Yesterday witnessed US ADP non-farm employment change and initial jobless claims pencil in better-than-expected data. According to the ADP National Employment report, private US employment jumped by 235,000 jobs in December, building on November’s upwardly revised 182,000 print. In terms of the US initial jobless filings, for the week ending 31 December, initial unemployment claims fell by 19,000 to 204,000, comfortably beating economists’ forecasts of 230,000.

‘The labour market is strong but fragmented, with hiring varying sharply by industry and establishment size’, said Nela Richardson, chief economist, ADP. ‘Business segments that hired aggressively in the first half of 2022 have slowed hiring and in some cases cut jobs in the last month of the year’.

Yesterday’s upbeat employment data has clearly stoked rate concerns across the market, a day before the much-awaited headline US non-farm payrolls data which market participants will look to attempt to assess the Fed’s rate path. The consensus heading into the NFP release forecasts a payroll increase of 200,000 in December, down from November’s 263,000 number.

Unsurprisingly, Thursday’s data elevated the US dollar against many of its major G10 currencies, consequently lifting the US Dollar Index nearly 1.0%. This weighed on the euro, the pound sterling and the Australian dollar, down 0.6%, 1.3% and 1.2%, respectively, at the time of writing. Major US equity indices also took a hit, all down more than 1.0%, as of writing.

What’s Ahead on the Calendar for Friday?

- Annual Euro Area Inflation Rate (Flash) for December at 10 am GMT (Expected: 9.7%; Previous: 10.1%).

- Canadian Employment Change for December at 1:30 pm GMT (Expected: 8,000; Previous: 10,100).

- US Non-Farm Employment Change for December at 1:30 pm GMT (Expected: 200,000; Previous: 263,000).

- US ISM Non-Manufacturing PMI for December at 3:00 pm GMT (Expected: 55.0; Previous: 56.5).

Technical View:

Dollar Rebound?

