Reading Time: 8 Minutes

Many calculators are available to help Forex traders in the Foreign Exchange Market (Forex market) and take the hard work out of calculations. However, it is always prudent to understand the basics of manual calculations, giving you an insight into how it works.

Frequently Asked Questions (FAQ)

- One of the most common questions is whether you need to understand how to calculate manually? The simple answer is no, but entry-level understanding can be advantageous, as stated above. However, basic math skills are generally required when trading, irrespective of the trading system used. This could be as simple as calculating protective stop-loss orders from the entry-level, as well as profit calculations based on the market price movement, to more advanced Fibonacci calculations.

- Where can I find Forex calculators? A brokerage such as FP Markets has all the calculators you need to begin Forex trading.

- Are Forex calculators free? Yes, there are hundreds of free calculators available online.

Common Forex Calculators:

- Pip Calculator

Working out the value of each pip in the account currency helps to accurately monitor the level of risk per trade. Fortunately, with FP Markets, your account deposit currency can be from either of the following: AUD, CAD, CHF, EUR, GBP, HKD, JPY, NZD, SGD, USD, CZK, PLN, or AED.

FP Markets Pip Calculator (figure 1. A)

Account Currency: This is your account deposit currency.

Trade Size: This refers to the number of units being traded, which is also commonly referred to as trading lots. This is found through your position size calculation.

Currency Pair: This is the currency pair you are trading. For example, EUR/USD, GBP/USD, or AUD/USD.

Currency Conversion Price: This is the currency pair needed to calculate the pip value.

Figure 1. A shows you must input the Account Currency, which is AUD (Australian dollars) in our example, with a Trade Size of 100,000 units (1 standard lot), and trade the currency pair AUD/CHF. Here, after inputting the figures, the trader can see that the pip value in the account currency is 15.07 AUD. This means each pip move is worth 15.07 AUD on a 100,000-unit position.

- Margin Calculator

Understanding margin, more commonly stated as initial margin or required margin, can be confusing for beginner traders and often mistaken for leverage. They are in fact closely related but are different.

Calculating margin is a straightforward process, though is dependent on the account currency and the currency pair traded.

From the drop-down menus, choose the Account Currency, the Currency Pair, Leverage ratio, Trade Size, and Currency Price, and the required margin will be displayed at the bottom: 200 AUD in figure 1.2. Note that the required margin is always in your account currency.

Account Currency: This is your account deposit currency.

Currency Pair: This is the currency pair you are trading. For example, EUR/USD, GBP/USD, or AUD/USD.

Currency Price: The price of the currency pair that you are trading—this will generally be done automatically.

Leverage: Leverage is the ratio that is fixed by your broker. In figure 1.2, you can see the leverage is set to 1:500.

Trade Size: This refers to the number of units being traded, which is also commonly referred to as trading lots. This is found through your position size calculation.

Figure 1.B (FP Markets Margin Calculator)

- Swaps Calculator

Using the Swap Calculator, you may determine the interest rate you will pay or receive for each overnight open CFD position. This interest will be instantly charged or debited and reflected in your account balance.

