XJO WEEKLY Price structure:

The “midpoint” support level at 6620 was tested during the week.

IMPORTANT DISCLAIMER

The information in this report is of a general nature only. It is not personal financial product advice. It does not take into account your objectives, financial situation, or needs. You should therefore consider the appropriateness of this general information in light of these. The Australian School of Technical Analysis (www.astatrading.com) recommend that you refer to the Product Disclosure Statements of any financial products which are discussed in this report before making any investment decisions. ASTA accepts no responsibility for your actions and recommends you contact a licensed advisor before acting on any information contained in this general information report.

The high close following a intra-week decline sets up another “hangman reversal” bar. The primary trend is down a further movement below the midpoint would give first warning of a move too or below 6400, this would further confirm that trend in place.

Indicator: Relative strength 14:

Relative strength has again closed below the 50 level as part of the overall decline in relative strength. Price momentum turns negative on the lower side of 50. However, should Relative strength move above the key 50 level a sign of improving price momentum would prevail.

Indicator: Relative strength 14:

Relative strength has again closed below the 50 level as part of the overall decline in relative strength. Price momentum turns negative on the lower side of 50. However, should Relative strength move above the key 50 level a sign of improving price momentum would prevail.

Comments from Last week: A very strong range following the lower retest of the 6400 level. The current impulsive price bar, often forcing a short cover gave the Index one of the best weekly gains for some 20 months. Weekly ranges can be used to develop mid-range support levels, (the October 2020 low is another example). The primary trend is down a further movement below the midpoint would give first warning of a move too or below 6400, this would further confirm that trend in place. .

XJO DAILY Price structure:

A closing price over 6772.0 this week would confirm the current pivot point in place as a new daily trend. Resistance at 6765 is now in play the first close should be over this level to give any hint of a continued bullish developing. The Daily trend remains in line with the Weekly trend- Down.

Indicator: Relative strength 14:

The Relative strength Indicator (14) reflecting the underlying price momentum has moved higher to the 50-level indicating a change in momentum. Relative strength is moving in sync with the trending action of the market and does not offer any trading signal other than indicating momentum is currently to the upside.

Indicator: VOLUME:

Friday low volume bar was developed from a large impulsive price range. However again last Friday set one of the lowest volume bars for the week, indicating a lack of conviction for further buying. Only volumes over 1Bil on a Daily basis would indicate strong new money buying.

Comments from Last week: The Daily chart shows the strong advance for the earlier FO (fake-out) currently an early Bearish reversal point in the form of a pivot point is displayed. This confirms another lower high compared to the previous pivot point set on the 14 th September. The first intimate support level is 6765, an immediate break of this level would bring the Weekly chart midpoint into play.

S&P 500 WEEKLY Price structure:

Key support is developing around the 3600 level within the current Primary down trend. On a seasonal basis the last 2 weeks of October can be very bullish, a closing price over the 3715 level would confirm this statistic. Last weeks low has set a FO (fake out) against the end of September closing low.

Indicator: Relative strength Indicator 14.

The reading below the 50 level again sets up the sell signal, last week the indicator turned higher, indicating a change in momentum, this week may ultimately continue the momentum move lower. A movement towards and over the 50 level would be a very strong short term bullish signal. Positive momentum requires a reading above the key level of 50.

Comments from Last week: The current inverted hammer bar when displayed in a weekly chart is a bullish signal, often with a lower price being set first then followed by a rise in price. This is the important level (3600) to achieve that outcome

result. The current Weekly bar also completes a 3 Bar reversal pattern, a close over 3795 will confirm the pattern. The Weekly trend remains down.

S&P 500 DAILY Price structure: Developing bullish structure has failed.

Last Friday’s trading has set up a dark cloud cover, usually a bearish trading signal for further declines. With the final closing price confirming the current closing price support level of 3580 the next price movement will offer direction for the coming days. An immediate close below the 3580 level would bring further Stop Loss selling with a retest of the OPu low at 3491.0. Daily trend remains down.