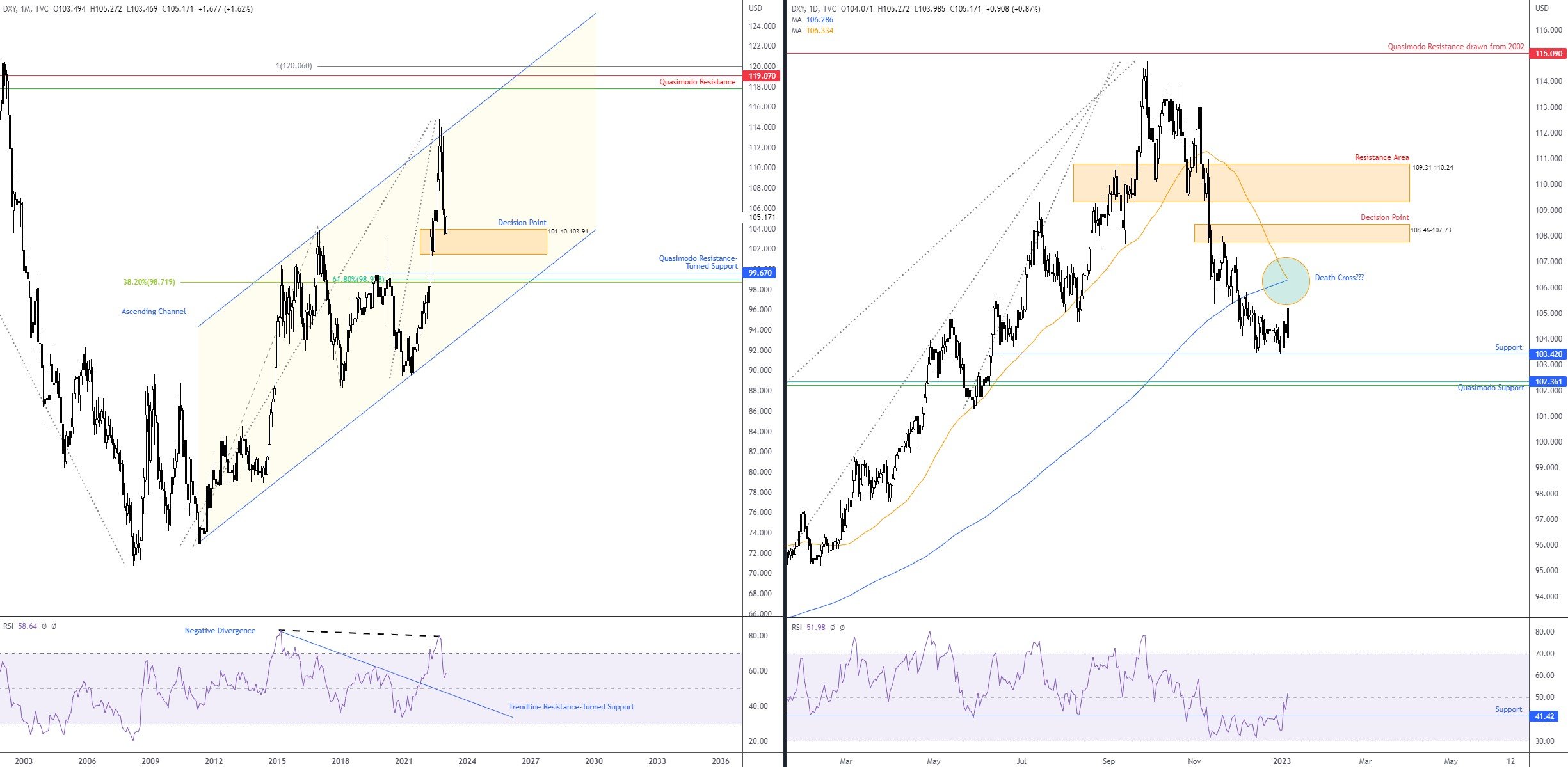

Charts: TradingView

Technically, the dollar strength is unlikely to raise many eyebrows for those who analyse the buck across multiple timeframes.

The Dollar Index has been trending higher since May of 2011, with the latest dip in Q4 of 2022 from the monthly ascending channel resistance (drawn from the high 103.82) poised to conclude on the doorstep of a decision point on the monthly timeframe at 101.40-103.91. The question is whether this will be the area we see the dollar recover or will we see the unit drop in on monthly Quasimodo resistance-turned support from 99.67.

Across the page on the daily timeframe, support has emerged at 103.42 with price approaching the 50- and 200-day simple moving averages at 106.33 and 106.29, respectively. We can also see that the shorter-term moving average is primed to cross under its longer 200-day moving average, emphasising what many technicians will, rather ominously, refer to as a Death Cross (a signal that a longer-term downtrend could materialise).

Overall, although the buck may find short-term resistance if price tests the underside of the moving averages, the monthly timeframe’s decision point mentioned above at 101.40-103.91 is likely to continue to underpin the greenback going forward. Supporting this is the relative strength index (RSI) crossing above the 50.00 centreline (positive momentum) on the daily timeframe, and the monthly timeframe’s RSI maintaining position north of the 50.00 centreline, following a negative divergence signal late last year.

GBP/USD: Interesting Position with the Pair Demonstrating Softness Beneath its 200-Day Simple Moving Average

The healthy USD bid on Thursday guided the pound to levels not seen since late November 2022. This, along with the current technical landscape, does not bode well for the GBP/USD at current levels.

Granted, the currency pair did stage an impressive recovery after clocking record lows of $1.0357 in late September, though it is important to remain aware that the trend is still directed to the downside since we topped out in early 2021 (in the shape of a double-top pattern).

Since December shook hands with resistance at $1.2263 on the weekly scale in December, buyers have been on the ropes. As evident from the weekly timeframe, scope to navigate southbound is clear. This is further supported by the daily timeframe’s price action forging a position under its 200-day simple moving average, currently circling around $1.2021. Additionally, space to the downside is seen until daily support coming in at $1.1611 (to the left of current price appears to be consumed demand), with the relative strength index (RSI) holding under the 50.00 centreline (reaffirming negative momentum).

DISCLAIMER:

The information contained in this material is intended for general advice only. It does not take into account your investment objectives, financial situation or particular needs. FP Markets has made every effort to ensure the accuracy of the information as at the date of publication. FP Markets does not give any warranty or representation as to the material. Examples included in this material are for illustrative purposes only. To the extent permitted by law, FP Markets and its employees shall not be liable for any loss or damage arising in any way (including by way of negligence) from or in connection with any information provided in or omitted from this material. Features of the FP Markets products including applicable fees and charges are outlined in the Product Disclosure Statements available from FP Markets website, www.fpmarkets.com and should be considered before deciding to deal in those products. Derivatives can be risky; losses can exceed your initial payment. FP Markets recommends that you seek independent advice. First Prudential Markets Pty Ltd trading as FP Markets ABN 16 112 600 281, Australian Financial Services License Number 286354.

Access +10,000 financial

instruments

Access +10,000 financial

instruments