declines.

Relative strength remains below the key 50 level and now shows BULLISH DIVERGENCE a strong sign of changing momentum from down to UP.

Comments from last week: Early BEAR MARKETS are often characterised by short sharp rallies as Buyers look to “buy the dips”, the real capitulation is yet to show as closing prices remain above the 2940 level.

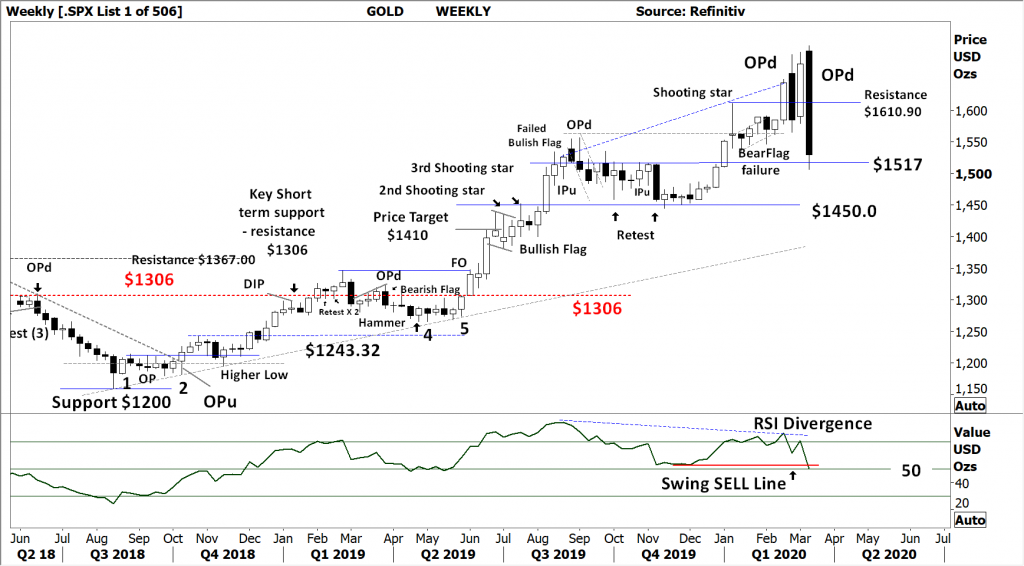

GOLD – WEEKLY

There are significant statistics of +90% that indicate the OPd can mark a “high” within 1-3 bars.

The retest of $1517 may usher in some consolidation above this important support level.

A further weekly close below this level would look for support at $1450.

Relative strength has shown a swing sell signal as the indicator moves below the internal low. A further sign of overall momentum slowing would be the indicator moving below the “50” level.

Comments from last week: The significant observation on this chart is the new high ($1691.72) set, overcoming the OPd (outside period down close) a very bullish signal as price momentum remains strong. The OPd remains in place as a statistically relevant marker of a “high within 3 periods”, within this primary UP trend.