Indicator: Relative strength 14:

Relative strength has turned higher while below the 50 level, a very strong indication of immediate improving momentum. A slight bullish divergence signal is showing, a swing over

the internal high point would provide the swing buy signal. Further price weakness for this index will see the RSI move lower.

Comments from Last week Resistance is confirmed at the 3800-level following the inside range (IP), last Friday’s pivot point reversal and remains a Bearish signal for further declines and further confirms the short term high point (LH) in place. The immediate support is 3620 with critical support shown at 3567. A further breakdown below this level will further confirm the Weekly Primary down trend This remains the area to monitor for a bullish divergence signal.

NASDAQ DAILY Price structure: Primary DOWN Trend remains

As with the S&P, the Nasdaq has also set a dark cloud cover bar at the close of Friday following the OP range bar, usually a bullish reversal . The key level to hold this week is 10,440, the OP low. A reversal close above the 11,000 would setup the potential to fill the Gap showing in the 11,500-point area. Primary tend remains down.

Indicator: Relative strength 14:

The Relative strength indicator moving back towards the 30 level a signal of slowing / negative momentum. With a strong divergence signal a continuing move higher could be expected, the indicator may cross lower below the 30 level, this would reset the divergence or negate the divergence with a lower low in the reading. Price movement will remain negative with a continued reading below 50.

Comments from Last week: In line with the other major indices the Nasdaq Daily displays an outside period (OPu) reversal signal that has further developed into an Island top reversal pattern confirmed with the gap lower last Friday. The

island top indicates a bullish trap for buyers and often leads to further stop loss selling. Immediate support is located at 10966, if a further close occurs below this level, further confirmation of the daily down trend will remain

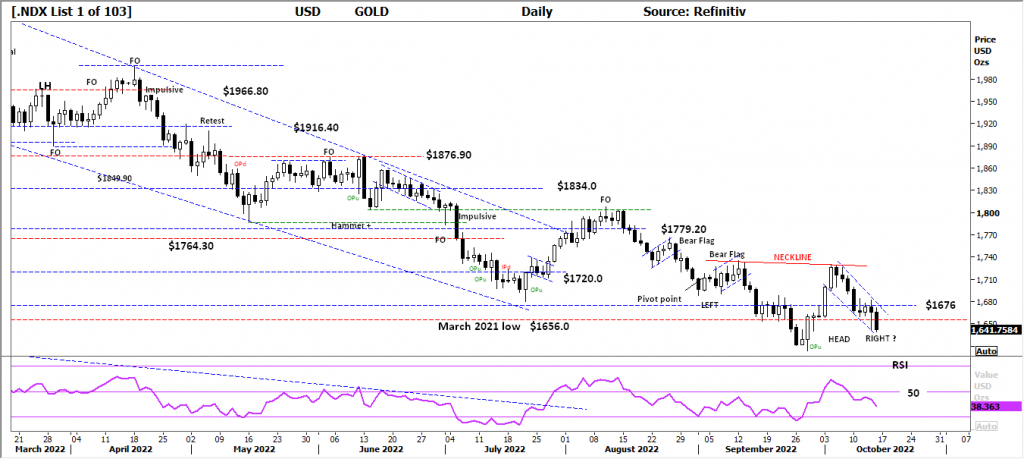

USD Spot GOLD – DAILY: Is it close to a Bull market? Answer = No

The Bullish flag pattern observed last week is at the point of failure, a break of the low at $1613.60 would signal a continuation of the down trend and negate the potential for an

inverse Head and Shoulder pattern reversal. To get bullish on this metal a close over the key level of $1656 is the first requirement.

Indicator: Relative Strength 14:

Price momentum is again working lower as the bullish flag develops or fails, the RSI moving below the 50 level is the signal of weakening momentum. (Currently 38.36) (Price consolidation would naturally see the RSI drift back too around the 50 level. A strong movement either way will show the next directional move.)

Comments from Last week: The $USD Index moving higher (see below) has seen a reversal in the Gold price, the current daily pattern developing into a bullish flag. The overall pattern from late August is developing into a Head and Shoulder reversal that will only be confirmed with a breakout above and followed by a successful retest of the neckline around $1740.0.