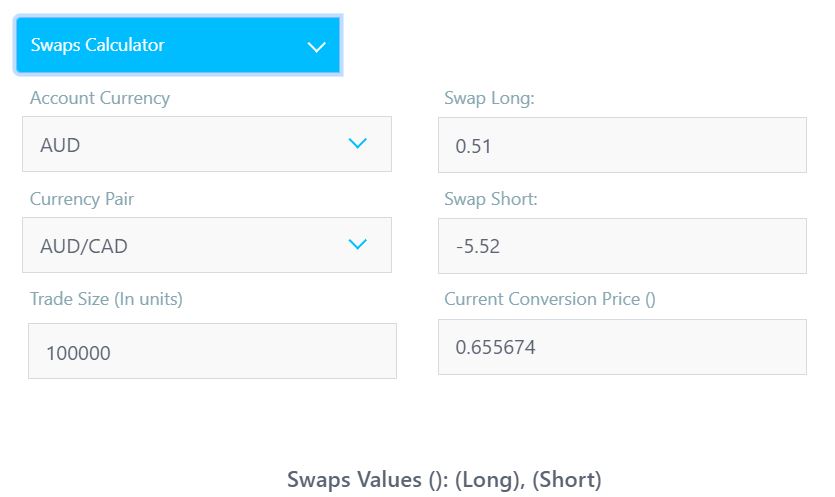

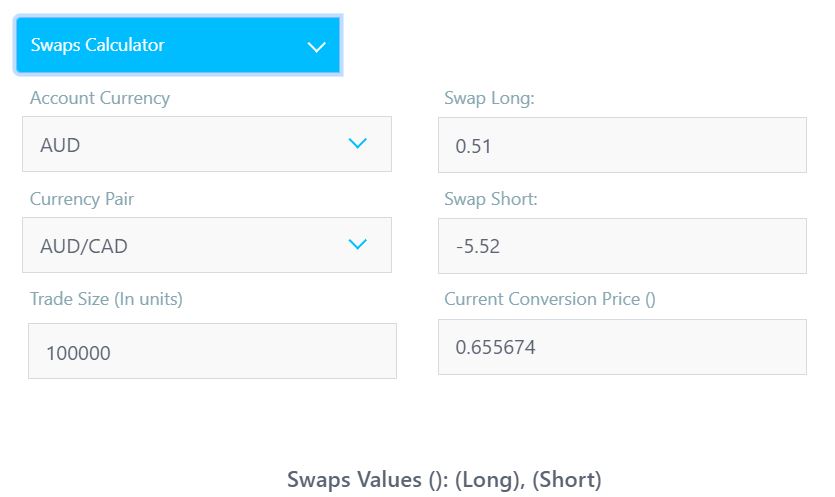

FP Markets Swaps Calculator (figure 1.C):

Account Currency: This is your account deposit currency.

Currency Pair: This is the currency pair you are trading. For example, EUR/USD, GBP/USD, or AUD/USD.

Trade Size: This refers to the number of units being traded, which is also commonly referred to as trading lots. This is found through your position size calculation.

Swap Long and Swap Short: To manually find the MetaTrader (MT4) swap rates, these can be accessed through the Market Watch tab (Ctrl+M). You must right click on the currency pair traded and select the Contract Specification to locate Swap Long and Swap Short values. Yet, the calculator will do this for you automatically.

Current Conversion Price: Conversion prices are equivalent to exchange rates on the foreign exchange market.

Figure 1.C (FP Markets Swaps Calculator)

- Profit Calculator

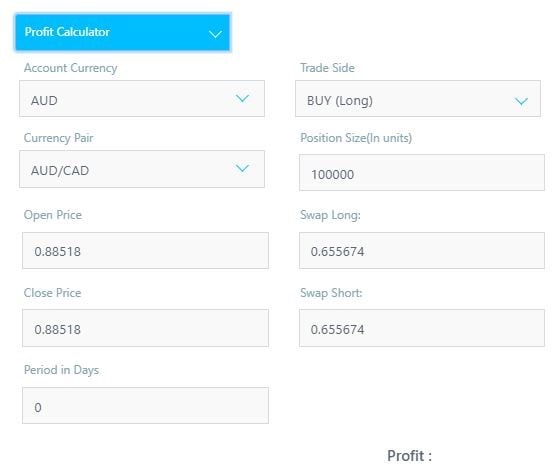

This calculator determines how much you stand to gain or lose after your protective stop-loss or take-profit level is reached. Enter the Account Currency, Currency Pair traded, the Open/Close price, and the number of days the trade was held for (the duration; Period in Days). Subsequent to this, you must input the Trade Side (whether you bought or sold—long or short), Position Size in units, and Swap Long and Swap Short values. Your profit will then be displayed at the bottom of the calculator.

Account Currency: This is your account deposit currency.

Currency Pair: This is the currency pair you are trading. For example, EUR/USD, GBP/USD, or AUD/USD.

Open Price: The price the instrument is first traded.

Close Price: An instrument’s last trading price level at the close is referred to as the closing price.

Period of Days: The duration in days the trade was held for.

FP Markets Profit Calculator (figure 1.D)

Access +10,000 financial

instruments

Access +10,000 financial

instruments