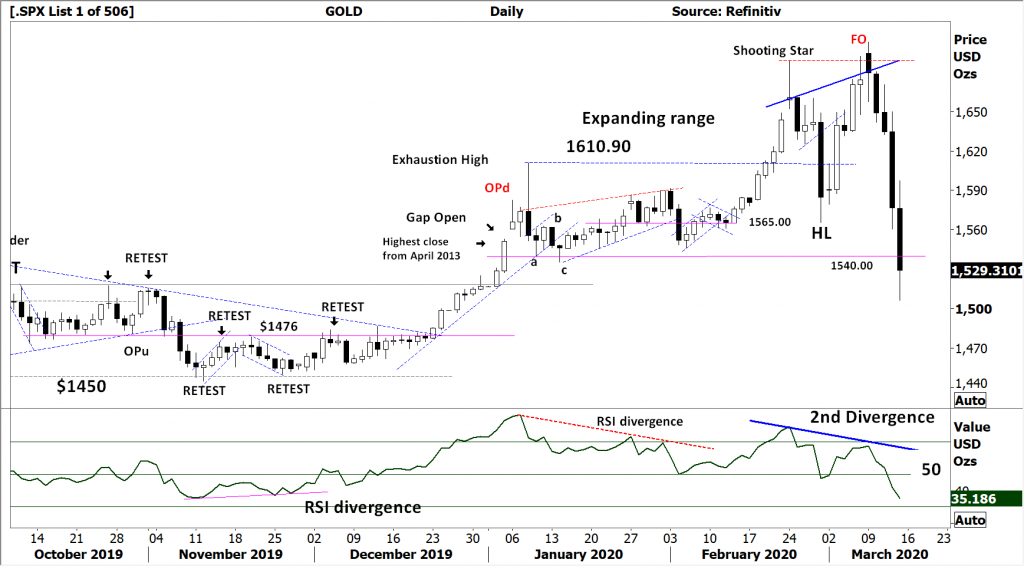

GOLD DAILY

Trade the price not the safe haven.

The “Fake out” mentioned last week has followed on to move price sharply lower on expanding ranges.

Buyer confidence will be shaken, any support should be consolidation not a further move higher.

The daily close below $1540 is a short term bearish signal in this “corrective” price movement.

Relative strength has moved below the key “50” level following the Bearish divergence signal showing from late February – early March.

Comments from last week: The current higher low now in place has followed through to a new high. The “fake out” is now set as the price closes below the shooting start high, showing buyers unwilling to hold at a high price. Relative strength remains as a potential bearish divergence signal as the indicator turns lower. Should price weakness come into the market, $1610.90 remains as the key level to hold.

SILVER DAILY

Silver failing to make a new high with Gold became the warning as Silver puts in a lower high and broke $16.50 support to test the $14.85 historical support. This level is the Bear flag price extension.

Consolidation would be expected following this sharp decline, traders would look for a further bearish flag pattern to show further declines.

Bullish consolidation should remain above $14.85 in the coming days. Failure of the level may test the next level of support at $14.30.

Relative strength has again “rolled” lower and remains below the key “50” level a sign of weak momentum.

Comments from last week: The daily chart of Silver has NOT confirmed the bullishness of the Gold chart. Current price action suggests a bearish flag pattern in play with a potential retest of $16.50 on any price break down.

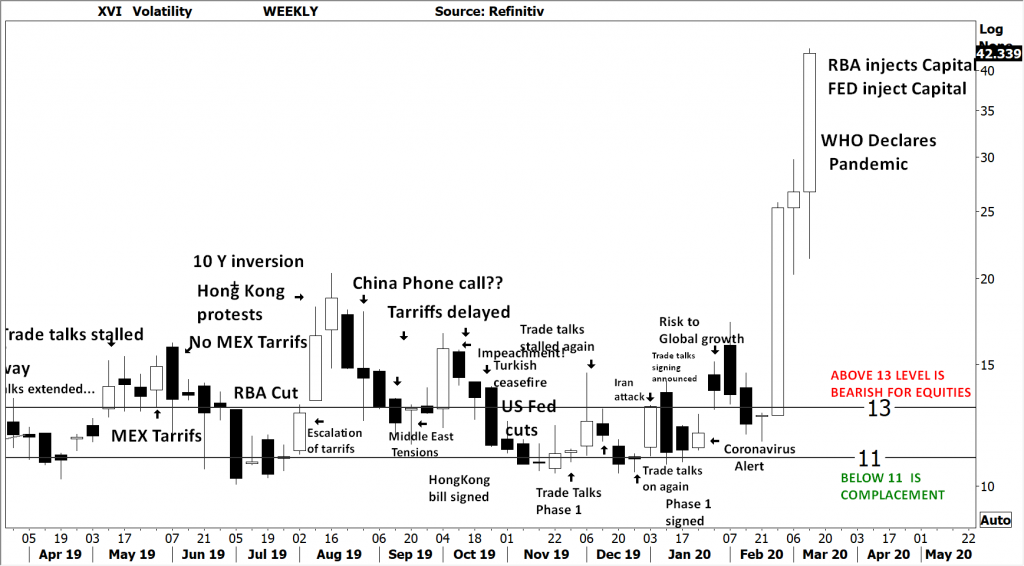

AUSTRALIAN VOLATILITY INDEX

Current volatility levels, the 2nd highest since the GFC shows a further increase in forward volatility values, this is a Bearish sign the market has increased immediate near term risk to valuations. This may again move higher in the coming weeks.