SILVER DAILY Price structure: Bull market? – No.

Last Friday Silver broke the last line of defence by closing below the $18.40 support level. The large range bar has the potential to follow through lower and again retest the $17.20 level as the Primary down trend reasserts itself. At this point it should be acknowledged Silver may be building a wider base pattern from the lows set during July 2022.

Relative strength 14:

Current Relative strength is rolling lower (again) with the movement crossing below the 50- level, RSI turning higher again would reflect the underlying momentum again turning positive. A continuing move above the 50 level and higher would be very bullish signal in the short term. Price consolidation results in the relative strength turning towards the 50 level.

Comments from last week: Silver displays the Fake out move (FO) followed by the inevitable decline, the overlapping nature of the decline constitutes a secondary movement in this case a Bullish flag pattern. This pattern following the higher low (HL) and impulsive price movement is a very strong signal of a Primary trend UP developing.

AUD GOLD DAILY Price structure: Breakout.

AUD Gold retesting towards the $2712 level with the OPd range bar has seen immediate rejection. Friday’s bar is bullish for the potential to again retest the highs. The overall observation is the AUD Gold price remains within a large trading range with $2712 as resistance and $2477 the support level. This will be a good outcome for Australian producers should the breakout continue over

$2676 and further over resistance of $2712.

Indicator Relative strength 14:

Relative strength has turned higher from above the 50 level to move above the 70 level and rolled over as consolidation takes place, this remains a positive for price momentum and remains a strong indication for further advances.

Comments from Last week: For Australian Gold producers this is the most important chart, it indicates their selling price and ultimately the difference between the selling price and cost of production – margin. $AUDXAU has currently moved back to the first key resistance level of $2676, the chart highlights the current USD Gold price and the $AUDUSD value. Only a lower $AUD will get this across the immediate resistance level. Current pricing bodes well for the Australian producers margins.

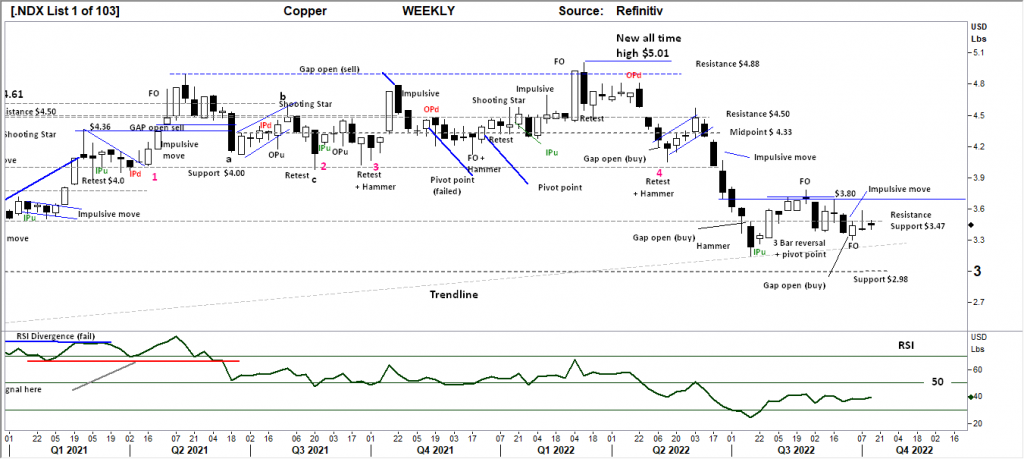

COPPER DAILY Price structure: “V” recovery failed.

Price consolidation below the $3.47 resistance level, adds to the view Copper may be building a support base above the current trendline with this week’s inside range bar. Copper has yet to confirm a “higher low” in place following the Gap open buy signal.

Indicator: Relative strength 14:

Current reading has swung from below the 30-level to again turn sideways to higher as downward momentum has slowed, however the current reading remains below the key 50 level.

The key now, is for the RSI to swung back above the 50 level as a reflection of ongoing price gains. A sharp cross of the 50 level is required to offer a strong buy signal.