Should the value fall in the coming days, this would show a bullish signal in equities.

The XVI is the difference of 1 month forward pricing of ETO Options against current month.

As markets anticipate events, the forward priced option volatility changes, hence as forward price changes, this “skew” in pricing is measured in this XVI.

The XVI value works as an inverse observation to the underlying market.

An XVI over “13” is generally bearish for equities.

USD DOLLAR INDEX

Potential resistance at 98.45 has failed to halt the price movement with expanding daily ranges.

Current momentum has the potential to retest the “100” level in the coming days.

Relative strength has moved above the “50” level indicating improving and bullish price momentum.

Comments from last week: The very large range movement below 96.57 suggest further weakness. For a bullish picture to develop the index must now trade higher from the confirmed 95.71 “fake out” low set on Friday. 96.57 to become resistance in any price rally in the coming days, a close over this level would be a very strong bullish signal.

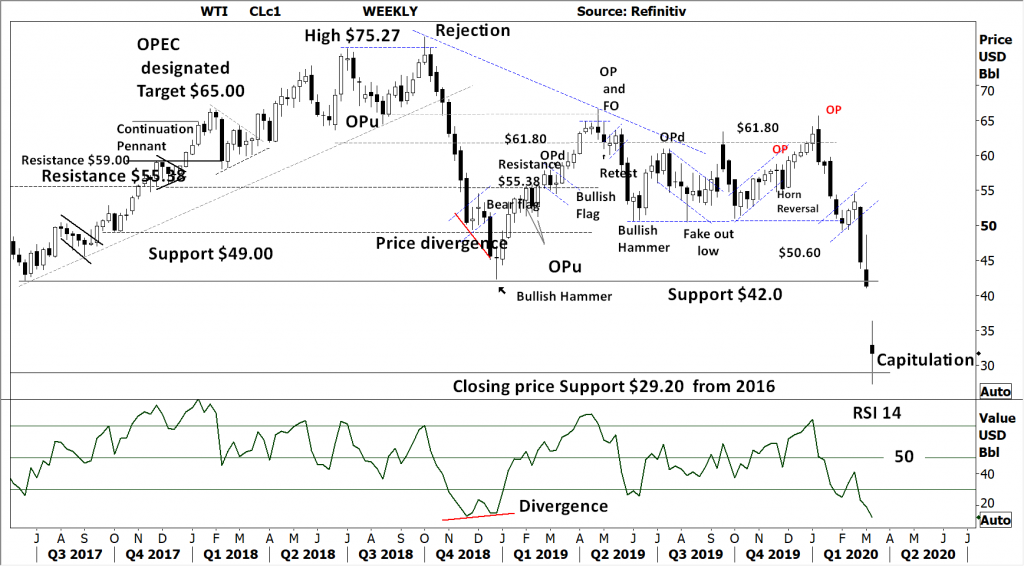

WTI CRUDE OIL

A news driven opening GAP setting a capitulation move to test support from 2016 at $29.20.

This earlier support level the key level in the coming days, a closing breakdown below this level would signal a further bearish move lower, potentially $20.

In the immediate further declines below the $30 level remain in play as the Relative strength moves below the “30” level indicating very weak price momentum.

Comments from last week: With complete failure of $42.0 support in this now confirmed Primary down trend, WTI shows an upper shadow in the current weekly candle/bar, a sign of higher price rejection. This is a very bearish signal for further declines in the coming days.

Access +10,000 financial

instruments

Access +10,000 financial

instruments