Comments from Last week: The current inverted Hammer bar is a bullish signal, traders should be aware a lower price is required first. Copper is consolidating around the $3.47 level and importantly above the long-term trend line. A further close above the $3.47 level and above the $3.80 would confirm a bullish move is underway. Should a break of the previous low set on the 15 th of July occur a bearish signal would develop, importantly a break of the trendline would bring in Stop loss selling.

AUSTRALIAN VOLATILITY INDEX:

Volatility reading has moved slightly lower from the mid-week high and remains above the 13 level indicating forward pricing of PUT options remains strong. In general, lower equity prices or consolidation of equity prices is indicated as the reading remains above the 13 level. For continued support of equities, the XVI should move below the “13” level.

The cost of 3month forward PUT options is decreasing from recent elevated levels.

The XVI is the difference between 3-month forward pricing of ETO Options against current month. As markets anticipate events, the forward priced option volatility changes, hence as forward price changes, this “skew” in pricing is measured in this XVI. The XVI value works as an inverse observation to the underlying market.

USD DOLLAR INDEX Price structure:

The OPd range bar sets a new resistance level of 113.92 as the first observation point for this week’s developments. The OP is often the marker of a turning point, a down trend can only be confirmed with a breakdown below the last higher low point circa 110.0 on observation would also be a break of the up-trend line and the first signal od real weakness.

Indicator: Relative strength 14:

The Relative strength has turned sideways in line with price movements indicating further consolidation as the current reading is below the 70 level. This will move lower to sideways should price decline, only a continued reading back above the 70 level would indicate continuing strong price momentum.

Comments from Last week: The $USD has reasserted a Primary UP trend move, following the retest towards the 109.47 level. This will place pressure back on PM commodities (read Gold and Silver). The chart will now be monitored for a potential “lower high” and further breakdown of the previous 110.05 closing low

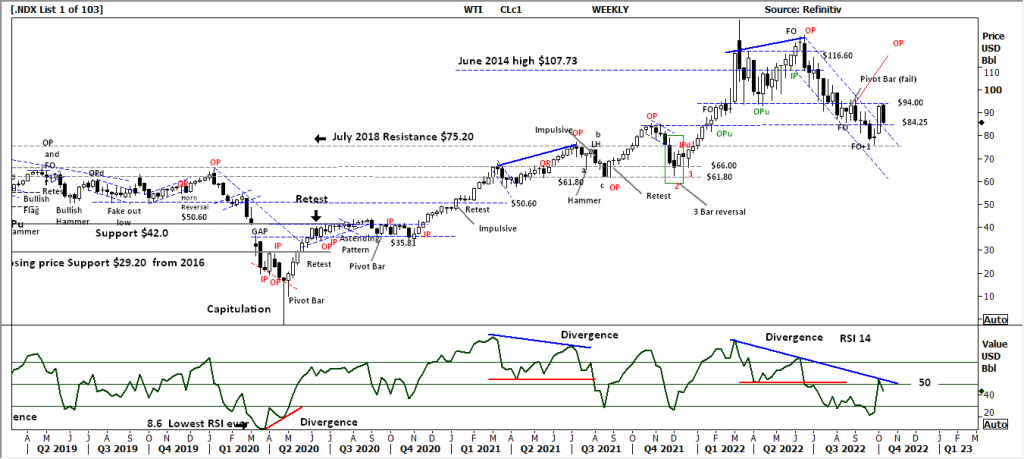

WTI – CRUDE OIL, Price structure: Full Bull Market remains-just.

This commodity is highly news driven around supply -demand.

Breakout failure with rejection at the $94 level now developing as the key resistance level. Price is now “trapped” below this level and above the $84.25 mark. A break either way will be decisive, in line with the rejection bar last week a break lower would be the highest probability.

Indicator: Relative strength 14:

The RSI running below the 50 is a result of strong price declines as upward momentum slows, recent price reversal has resulted in a sharp movement over the key level of 50 signalling increasing positive price momentum. This current move lower is indicating the loss of positive momentum.

Access +10,000 financial

instruments

Access +10,000 financial

instruments